- Switzerland

- /

- Food

- /

- SWX:NESN

Nestlé (SWX:NESN): Reassessing Valuation After a Quiet Share Price Grind Higher

Reviewed by Simply Wall St

Nestlé (SWX:NESN) has been quietly grinding higher this year, and that slow, steady move is starting to catch investors attention as they reassess what they are paying for its global food empire.

See our latest analysis for Nestlé.

After a soft patch in prior years, Nestlé’s roughly mid single digit year to date share price return has been backed by improving sales and earnings, hinting that investors are slowly rebuilding confidence after a weaker three year total shareholder return.

If Nestlé’s steady grind appeals to you, this could be a good moment to see what else is quietly compounding in the background via fast growing stocks with high insider ownership.

With earnings momentum improving and the shares still trading at a notable discount to analyst targets and intrinsic value estimates, the key question now is whether Nestlé is a quietly undervalued compounder or if the market is already baking in its next leg of growth.

Most Popular Narrative: 10.5% Undervalued

With Nestlé last closing at CHF78.82 against a narrative fair value near CHF88, the valuation case leans on a slow burn of quality growth and margins.

Continued investment in efficiency initiatives (e.g., "Fuel for Growth" savings, digitalization, AI-driven procurement, and end-to-end process automation) is already enabling higher marketing intensity without increasing costs, paving the way for margin improvement and stronger cash generation over the medium term.

Want to see what sits behind that confidence in higher margins and rising earnings on modest sales growth? The narrative leans on a deliberate shift toward premium health focused brands, steadier profit expansion, and a richer earnings multiple than the wider food sector. Curious which precise revenue, margin, and valuation assumptions have to line up for this story to work? Dive into the full narrative to see the exact numbers driving that fair value.

Result: Fair Value of CHF88.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that story could be derailed if commodity inflation keeps squeezing margins or if weak consumer demand in China persists longer than expected.

Find out about the key risks to this Nestlé narrative.

Another Lens on Value

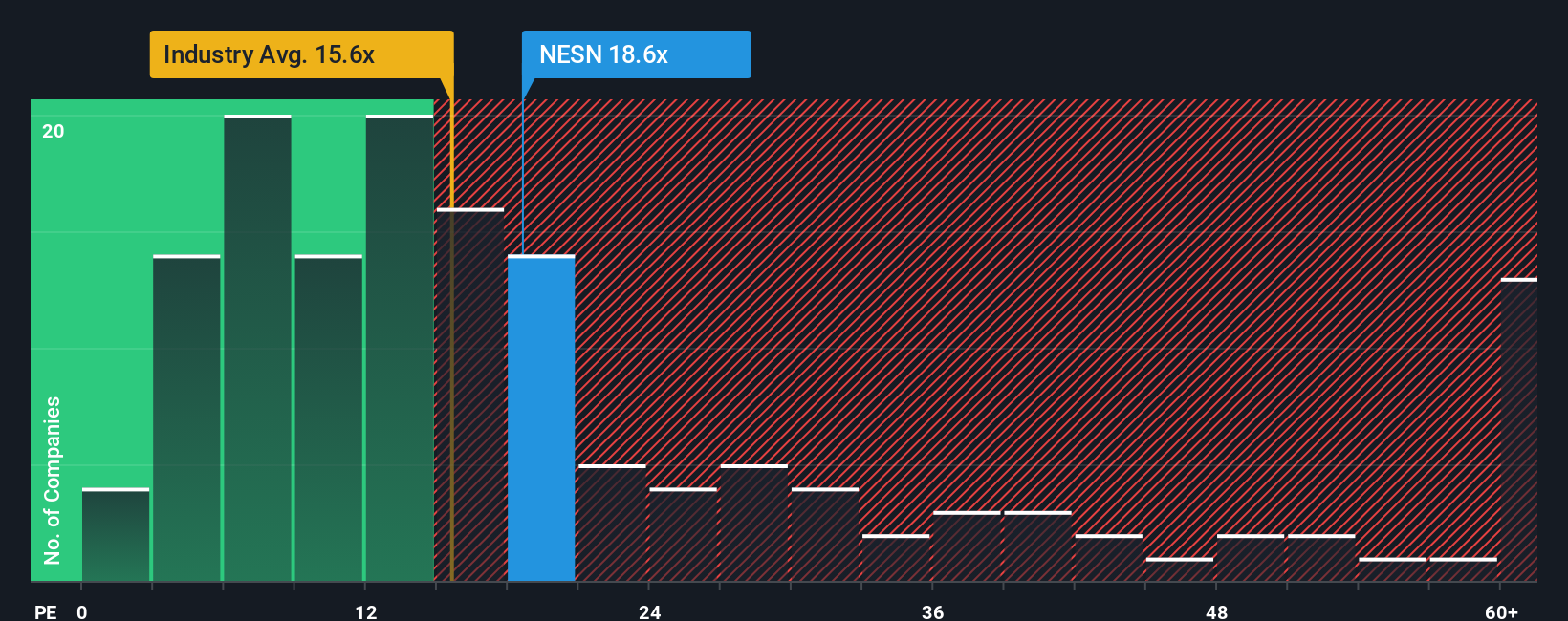

On earnings based valuation, Nestlé looks more stretched. Its price to earnings ratio of about 19.7 times sits well above the European food industry at 15.3 times, yet below a fair ratio nearer 26.5 times. This raises the question of whether investors are paying up too early for a turnaround.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nestlé Narrative

If you see the data differently or want to stress test your own assumptions, you can build a fully custom narrative in minutes: Do it your way.

A great starting point for your Nestlé research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Nestlé looks promising, do not stop there, your next great opportunity could be hiding in plain sight on the Simply Wall Street Screener right now.

- Capture potential multi baggers early by scanning these 3575 penny stocks with strong financials that already back up their low prices with improving fundamentals and real business momentum.

- Ride the structural shift toward intelligent automation by focusing on these 26 AI penny stocks powering breakthroughs in data analytics, machine learning, and scalable cloud infrastructure.

- Lock in stronger risk reward profiles by targeting these 15 dividend stocks with yields > 3% that combine reliable income streams with balance sheets built to handle tougher market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nestlé might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NESN

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026