Stock Analysis

- Switzerland

- /

- Transportation

- /

- SWX:JFN

Swiss Dividend Stocks To Watch In June 2024

Reviewed by Simply Wall St

Amid a backdrop of a declining Switzerland market, with the SMI index closing down by 0.95% amid global economic growth concerns, investors may be looking for more stable investment opportunities. In such uncertain times, dividend stocks can offer potential for steady income, making them an appealing option to consider in June 2024.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Vontobel Holding (SWX:VONN) | 5.43% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 5.14% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.45% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.32% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.42% | ★★★★★☆ |

| Roche Holding (SWX:ROG) | 3.80% | ★★★★★☆ |

| EFG International (SWX:EFGN) | 4.20% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.12% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.74% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 5.13% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

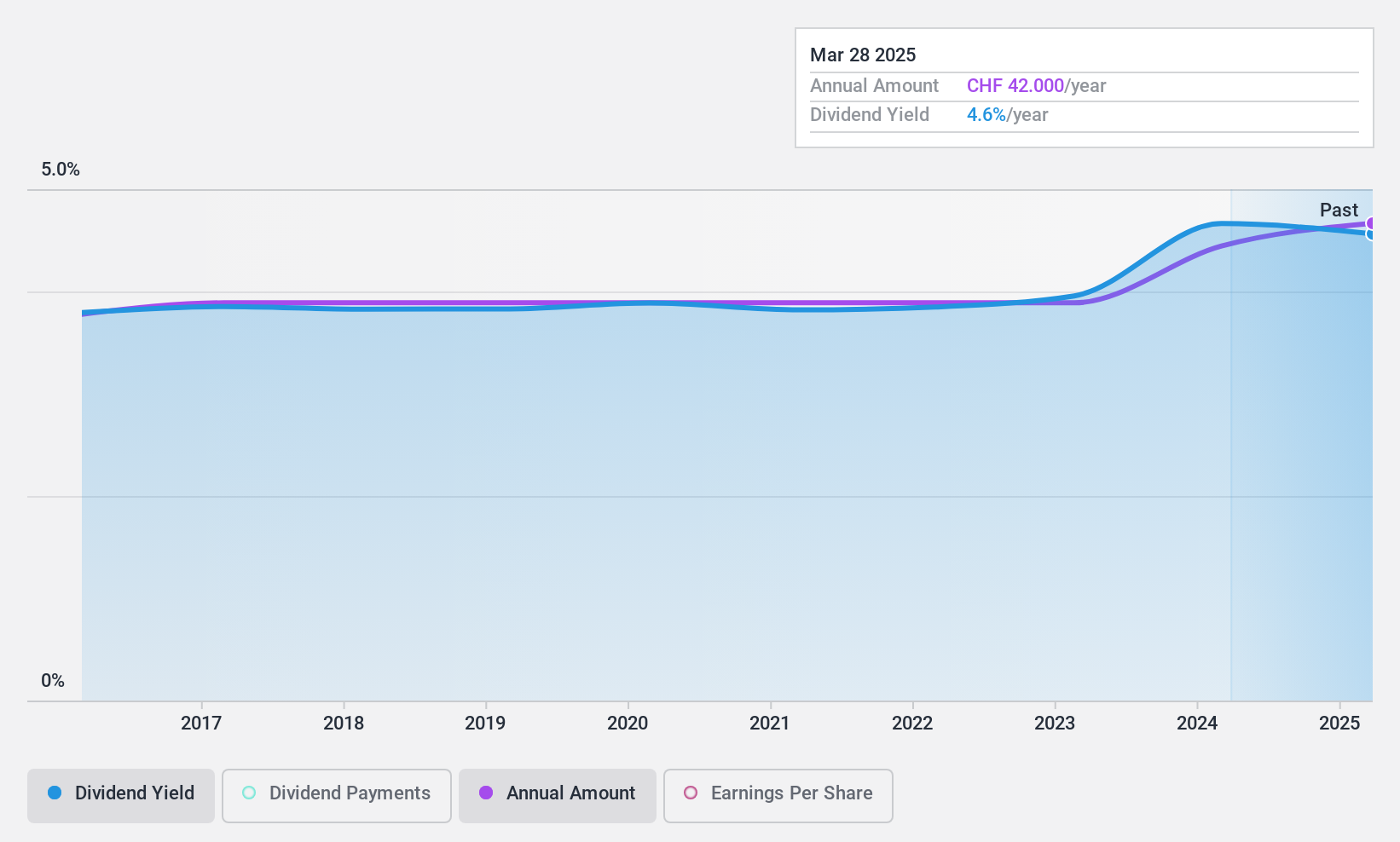

Basellandschaftliche Kantonalbank (SWX:BLKB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Basellandschaftliche Kantonalbank offers a range of banking products and services to private, institutional, business, and public sector clients in Switzerland, with a market capitalization of CHF 1.82 billion.

Operations: Basellandschaftliche Kantonalbank generated CHF 458.55 million in revenue from its banking operations.

Dividend Yield: 4.7%

Basellandschaftliche Kantonalbank maintains a solid dividend profile with a 4.74% yield, placing it in the top 25% of Swiss dividend payers. Its dividends are well-supported by earnings, evidenced by a reasonable payout ratio of 56.7%. Over the past decade, BLKB has demonstrated reliability in its dividend payments, showing growth and stability. Despite trading at a 31% discount to its estimated fair value, concerns about future coverage persist due to insufficient data on long-term sustainability.

- Click here to discover the nuances of Basellandschaftliche Kantonalbank with our detailed analytical dividend report.

- Our expertly prepared valuation report Basellandschaftliche Kantonalbank implies its share price may be too high.

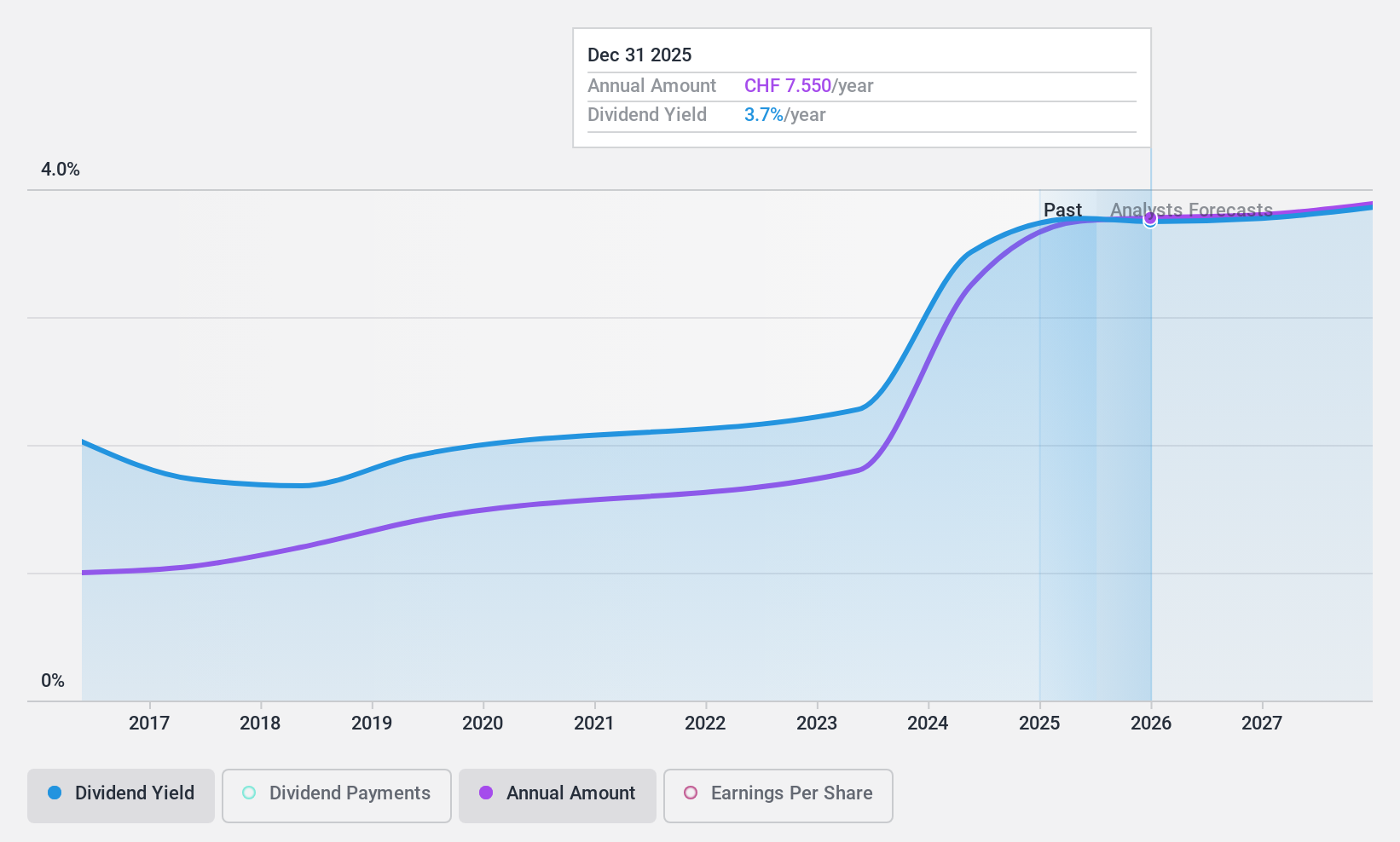

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG operates cogwheel railways and winter sports facilities in the Jungfrau region of Switzerland, with a market capitalization of approximately CHF 1.07 billion.

Operations: Jungfraubahn Holding AG generates revenue primarily through three segments: CHF 188.24 million from Jungfraujoch - Top of Europe, CHF 45.94 million from Experience Mountains, and CHF 41.26 million from Winter Sports.

Dividend Yield: 3.4%

Jungfraubahn Holding AG offers a dividend yield of 3.39%, which is below the top quartile of Swiss dividend stocks. While its dividends are well-covered by both earnings and cash flows, with payout ratios of 47.8% and 61.7% respectively, the company has experienced volatility in its dividend payments over the past decade, including significant annual fluctuations. Recent growth in earnings (81.6% last year) suggests potential for future improvements, but dividends remain unpredictable as evidenced by an irregular historical pattern and modest forecasted earnings growth of 2.54% per year.

- Click to explore a detailed breakdown of our findings in Jungfraubahn Holding's dividend report.

- Our valuation report here indicates Jungfraubahn Holding may be overvalued.

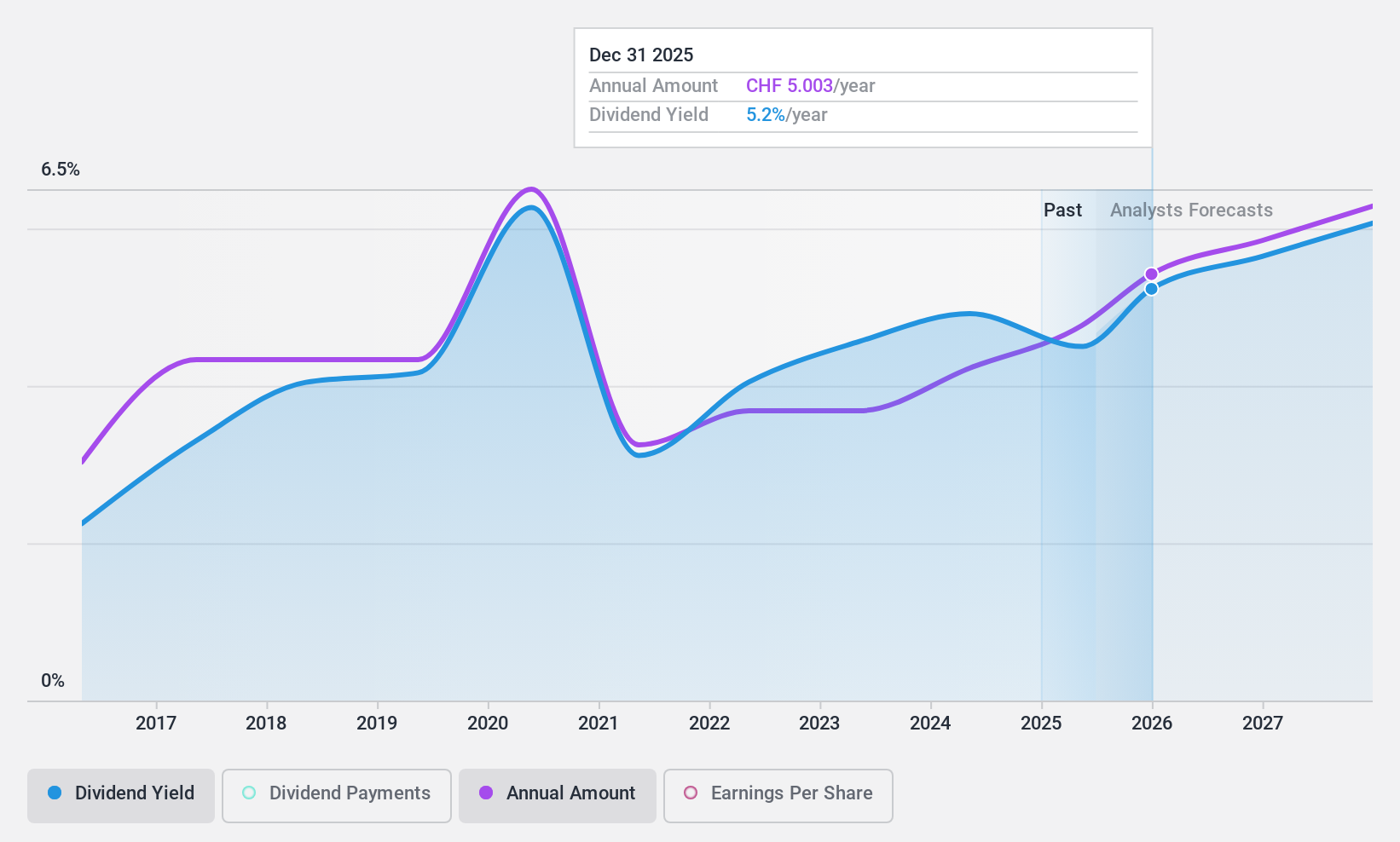

Orell Füssli (SWX:OFN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Orell Füssli AG operates in security solutions and book retailing, serving both Swiss and international markets, with a market capitalization of CHF 152.49 million.

Operations: Orell Füssli AG generates CHF 117.48 million from its book trade, CHF 77.15 million from security printing, and CHF 21.59 million from industrial systems.

Dividend Yield: 5%

Orell Füssli exhibits a dividend yield of 5.01%, positioning it well within the top 25% of Swiss dividend payers. Despite this, its dividend history over the past eight years shows volatility and inconsistency in payments. The company's dividends are supported by a payout ratio of 63.5% from earnings and a cash payout ratio of 61.6%, suggesting reasonable coverage by both earnings and cash flows. However, Orell Füssli's relatively short history of dividend payments and their unstable nature may concern conservative investors seeking steady income streams.

- Delve into the full analysis dividend report here for a deeper understanding of Orell Füssli.

- In light of our recent valuation report, it seems possible that Orell Füssli is trading behind its estimated value.

Next Steps

- Click here to access our complete index of 28 Top Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Jungfraubahn Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:JFN

Jungfraubahn Holding

Operates cogwheel railway and winter sports related facilities in Jungfrau region, Switzerland.

Solid track record with adequate balance sheet and pays a dividend.