- Switzerland

- /

- Food

- /

- SWX:BARN

3 Companies On The SIX Swiss Exchange That May Be Trading Below Their Estimated Value In October 2024

Reviewed by Simply Wall St

The Swiss market has experienced a flat performance in the past week, yet it has shown a robust 16% increase over the past year with earnings projected to grow by 12% annually. In this context, identifying stocks that may be trading below their estimated value can present intriguing opportunities for investors looking to capitalize on potential growth and value discrepancies in the market.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Swissquote Group Holding (SWX:SQN) | CHF305.20 | CHF561.42 | 45.6% |

| Georg Fischer (SWX:GF) | CHF55.45 | CHF108.39 | 48.8% |

| lastminute.com (SWX:LMN) | CHF18.10 | CHF29.08 | 37.7% |

| Julius Bär Gruppe (SWX:BAER) | CHF54.00 | CHF104.06 | 48.1% |

| Komax Holding (SWX:KOMN) | CHF114.20 | CHF202.68 | 43.7% |

| Comet Holding (SWX:COTN) | CHF301.00 | CHF526.74 | 42.9% |

| Clariant (SWX:CLN) | CHF12.37 | CHF21.46 | 42.4% |

| Dätwyler Holding (SWX:DAE) | CHF150.60 | CHF237.75 | 36.7% |

| SGS (SWX:SGSN) | CHF95.48 | CHF151.83 | 37.1% |

| Sensirion Holding (SWX:SENS) | CHF65.40 | CHF117.65 | 44.4% |

Let's explore several standout options from the results in the screener.

Barry Callebaut (SWX:BARN)

Overview: Barry Callebaut AG, along with its subsidiaries, manufactures and sells chocolate and cocoa products, with a market cap of CHF8.52 billion.

Operations: The company's revenue segments include Global Cocoa, which generated CHF5.31 billion.

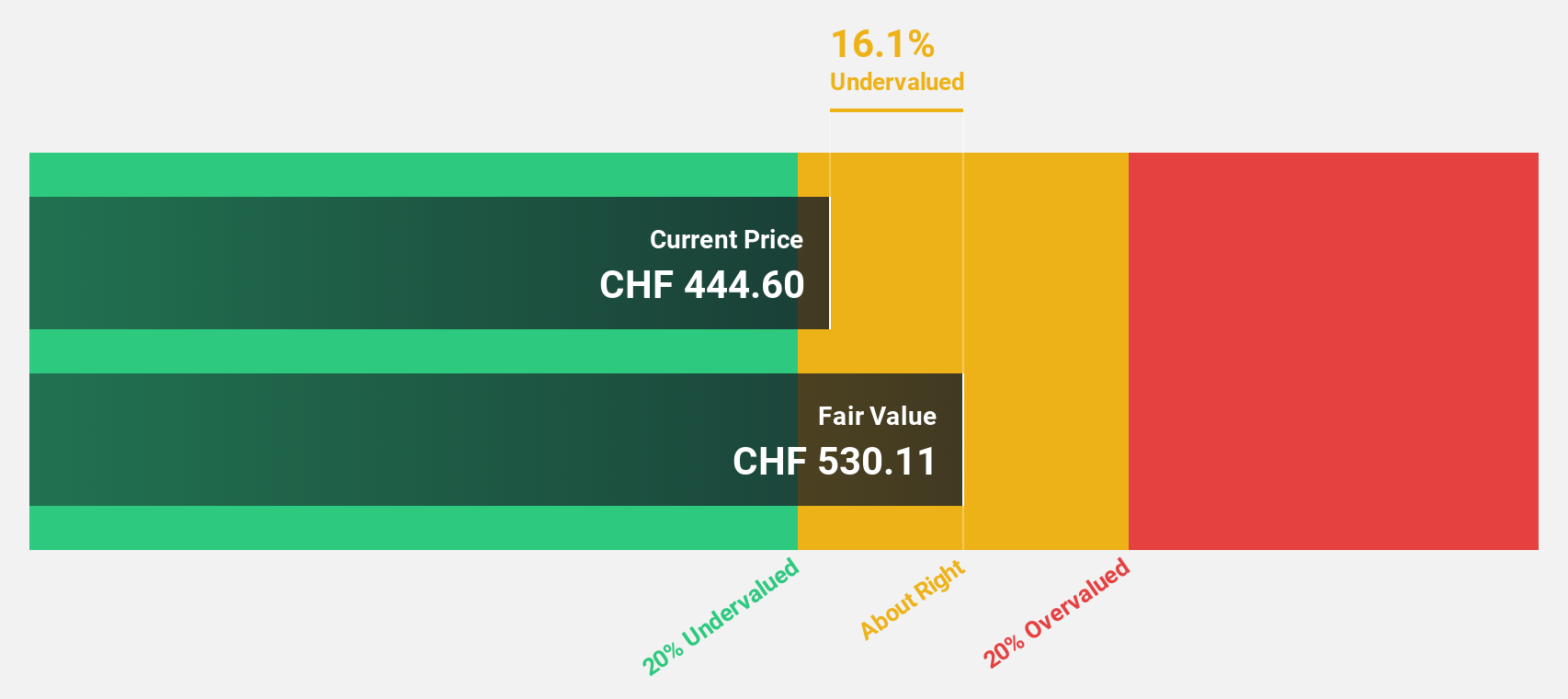

Estimated Discount To Fair Value: 31.9%

Barry Callebaut is trading at CHF1557, significantly below its estimated fair value of CHF2287.69, indicating a substantial undervaluation based on discounted cash flow analysis. While earnings are projected to grow significantly at 25.9% annually, surpassing the Swiss market's growth rate of 11.6%, the company's return on equity is expected to be modest at 15% in three years. However, Barry Callebaut faces challenges as its debt isn't well covered by operating cash flow.

- Our earnings growth report unveils the potential for significant increases in Barry Callebaut's future results.

- Navigate through the intricacies of Barry Callebaut with our comprehensive financial health report here.

Comet Holding (SWX:COTN)

Overview: Comet Holding AG, with a market cap of CHF2.34 billion, operates through its subsidiaries to offer X-ray and radio frequency (RF) power technology solutions across Europe, North America, Asia, and other international markets.

Operations: The company generates revenue through its segments: X-Ray Systems (IXS) with CHF115.34 million, Industrial X-Ray Modules (IXM) at CHF95.90 million, and Plasma Control Technologies (PCT) contributing CHF180.62 million.

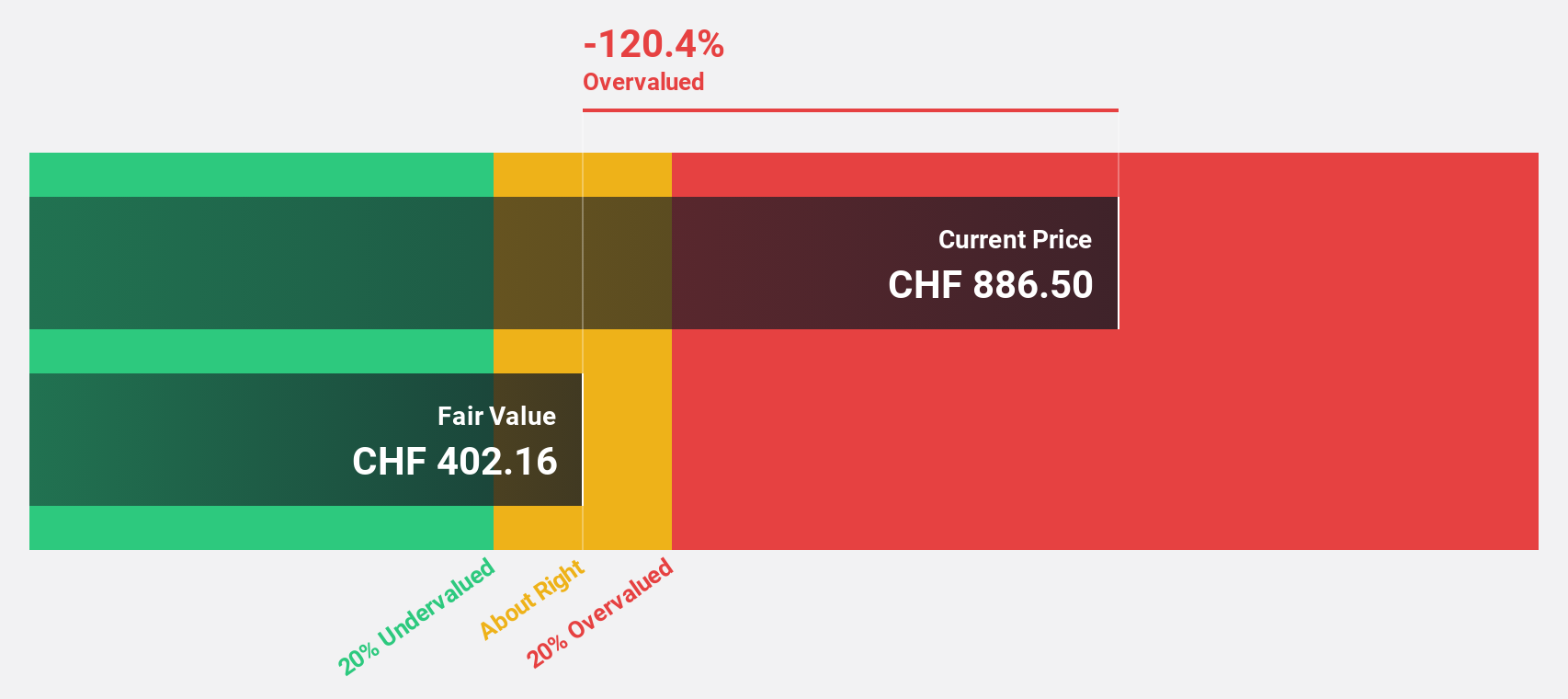

Estimated Discount To Fair Value: 42.9%

Comet Holding is trading at CHF301, significantly below its estimated fair value of CHF526.74, presenting a substantial undervaluation based on discounted cash flow analysis. Earnings are forecast to grow substantially at 48.6% annually, outpacing the Swiss market's growth rate of 11.6%. Despite recent volatility in share price and declining profit margins from last year, analysts agree that the stock price could rise by 22.2%, with revenue growth expected to exceed market averages.

- The analysis detailed in our Comet Holding growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Comet Holding.

Swissquote Group Holding (SWX:SQN)

Overview: Swissquote Group Holding Ltd offers a range of online financial services to retail, affluent, and professional institutional investors globally, with a market cap of CHF4.53 billion.

Operations: The company generates revenue through its primary segments of Leveraged Forex, contributing CHF93.28 million, and Securities Trading, which accounts for CHF488.98 million.

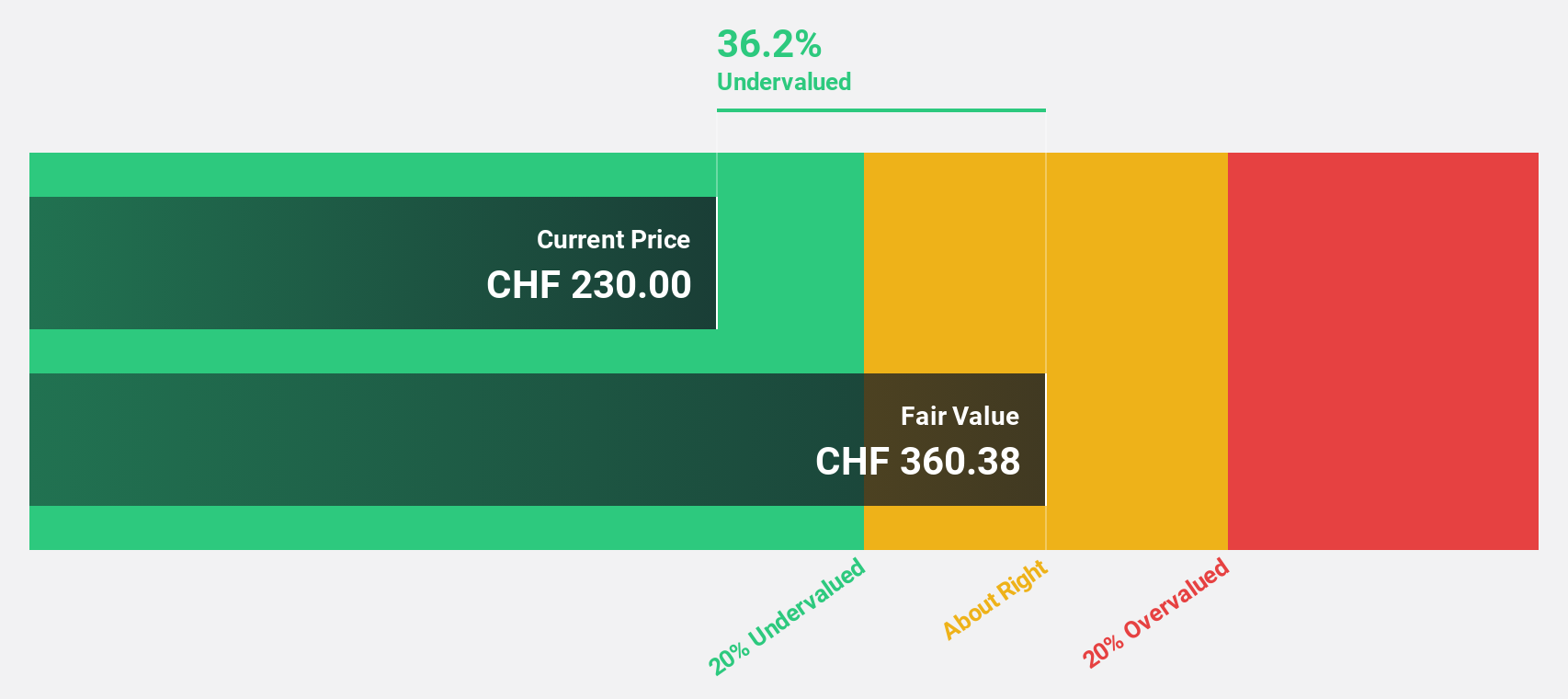

Estimated Discount To Fair Value: 45.6%

Swissquote Group Holding is trading at CHF305.2, well below its fair value estimate of CHF561.42, highlighting a significant undervaluation based on discounted cash flow analysis. Recent earnings growth was robust, with net income rising to CHF144.56 million for the half year ended June 2024 from CHF106.53 million a year ago. Forecasts suggest revenue and earnings will grow faster than the Swiss market at 11.1% and 12.6% annually, respectively, supporting its potential as an undervalued investment opportunity in Switzerland.

- Our expertly prepared growth report on Swissquote Group Holding implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Swissquote Group Holding's balance sheet by reading our health report here.

Taking Advantage

- Click here to access our complete index of 17 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barry Callebaut might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BARN

Barry Callebaut

Engages in the manufacture and sale of chocolate and cocoa products.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives