- Switzerland

- /

- Capital Markets

- /

- SWX:CFT

Exploring LU-VE And Two Hidden European Small Caps With Strong Financials

Reviewed by Simply Wall St

In recent weeks, European markets have faced significant turbulence, with the pan-European STOXX Europe 600 Index experiencing its largest drop in five years due to higher-than-expected U.S. trade tariffs. Amidst this volatility, small-cap stocks have been particularly impacted, as investors navigate the uncertainties of global trade policies and their potential effects on economic growth and inflation. In such challenging conditions, identifying companies with robust financials becomes crucial for investors seeking stability and long-term potential. This article explores LU-VE along with two other lesser-known European small caps that exhibit strong financial health despite the current market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Alantra Partners | NA | -3.99% | -23.83% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| ABG Sundal Collier Holding | 0.61% | -4.24% | -12.70% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

LU-VE (BIT:LUVE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: LU-VE S.p.A. is involved in the production and marketing of heat exchangers and air-cooled equipment both in Italy and internationally, with a market capitalization of approximately €618.45 million.

Operations: LU-VE S.p.A. generates revenue primarily from two segments: Components (€285.02 million) and Cooling Systems (€295.98 million). The company's market capitalization stands at approximately €618.45 million, reflecting its financial stature in the industry.

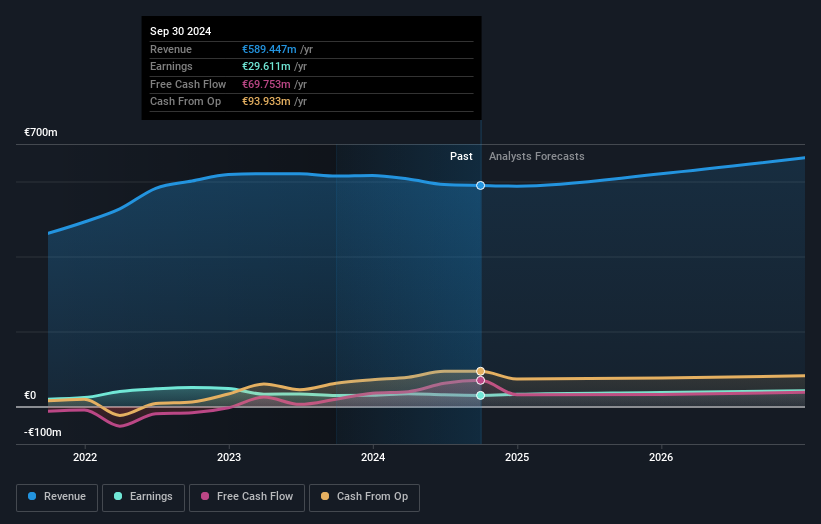

LU-VE, a notable player in the European market, has demonstrated resilience with a 16% earnings growth over the past year, outpacing the Building industry's -50.5%. The company's net income climbed to €34.5 million from €29.75 million, reflecting its high-quality earnings profile. Although sales dipped to €589.09 million from €617.26 million, LU-VE's free cash flow remains positive at €69.75 million as of September 2024, indicating robust operational efficiency despite increased debt-to-equity ratio from 136.7% to 153.7% over five years and satisfactory net debt levels at 29.9%.

- Dive into the specifics of LU-VE here with our thorough health report.

Evaluate LU-VE's historical performance by accessing our past performance report.

Plejd (NGM:PLEJD)

Simply Wall St Value Rating: ★★★★★★

Overview: Plejd AB (publ) is a technology company that develops products and services for smart lighting control across Sweden, Norway, Finland, the Netherlands, Germany, and internationally with a market cap of SEK6.01 billion.

Operations: Plejd generates revenue primarily from the sale of smart lighting control products and services across multiple countries. The company's financial performance includes a focus on maintaining efficient cost structures to support its operations.

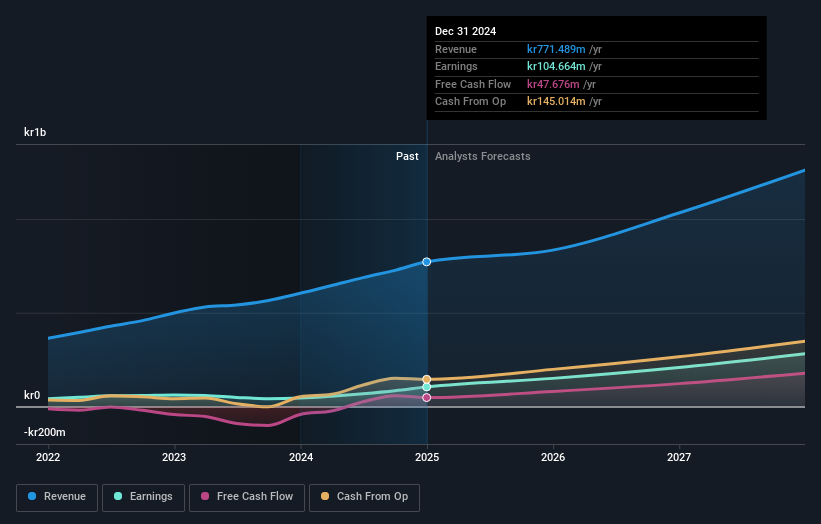

Plejd, a nimble player in the European market, has demonstrated robust growth with earnings surging 132.8% over the past year, outpacing its industry peers. The company is debt-free and trades at 8% below estimated fair value, suggesting potential for appreciation. Recent figures show Q1 revenue of SEK 256.36 million compared to SEK 186.97 million last year, while net income climbed to SEK 44.99 million from SEK 22.68 million a year ago. Despite significant insider selling recently, Plejd's high-quality earnings and free cash flow positivity position it well for future growth prospects in the electrical sector.

- Navigate through the intricacies of Plejd with our comprehensive health report here.

Explore historical data to track Plejd's performance over time in our Past section.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market capitalization of CHF1.54 billion.

Operations: The company generates revenue from three main regions: Europe, Middle East and Africa (CHF475.39 million), Americas (CHF371.20 million), and Asia-Pacific (CHF286.26 million).

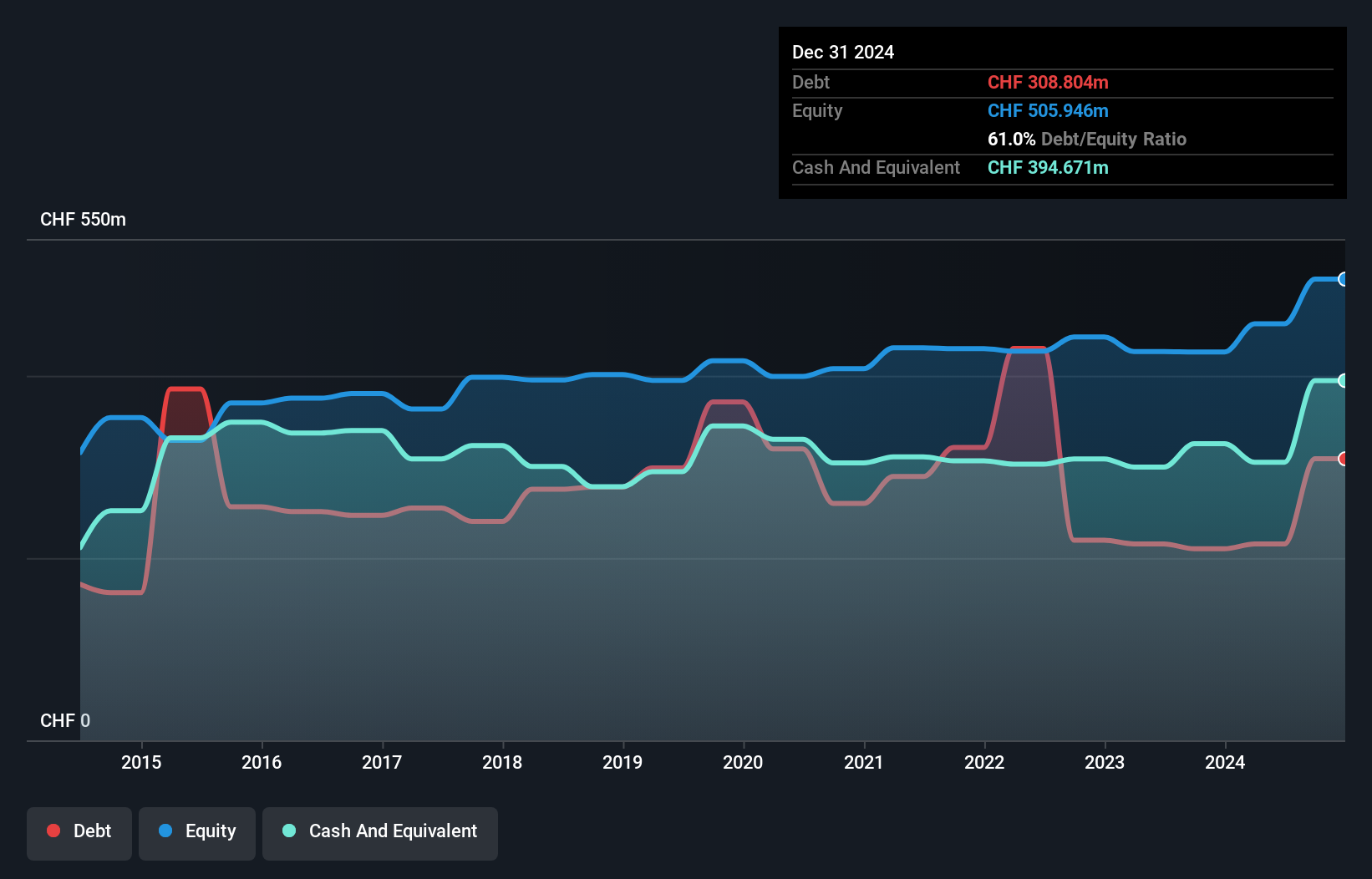

Compagnie Financière Tradition, a smaller player in the financial sector, showcases robust performance with its debt to equity ratio dropping from 89.1% to 61% over five years. Earnings growth of 22.4% outpaced the Capital Markets industry’s 14.6%, indicating strong momentum. The company trades at a discount of 19.4% below estimated fair value, suggesting potential upside for investors seeking value opportunities. Recent earnings results revealed net income of CHF 115.6 million for the year ended December 2024, up from CHF 94.4 million previously, with basic EPS rising to CHF 15.09 from CHF 12.71, reflecting solid profitability and high-quality earnings.

- Delve into the full analysis health report here for a deeper understanding of Compagnie Financière Tradition.

Understand Compagnie Financière Tradition's track record by examining our Past report.

Key Takeaways

- Dive into all 351 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CFT

Compagnie Financière Tradition

Operates as an interdealer broker of financial and non-financial products worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives