- Switzerland

- /

- Medical Equipment

- /

- SWX:SOON

High Insider Ownership Growth Companies On SIX Swiss Exchange In July 2024

Reviewed by Simply Wall St

The Swiss stock market has shown robust performance recently, with the SMI index reaching a new record high, buoyed by positive sentiments surrounding U.S. interest rates and strong quarterly earnings. This thriving environment sets an optimistic backdrop for investors looking at growth companies with high insider ownership on the SIX Swiss Exchange. In such a favorable market climate, stocks with substantial insider ownership can be particularly appealing as they often indicate confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.1% |

| Straumann Holding (SWX:STMN) | 32.7% | 20.8% |

| VAT Group (SWX:VACN) | 10.2% | 20.1% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 13.7% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| Sonova Holding (SWX:SOON) | 17.7% | 9% |

| HOCHDORF Holding (SWX:HOCN) | 20.7% | 103% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 75.4% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

We'll examine a selection from our screener results.

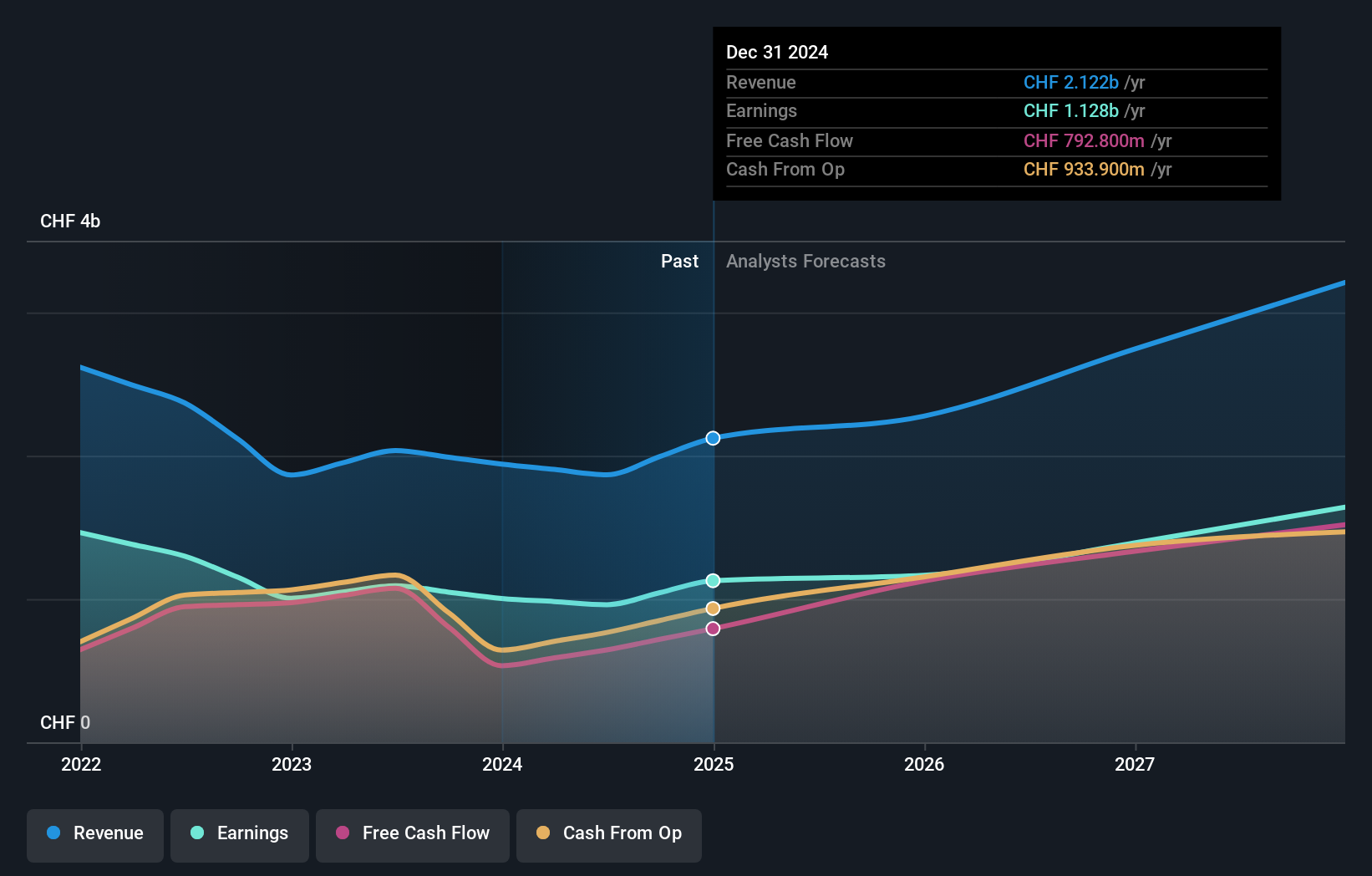

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a global private equity firm that manages a diverse range of investment strategies including direct, secondary, and primary investments in private equity, real estate, infrastructure, and debt, with a market capitalization of approximately CHF 32.36 billion.

Operations: The revenue for the company is divided among several segments: private equity generating CHF 1.17 billion, infrastructure at CHF 379.20 million, private credit with CHF 211.30 million, and real estate contributing CHF 186.90 million.

Insider Ownership: 17.1%

Partners Group Holding AG, a Swiss private equity firm, is experiencing robust growth with earnings and revenue forecasted to outpace the Swiss market at 13.65% and 14.3% per year respectively. Despite high insider ownership, challenges include a substantial level of debt and dividends that are poorly covered by earnings or free cash flows. Recent activities include a CHF 300 million fixed-income offering and potential M&A discussions regarding the sale of Formosa Solar, signaling active strategic maneuvers in its sector.

- Click here and access our complete growth analysis report to understand the dynamics of Partners Group Holding.

- Upon reviewing our latest valuation report, Partners Group Holding's share price might be too optimistic.

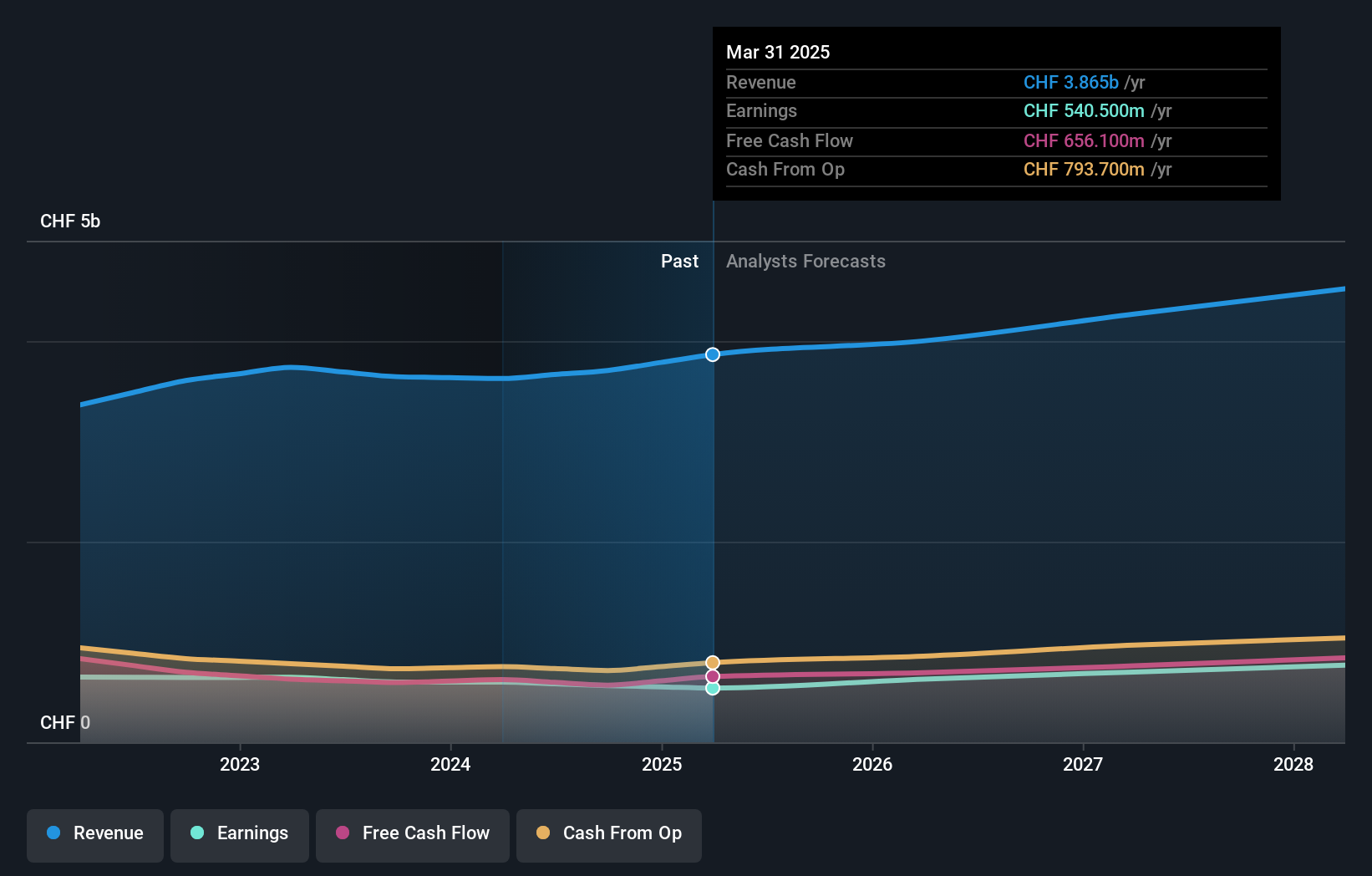

Sonova Holding (SWX:SOON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sonova Holding AG, with a market cap of CHF 16.53 billion, specializes in the manufacturing and sale of hearing care solutions for adults and children across regions including the United States, Europe, the Middle East, Africa, and Asia Pacific.

Operations: Sonova's revenue is primarily generated from two segments: Cochlear Implants, which contributed CHF 282.40 million, and Hearing Instruments, accounting for CHF 3.36 billion.

Insider Ownership: 17.7%

Sonova Holding AG, a Swiss-based company, is trading at 40.9% below its estimated fair value, presenting a potential opportunity despite its slower revenue growth forecast of 7% per year compared to the industry's higher rates. With earnings expected to grow by 9% annually—outpacing the Swiss market average—Sonova demonstrates solid financial prospects. However, it carries a high level of debt which could be a concern. Recent financial results showed CHF 3.63 billion in sales and CHF 609.5 million in net income for the full year ended March 31, 2024.

- Delve into the full analysis future growth report here for a deeper understanding of Sonova Holding.

- Insights from our recent valuation report point to the potential undervaluation of Sonova Holding shares in the market.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG is a global company that develops, markets, and sells integrated banking software systems to financial institutions, with a market capitalization of approximately CHF 4.74 billion.

Operations: The company generates revenue from the development, marketing, and sale of integrated banking software systems to financial institutions globally.

Insider Ownership: 17.4%

Temenos, a Swiss growth company with high insider ownership, is trading at 22.9% below its fair value, signaling a potential opportunity. Its earnings have grown by 16.2% over the past year and are expected to increase by 14.7% annually, outpacing the Swiss market's 8.2%. Despite its high debt levels and volatile share price, Temenos has secured significant client commitments like Haventree Bank for digital transformation projects using its scalable SaaS solutions, enhancing business agility and performance.

- Click here to discover the nuances of Temenos with our detailed analytical future growth report.

- According our valuation report, there's an indication that Temenos' share price might be on the cheaper side.

Seize The Opportunity

- Take a closer look at our Fast Growing SIX Swiss Exchange Companies With High Insider Ownership list of 16 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SOON

Sonova Holding

Manufactures and sells hearing care solutions for adults and children in the United States, Europe, the Middle East, Africa, and the Asia Pacific.

Good value with moderate growth potential.