Stock Analysis

- Switzerland

- /

- Paper and Forestry Products

- /

- SWX:CPHN

Exploring Swiss Dividend Stocks In May 2024

Reviewed by Simply Wall St

In recent trading, the Swiss market demonstrated resilience, with the benchmark SMI index closing modestly higher after a day of fluctuating gains and losses. This stability is reflective of underlying support in various sectors, setting an intriguing backdrop for investors interested in Swiss dividend stocks as we approach May 2024. In this context, understanding what constitutes a robust dividend stock is crucial, especially considering current market dynamics where companies like Kuehne & Nagel and Sandoz Group have shown notable performance improvements.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Roche Holding (SWX:ROG) | 4.18% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 5.62% | ★★★★★★ |

| Vontobel Holding (SWX:VONN) | 5.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.59% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.32% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.56% | ★★★★★☆ |

| EFG International (SWX:EFGN) | 4.45% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.73% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.64% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 4.88% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

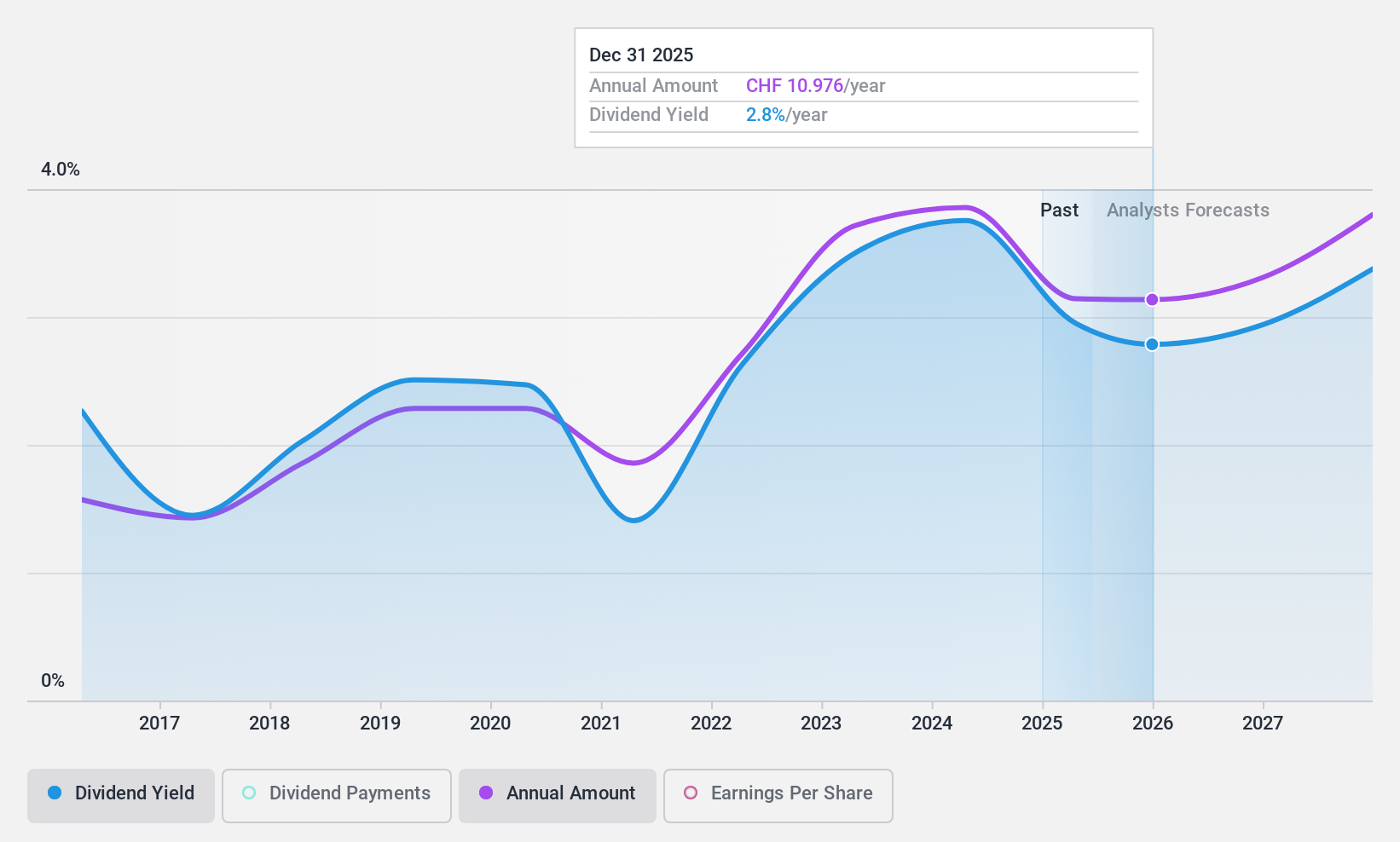

Bucher Industries (SWX:BUCN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bucher Industries AG, a global company, manufactures and sells machinery and systems for food production, packaging, and agricultural harvesting, as well as hydraulic components for maintaining roads and public spaces; it has a market capitalization of CHF 3.95 billion.

Operations: Bucher Industries AG's revenue is divided among its segments as follows: Kuhn Group generates CHF 1.42 billion, Bucher Specials brings in CHF 398 million, Bucher Municipal earns CHF 572.50 million, Bucher Hydraulics accounts for CHF 743.60 million, and Bucher Emhart Glass contributes CHF 523.60 million.

Dividend Yield: 3.5%

Bucher Industries AG offers a dividend yield of 3.5%, which is below the top quartile for Swiss dividend stocks at 4.1%. Despite a stable ten-year history of dividend payments, its dividends are not well supported by cash flows, with a high cash payout ratio of 127.1%. However, earnings have grown by an annual rate of 14% over the past five years. Recent financial results show increased net income from CHF 331.2 million in 2022 to CHF 352.1 million in 2023 and stable earnings per share, indicating some resilience despite forecasts of declining earnings over the next three years.

- Unlock comprehensive insights into our analysis of Bucher Industries stock in this dividend report.

- Upon reviewing our latest valuation report, Bucher Industries' share price might be too pessimistic.

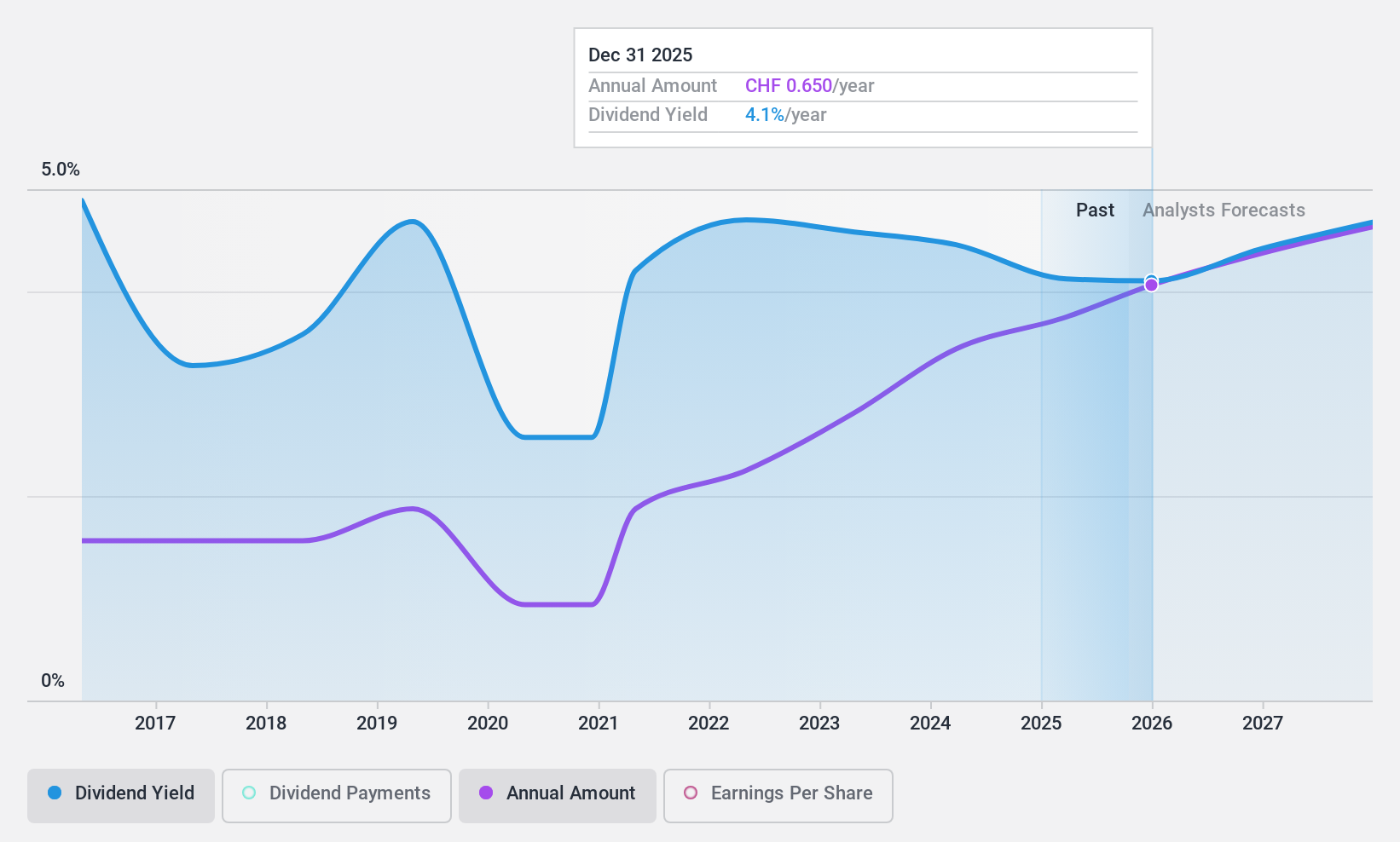

CPH Chemie + Papier Holding (SWX:CPHN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CPH Chemie + Papier Holding AG operates in the production and distribution of chemicals, printing paper, and pharmaceutical packaging films, with a market capitalization of CHF 538.37 million.

Operations: CPH Chemie + Papier Holding AG generates revenue through three primary segments: Chemistry (CHF 124.17 million), Paper (CHF 262.48 million), and Packaging (CHF 237.33 million).

Dividend Yield: 4.5%

CPH Chemie + Papier Holding AG maintains a dividend yield of 4.45%, ranking it among the top 25% in the Swiss market. While its dividends are supported by a low payout ratio of 30.4% and a similar cash payout ratio of 31.9%, indicating sustainability from earnings and cash flow perspectives, the company has experienced volatility in its dividend payments over the past decade. Additionally, CPHN trades at a P/E ratio of 6.8x, significantly below the Swiss market average, suggesting relative undervaluation despite forecasts of declining earnings by an average of 10.6% annually over the next three years.

- Click to explore a detailed breakdown of our findings in CPH Chemie + Papier Holding's dividend report.

- The valuation report we've compiled suggests that CPH Chemie + Papier Holding's current price could be quite moderate.

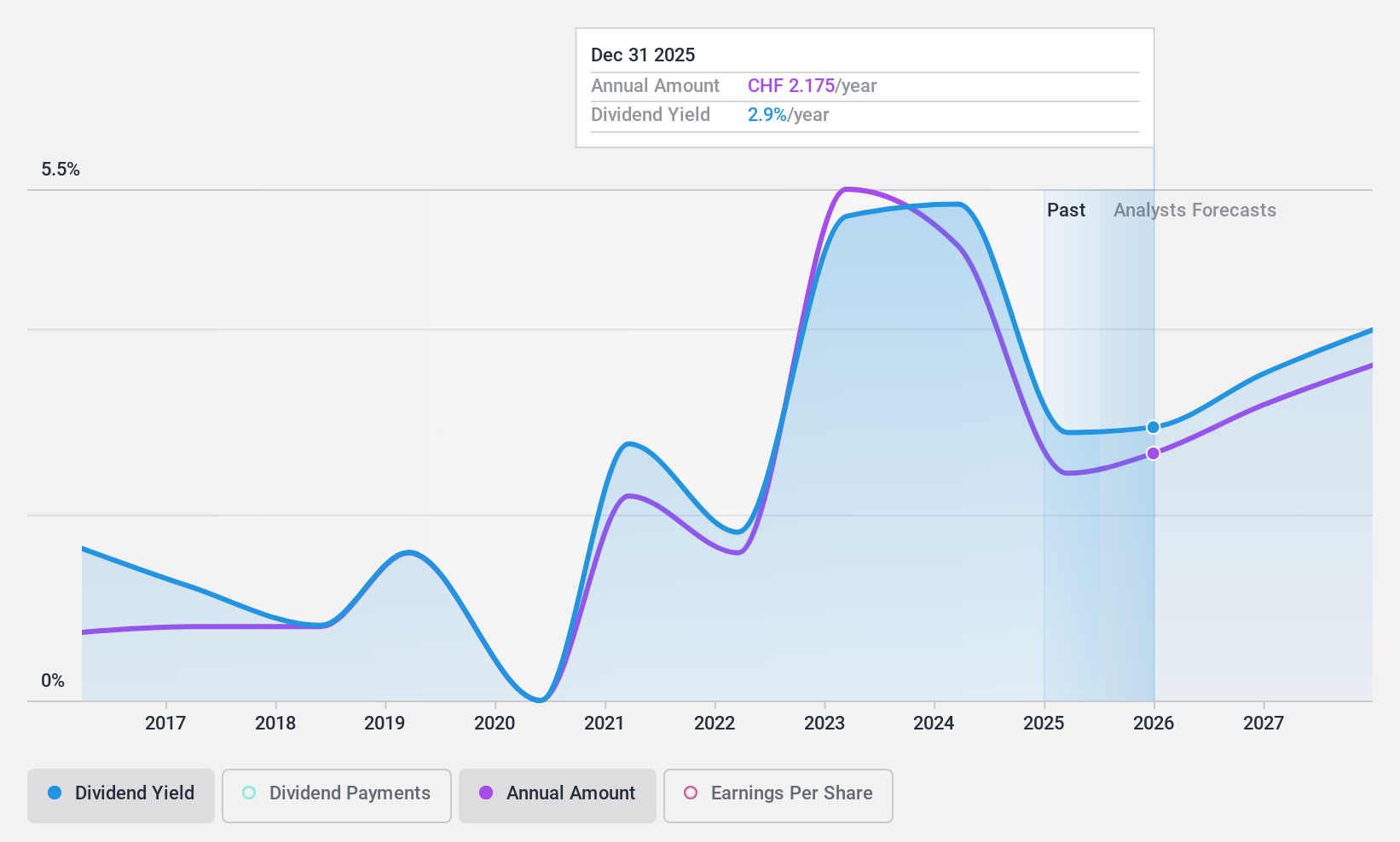

EFG International (SWX:EFGN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EFG International AG operates in private banking, wealth management, and asset management, with a market capitalization of approximately CHF 3.73 billion.

Operations: EFG International AG generates revenue through various regional and functional segments, including CHF 450.20 million from Switzerland & Italy, CHF 249.70 million from Continental Europe & Middle East, CHF 177.40 million from the United Kingdom, CHF 165.30 million from Asia Pacific, CHF 133.20 million from the Americas, and smaller contributions from Global Markets & Treasury (CHF 83 million) and Investment and Wealth Solutions (CHf 122.40 million).

Dividend Yield: 4.4%

EFG International AG, trading 34.5% below its estimated fair value, offers a dividend yield of 4.45%, placing it in the top 25% of Swiss dividend payers. The company's dividends are supported by a sustainable payout ratio of 58.5%, with earnings growth last year at 56.6%. However, EFG has faced challenges with a high bad loans ratio at 2.5% and historical volatility in dividend payments over the past decade, suggesting potential concerns for long-term stability.

- Take a closer look at EFG International's potential here in our dividend report.

- Our expertly prepared valuation report EFG International implies its share price may be lower than expected.

Seize The Opportunity

- Navigate through the entire inventory of 27 Top Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether CPH Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CPHN

CPH Group

CPH Chemie + Papier Holding AG, together with its subsidiaries, engages in manufacture and sale of chemicals and packaging films in Switzerland, rest of Europe, the Americas, Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.