- Switzerland

- /

- Food

- /

- SWX:EMMN

Most Shareholders Will Probably Agree With Emmi AG's (VTX:EMMN) CEO Compensation

Key Insights

- Emmi's Annual General Meeting to take place on 10th of April

- Salary of CHF733.0k is part of CEO Ricarda Demarmels's total remuneration

- Total compensation is 39% below industry average

- Emmi's EPS grew by 0.5% over the past three years while total shareholder loss over the past three years was 19%

The performance at Emmi AG (VTX:EMMN) has been rather lacklustre of late and shareholders may be wondering what CEO Ricarda Demarmels is planning to do about this. At the next AGM coming up on 10th of April, they can influence managerial decision making through voting on resolutions, including executive remuneration. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We think CEO compensation looks appropriate given the data we have put together.

Check out our latest analysis for Emmi

How Does Total Compensation For Ricarda Demarmels Compare With Other Companies In The Industry?

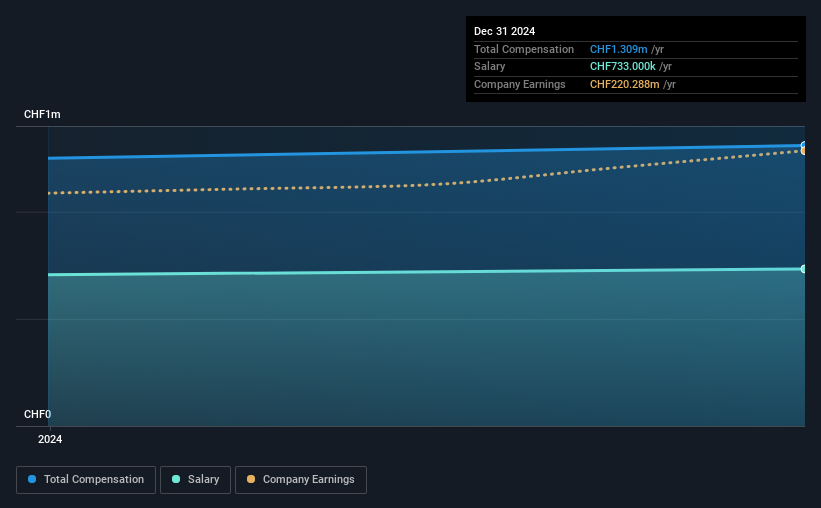

At the time of writing, our data shows that Emmi AG has a market capitalization of CHF4.3b, and reported total annual CEO compensation of CHF1.3m for the year to December 2024. That's a fairly small increase of 4.8% over the previous year. We note that the salary of CHF733.0k makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the Swiss Food industry with market capitalizations ranging from CHF3.4b to CHF10b, the reported median CEO total compensation was CHF2.1m. Accordingly, Emmi pays its CEO under the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CHF733k | CHF706k | 56% |

| Other | CHF576k | CHF543k | 44% |

| Total Compensation | CHF1.3m | CHF1.2m | 100% |

On an industry level, roughly 56% of total compensation represents salary and 44% is other remuneration. Although there is a difference in how total compensation is set, Emmi more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Emmi AG's Growth

Over the last three years, Emmi AG has not seen its earnings per share change much, though there is a slight positive movement. Its revenue is up 2.5% over the last year.

We're not particularly impressed by the revenue growth, but it is good to see modest EPS growth. Considering these factors we'd say performance has been pretty decent, though not amazing. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Emmi AG Been A Good Investment?

With a three year total loss of 19% for the shareholders, Emmi AG would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The fact that shareholders have earned a negative share price return is certainly disconcerting. Perhaps the poor price performance may have something to do with the the fact that earnings per share growth has not been performing as strongly either. In the upcoming AGM, shareholders will get the opportunity to discuss these concerns with the board and assess if the board's plan is likely to improve company performance.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for Emmi that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Emmi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:EMMN

Emmi

Manufactures and sells dairy products in Switzerland, the United States, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success