- Switzerland

- /

- Food

- /

- SWX:ARYN

How Investors Are Reacting To ARYZTA (SWX:ARYN) CEO Departure and Maintained 2025 Growth Guidance

Reviewed by Sasha Jovanovic

- ARYZTA AG’s Board of Directors recently announced that Michael Schai has stepped down as CEO with immediate effect, with Chairman Urs Jordi appointed as interim CEO, while also confirming unchanged organic growth guidance for 2025.

- This simultaneous leadership transition and reaffirmation of earnings guidance highlights the company’s intent to maintain stability during executive changes and ongoing strategy execution.

- We’ll now explore how the immediate CEO transition, alongside steady growth guidance, could influence ARYZTA’s long-term investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

ARYZTA Investment Narrative Recap

To invest in ARYZTA, an investor must trust in its ability to execute growth through product innovation and premiumization in a competitive, margin-sensitive food sector. The immediate CEO change, paired with management's confirmation of unchanged 2025 organic growth guidance, does not materially impact the current short-term catalyst: execution on efficiency and cost control initiatives. The main risk, continued gross margin pressure from input cost inflation, remains front and center for earnings quality in the near term.

Among recent announcements, ARYZTA's repeated confirmation of its low to mid-single digit organic growth target for 2025 stands out as most relevant, reinforcing management’s intention to maintain consistency despite boardroom changes. Investors watching for progress on cost discipline and premium product innovation will see this stable guidance as a marker that the company's underlying strategy remains firmly in place, whatever the boardroom dynamics.

In contrast, the potential for margin compression due to ongoing raw material cost volatility is something investors should be aware of if...

Read the full narrative on ARYZTA (it's free!)

ARYZTA's narrative projects €2.4 billion revenue and €141.5 million earnings by 2028. This requires 2.8% yearly revenue growth and an earnings increase of €36.5 million from €105.0 million today.

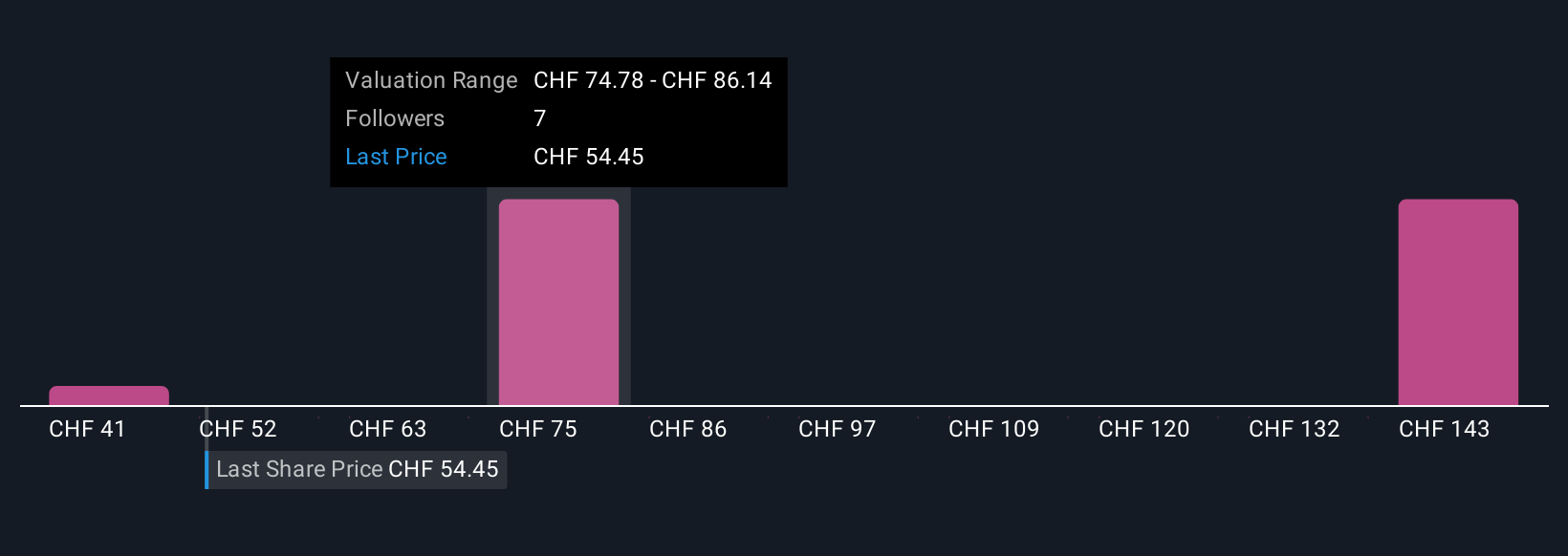

Uncover how ARYZTA's forecasts yield a CHF86.23 fair value, a 62% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community offers three unique fair value estimates for ARYZTA, stretching from CHF40.72 to CHF177.30 per share. While cost inflation remains a crucial risk for future returns, these varied perspectives reveal just how differently ARYZTA's prospects can be assessed, explore the range of viewpoints to make an informed decision.

Explore 3 other fair value estimates on ARYZTA - why the stock might be worth over 3x more than the current price!

Build Your Own ARYZTA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ARYZTA research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ARYZTA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ARYZTA's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ARYN

ARYZTA

Provides products and services for in-store bakery solutions in Europe and internationally.

Very undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives