Stock Analysis

- Switzerland

- /

- Insurance

- /

- SWX:SREN

3 Swiss Dividend Stocks Yielding Up To 5.7%

Reviewed by Simply Wall St

Swiss stocks remained resilient throughout Thursday's trading session, buoyed by positive earnings updates from key companies. The benchmark SMI index closed with a gain of 47.40 points or 0.4% at $11,946.66, driven by notable performances in the insurance sector. In this favorable market environment, investors may find attractive opportunities in dividend stocks that offer stable returns and potential for growth. Here are three Swiss dividend stocks yielding up to 5.7%.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Roche Holding (SWX:ROG) | 4.09% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 5.66% | ★★★★★★ |

| Vontobel Holding (SWX:VONN) | 5.37% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.60% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.15% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.51% | ★★★★★☆ |

| EFG International (SWX:EFGN) | 4.68% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.11% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.76% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.57% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

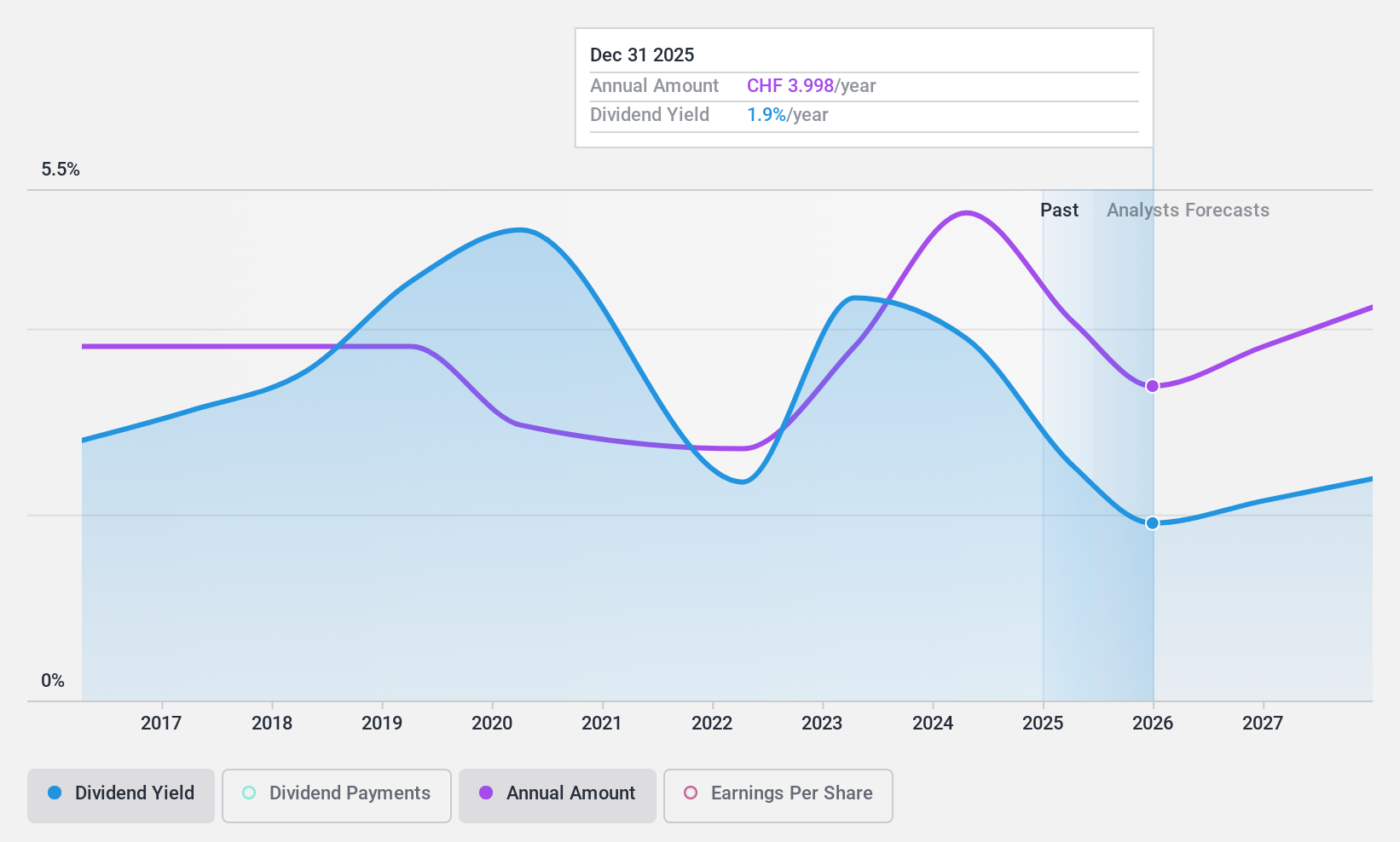

EFG International (SWX:EFGN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EFG International AG, with a market cap of CHF3.54 billion, offers private banking, wealth management, and asset management services through its subsidiaries.

Operations: EFG International AG's revenue segments include Americas (CHF133.20 million), Corporate (CHF42.80 million), Asia Pacific (CHF165.30 million), United Kingdom (CHF177.40 million), Switzerland & Italy (CHF450.20 million), Global Markets & Treasury (CHF83 million), Investment and Wealth Solutions (CHF122.40 million), and Continental Europe & Middle East (CHF249.70 million).

Dividend Yield: 4.7%

EFG International has shown robust earnings growth of 56.6% over the past year and maintains a reasonable payout ratio of 58.5%, ensuring dividends are covered by earnings. The dividend yield stands at 4.68%, placing it in the top quartile in Switzerland, though payments have been volatile over the past decade. Recent news includes an extension of its buyback plan until July 2024 and a special cash dividend ex-date on March 26, 2024 (CHF0.55).

- Navigate through the intricacies of EFG International with our comprehensive dividend report here.

- According our valuation report, there's an indication that EFG International's share price might be on the cheaper side.

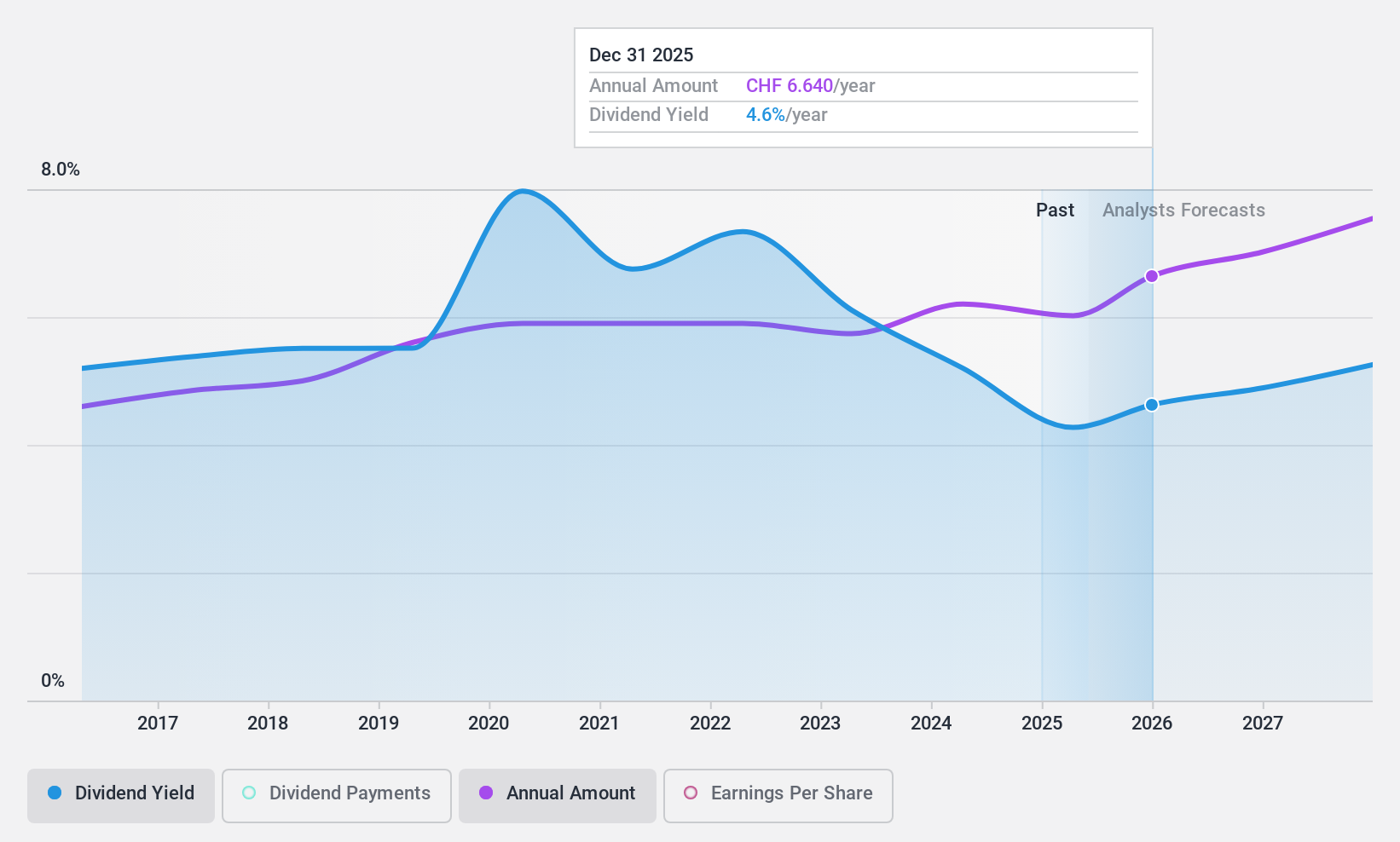

Swiss Re (SWX:SREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swiss Re AG, with a market cap of CHF31.26 billion, offers wholesale reinsurance, insurance, other insurance-based risk transfer solutions, and related services globally through its subsidiaries.

Operations: Swiss Re AG generates its revenue primarily from Property & Casualty Reinsurance ($24.96 billion), Life & Health Reinsurance ($17.87 billion), and Corporate Solutions ($5.94 billion).

Dividend Yield: 5.7%

Swiss Re's dividend yield is among the top 25% in Switzerland, though payments have been volatile and declining over the past decade. With a payout ratio of 61.3% and a cash payout ratio of 48.3%, dividends are well-covered by earnings and cash flows. Recent news includes a proposed 6% dividend increase to US$6.80 per share for 2023, net income of US$1.09 billion for Q1 2024, and Andreas Berger's appointment as CEO starting July 1, 2024.

- Delve into the full analysis dividend report here for a deeper understanding of Swiss Re.

- In light of our recent valuation report, it seems possible that Swiss Re is trading behind its estimated value.

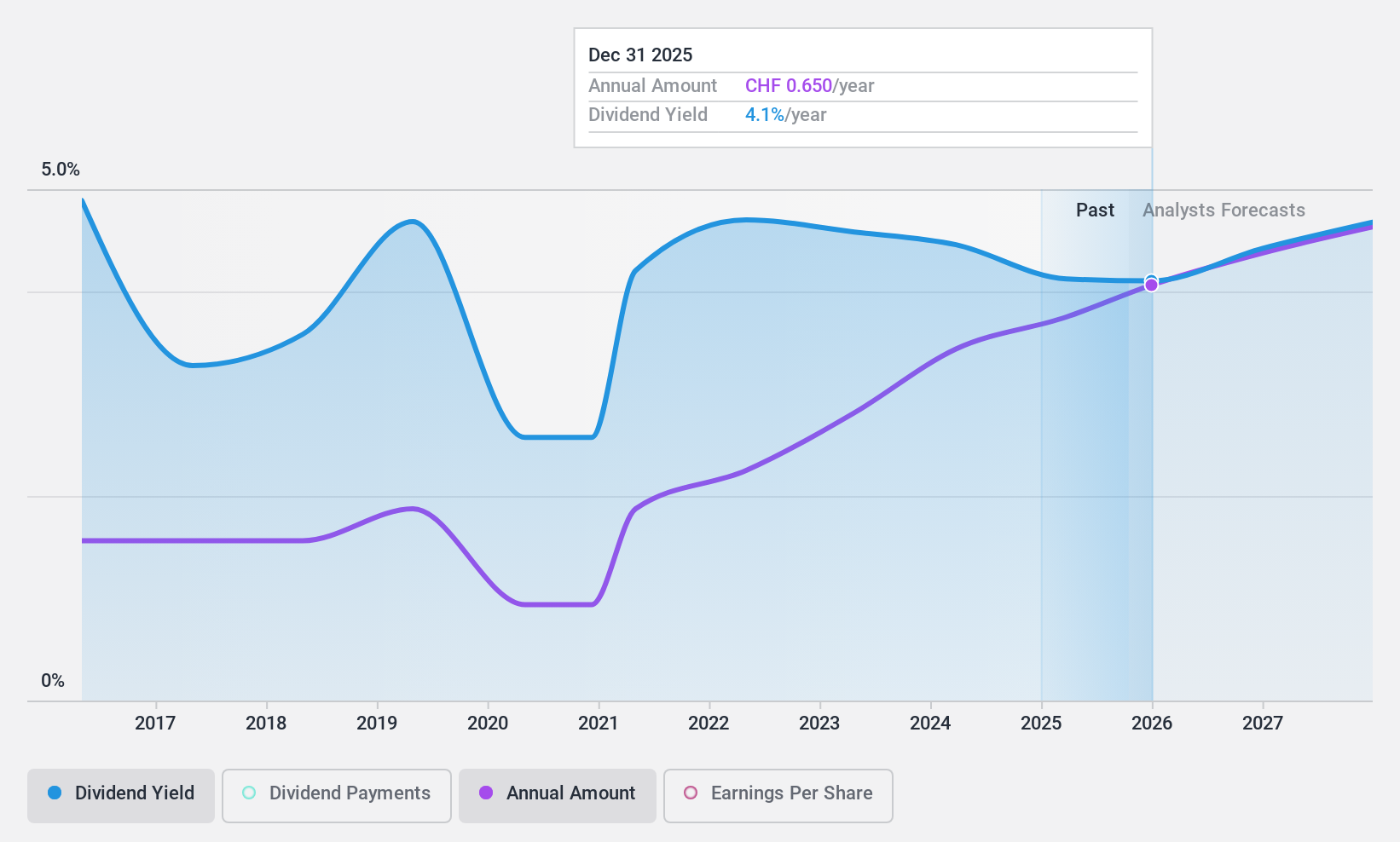

TX Group (SWX:TXGN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TX Group AG operates a network of platforms offering information, orientation, entertainment, and support services in Switzerland with a market cap of CHF1.60 billion.

Operations: TX Group AG's revenue segments include Tamedia (CHF446.40 million), Goldbach (CHF274.70 million), 20 Minutes (CHF118.40 million), TX Markets (CHF133.80 million), and Groups & Ventures (CHF159.40 million).

Dividend Yield: 4.1%

TX Group's dividend yield is in the top 25% of Swiss stocks, supported by a cash payout ratio of 42.1%. Despite this, dividend payments have been volatile over the past decade. Recent events include an ex-dividend date for a regular CHF2.00 and special CHF4.20 payment on April 23, 2024. Additionally, TX Group is exploring the sale of printing plants and office buildings potentially worth hundreds of millions CHF amid industry pressures and strategic realignment efforts continuing through June 2026.

- Get an in-depth perspective on TX Group's performance by reading our dividend report here.

- Our expertly prepared valuation report TX Group implies its share price may be too high.

Next Steps

- Delve into our full catalog of 27 Top Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Swiss Re is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SREN

Swiss Re

Provides wholesale reinsurance, insurance, other insurance-based forms of risk transfer, and other insurance-related services worldwide.

Undervalued with solid track record and pays a dividend.