- Switzerland

- /

- Capital Markets

- /

- SWX:PGHN

Partners Group (SWX:PGHN): Is the Current Valuation an Opportunity for Investors?

Reviewed by Kshitija Bhandaru

Partners Group Holding (SWX:PGHN) shares have seen little movement this week, with the stock drifting amid a lack of clear news or major announcements. Investors appear to be watching the broader market for direction as fundamentals remain steady.

See our latest analysis for Partners Group Holding.

While Partners Group Holding’s share price has barely budged in recent weeks, that comes after a more subdued stretch overall. This year’s share price return is still in negative territory. Despite some solid underlying earnings growth, the one-year total shareholder return of -0.16% reflects a market that is cautious on future prospects. Longer-term returns over the last five years remain comfortably positive.

If you’re curious to see where the next wave of momentum might be emerging, now’s a great opportunity to broaden your radar and discover fast growing stocks with high insider ownership

With shares trading below analyst targets and steady profit growth in the background, investors face a familiar dilemma: is the current dip a compelling entry point or is the market already factoring in future gains?

Most Popular Narrative: 16.6% Undervalued

Partners Group Holding last traded at CHF1033, notably below the fair value estimate of CHF1238 set by the most widely followed narrative. The stage is set for a closer look at the powerful drivers supporting this view.

The trend toward broader access to private markets, accelerated by regulatory moves enabling inclusion of private assets in retirement plans and more democratized products, positions Partners Group to benefit from rising asset flows from both high-net-worth and retail clients. This is likely to lead to higher long-term AUM and increased recurring management fee revenues.

Want to know the forward-thinking assumptions fueling this valuation? The narrative is built on bold projections about long-term client inflows and sustained growth. Discover the specific growth pathways and financial targets the analysts are counting on. There is more to these numbers than meets the eye.

Result: Fair Value of $1238 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from alternative managers and lower-margin products could limit future growth and put pressure on margins if the market environment becomes less favorable.

Find out about the key risks to this Partners Group Holding narrative.

Another View: What Do the Ratios Say?

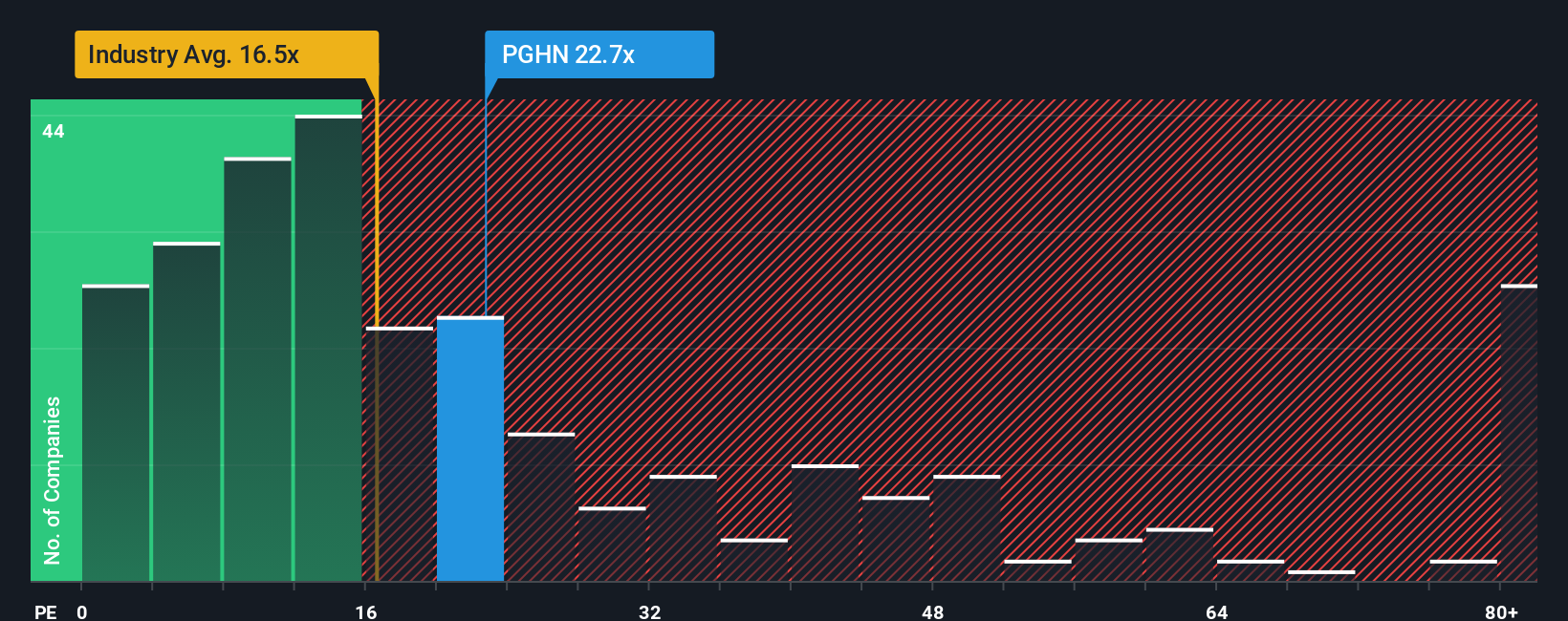

While the analyst consensus points to upside, valuation based on the price-to-earnings ratio tells a different story. At 22.4 times earnings, Partners Group Holding trades well above both the industry average (15.9x) and its peers (17.1x). The company’s ratio also outpaces the fair ratio of 20.6x. This suggests investors are paying a premium for future growth. Does this premium reflect genuine opportunity, or does it increase the risk if expectations are missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Partners Group Holding Narrative

If you see things differently, or enjoy shaping your own perspective from the numbers, you can create a personalized view in just minutes, so Do it your way.

A great starting point for your Partners Group Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for the next opportunity. Expand your investment universe and boost your confidence with focused lists designed for forward-thinking strategies.

- Tap into steady income streams by reviewing these 19 dividend stocks with yields > 3% with reliable yields above 3% that can help grow your portfolio’s long-term returns.

- Uncover tomorrow’s market movers with these 3568 penny stocks with strong financials featuring exceptional financial strengths and growth momentum that mainstream analysts may have missed.

- Capitalize on breakthroughs in medicine by exploring these 31 healthcare AI stocks where artificial intelligence is transforming the future of healthcare investment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PGHN

Partners Group Holding

A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives