- Switzerland

- /

- Food

- /

- SWX:NESN

Nestlé (SWX:NESN): Valuation Check as U.S. Portfolio Overhaul Targets Core Brands and New Growth Paths

Reviewed by Simply Wall St

Nestlé (SWX:NESN) is back in the spotlight after Nestlé USA chief Marty Thompson kicked off a sweeping review of the U.S. portfolio, doubling down on core brands while weighing divestments and fresh product and packaging ideas.

See our latest analysis for Nestlé.

That U.S. shake-up comes as investors warm back up to Nestlé, with a roughly 10% 90 day share price return and a 12 month total shareholder return near 11% hinting that sentiment and momentum are rebuilding after weaker multi year results.

If this kind of portfolio reshaping has your attention, it might also be a good moment to explore fast growing stocks with high insider ownership as potential next wave opportunities.

With earnings recovering, modest top line growth, and the stock trading at a discount to analyst targets and some intrinsic estimates, is Nestlé quietly undervalued today, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 10% Undervalued

With Nestlé closing at CHF79.36 against a narrative fair value of about CHF88, the valuation case rests heavily on execution, mix, and margin upgrades.

Continued investment in efficiency initiatives (for example, "Fuel for Growth" savings, digitalization, AI-driven procurement, and end-to-end process automation) is already enabling higher marketing intensity without increasing costs, paving the way for margin improvement and stronger cash generation over the medium term.

Curious how modest revenue growth, rising margins, and a richer earnings multiple together argue for a higher price? See which future profit profile powers this fair value.

Result: Fair Value of $88.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained margin pressure from higher input costs and weaker demand, particularly in China, could undermine both the rerating thesis and consensus growth assumptions.

Find out about the key risks to this Nestlé narrative.

Another Angle on Valuation

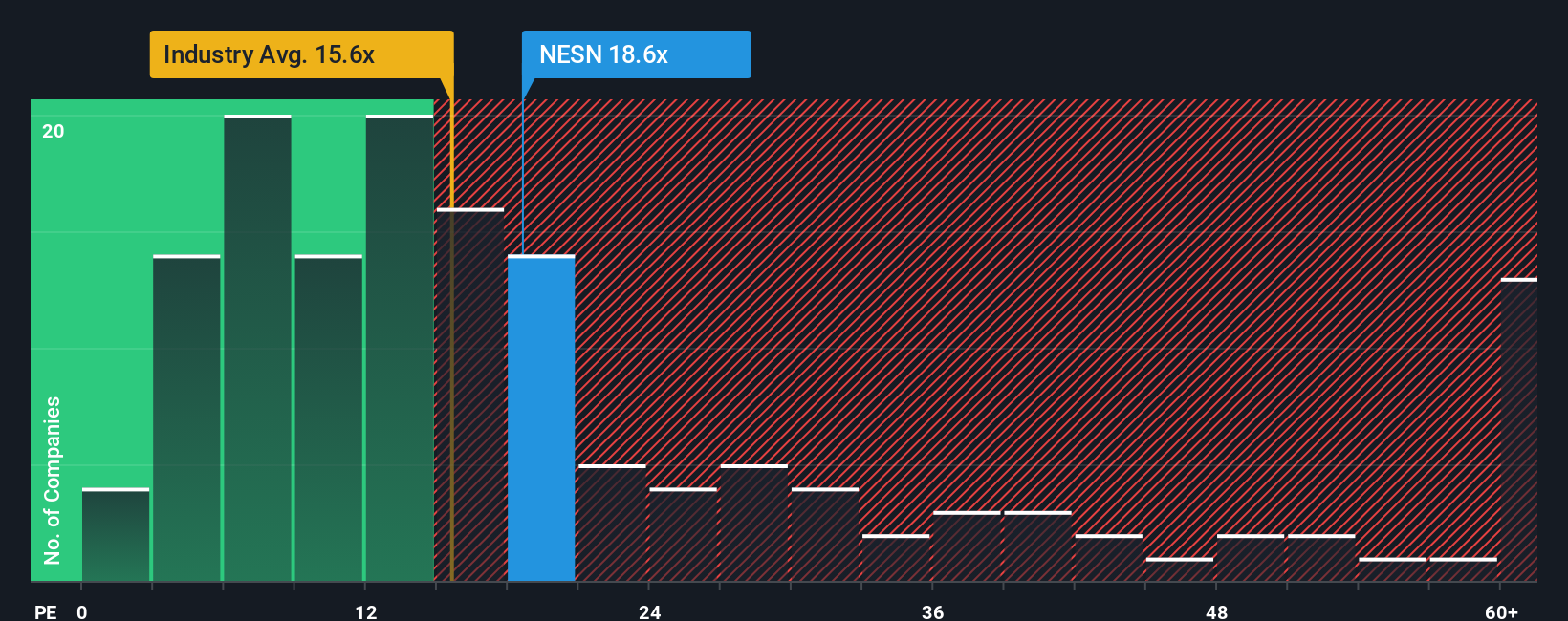

Our fair value work suggests Nestlé trades about 44% below intrinsic value, yet the market is not giving it away on earnings, with the shares at 19.8 times profits versus 15.6 times for the European food sector and a fair ratio of 26.6 times.

That mix, cheaper than peers on a fair ratio basis but pricier than the wider industry, points to a middle ground, with enough embedded expectations to carry downside risk if execution slips and with room for upside if the rerating story plays out. Which side of that trade do you think is more likely?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nestlé Narrative

If you see the story differently or want to stress test these assumptions against your own data, you can build a custom narrative in under three minutes, Do it your way.

A great starting point for your Nestlé research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at Nestlé, you could miss the next big winner. Let the Simply Wall St Screener surface fresh opportunities that match your strategy.

- Capture early growth stories before they hit the mainstream by scanning these 3640 penny stocks with strong financials with improving fundamentals and institutional attention.

- Position yourself in the digital transformation wave by targeting these 26 AI penny stocks that may benefit from the rapid adoption of intelligent automation.

- Explore possible mispricings by focusing on these 911 undervalued stocks based on cash flows where strong cash flows might not yet be fully reflected in market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nestlé might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NESN

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)