- Switzerland

- /

- Food

- /

- SWX:NESN

Is Now the Right Moment for Nestlé After Its Recent 2.9% Share Price Rise?

Reviewed by Bailey Pemberton

If you’re wondering whether Nestlé’s stock deserves a spot in your portfolio right now, you’re definitely not alone. With a company as globally recognized as Nestlé, it’s tempting to expect smooth sailing, but recent performance has kept investors on their toes. Over the past week, the stock has quietly risen 2.9%, hinting at some renewed optimism in the market. Yet, zooming out tells a slightly different story: the one-year return sits at -8.1%, and over the past five years, shares are down by 21.9%. These numbers can raise questions about whether the stock’s current price truly reflects its value or if there are hidden strengths the broader market hasn’t fully recognized.

Much of the recent movement can be traced back to shifting sentiment in consumer goods sectors and evolving market expectations as global economic priorities ebb and flow. Some long-term investors are interpreting the recent uptick as a sign that risk perception could be normalizing after a stretch of uncertainty. But is the underlying value compelling enough to take action?

Here’s where it gets interesting: Nestlé’s valuation score currently sits at 4 out of 6, meaning the company looks undervalued in two-thirds of the checks we use when sizing up opportunities. Valuation is about more than just headline numbers, though; it’s about perspective. So let’s dig into the key metrics and approaches analysts rely on, before exploring an even better way to understand whether Nestlé’s shares are a true bargain today.

Why Nestlé is lagging behind its peers

Approach 1: Nestlé Discounted Cash Flow (DCF) Analysis

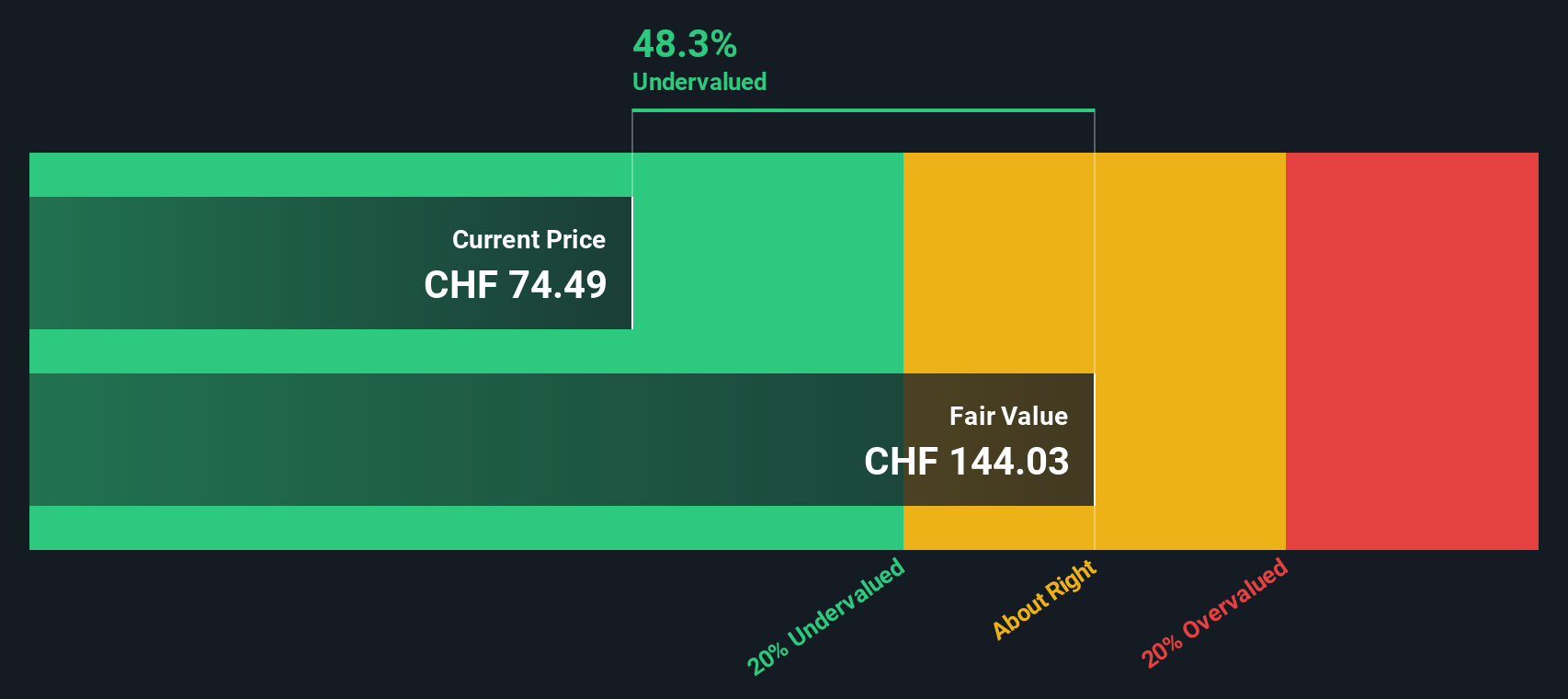

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's value, capturing what those future earnings are truly worth right now. For Nestlé, this approach focuses on Free Cash Flow (FCF), which sits at CHF 8.82 billion for the last twelve months.

Looking ahead, analyst forecasts see Nestlé's FCF rising steadily, reaching about CHF 11.93 billion by 2029. Over a ten-year span, projections continue to climb, with Simply Wall St extrapolating FCFs up to CHF 13.29 billion by 2035. All cash flow figures are presented in Swiss Francs (CHF), highlighting the scale of Nestlé's operations and future earning potential.

The DCF model used here is the "2 Stage Free Cash Flow to Equity" method. It incorporates both analyst estimates and careful long-term projections. Based on these calculations, Nestlé’s estimated intrinsic value per share is CHF 144.03. As of today, the stock trades nearly 48.5% below this fair value estimate. This may suggest that the market is overlooking substantial underlying worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nestlé is undervalued by 48.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Nestlé Price vs Earnings

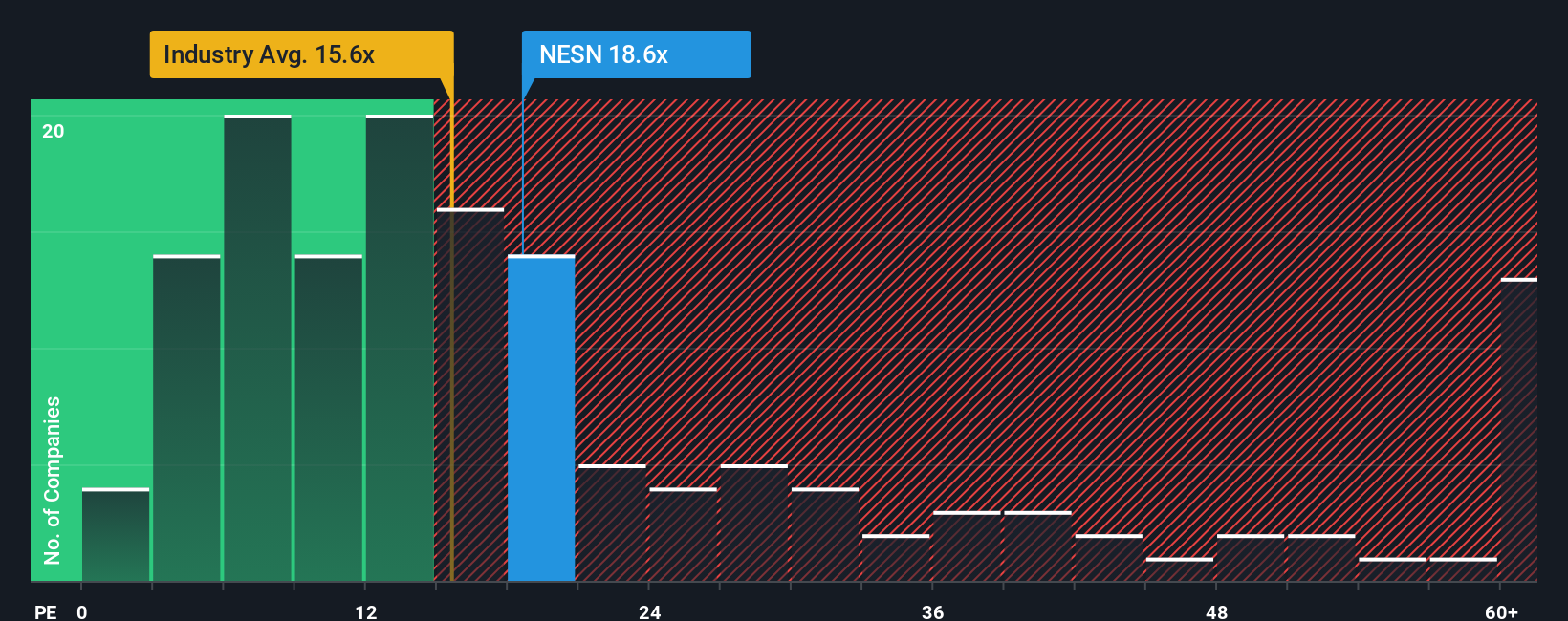

Price-to-Earnings (PE) is a go-to valuation tool for profitable companies like Nestlé, because it directly compares what investors are currently paying for one Swiss franc of today’s earnings. This makes it especially relevant for assessing established businesses with steady profits, as it reflects both market expectations for future growth and the overall level of perceived risk.

Growth prospects and risk perceptions play a big role in shaping a company’s “normal” or “fair” PE ratio. Firms with higher growth potential often command a richer PE, while those facing uncertainty or industry headwinds may trade at a discount. For Nestlé, the current PE ratio stands at 18.5x. That is above the food industry average of 16.3x, but significantly below the peer group average of 28.6x. This shows the market is not giving it the same premium as faster-growing or more favored rivals.

Simply Wall St’s “Fair Ratio” goes a step further than ordinary comparisons by modeling the ideal PE multiple based on Nestlé’s unique growth outlook, profit margins, market cap, and risk factors, along with industry context. This provides a more tailored benchmark than a one-size-fits-all industry or peer average. For Nestlé, the Fair Ratio is calculated at 28.3x. Comparing this with the current PE of 18.5x, the stock appears to be trading well below where fundamentals suggest it could be. This may indicate the potential for undervaluation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

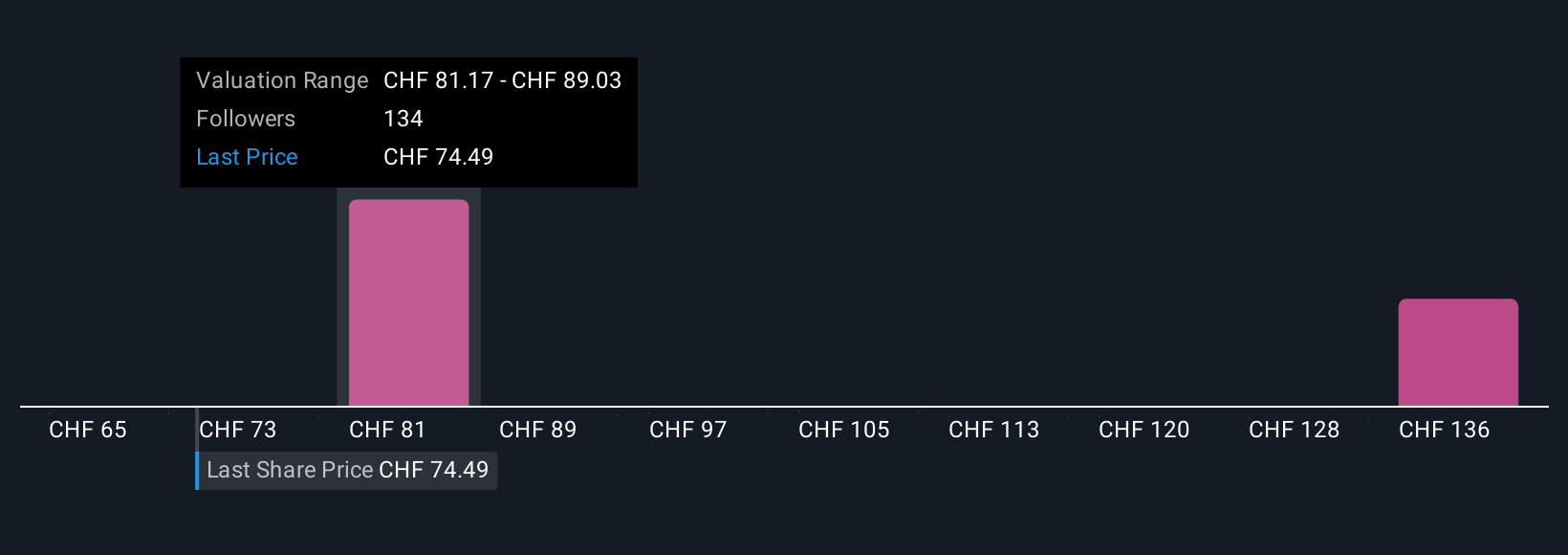

Upgrade Your Decision Making: Choose your Nestlé Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a dynamic, user-friendly tool designed to help investors connect the “story” behind a company to its financial forecasts and ultimately its fair value. A Narrative is simply your perspective on Nestlé’s future, combining your views on what drives the company, your own revenue and margin assumptions, and what you believe is a reasonable fair value. Narratives are at the heart of the Simply Wall St Community page, where millions of investors exchange their views in an accessible, interactive environment.

By building your own Narrative, or exploring those contributed by others, you can see how different assumptions about growth or risks translate into fair value estimates, and quickly spot when price and value are out of sync, making buy or sell decisions more grounded and personal. Best of all, Narratives update live whenever new earnings or news hits, so your forecasts stay fresh and relevant. For example, one investor might believe Nestlé’s growth in China and digital transformation justifies a bullish price target of CHF 103, while another focuses on margin pressures and sets a more cautious target near CHF 71. Narratives make it easy to compare and decide what you believe is most probable.

Do you think there's more to the story for Nestlé? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nestlé might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NESN

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives