- Switzerland

- /

- Capital Markets

- /

- SWX:BAER

Assessing Julius Baer (SWX:BAER) Valuation as Shares Outperform Peers Without Major Headlines

Reviewed by Simply Wall St

Julius Bär Gruppe (SWX:BAER) might not have made headlines with any one seismic event this week, but the recent stock move has caught the attention of investors wondering what lies beneath the surface. Sometimes it is the absence of drama that sparks the biggest questions. Is a quiet period a sign the market is overlooking new value, or simply waiting for more news?

To put things in context, Julius Bär Gruppe shares have climbed 29% over the past year, outpacing some peers and signaling that momentum has been building. Despite a slight dip since the start of this year, steady annual revenue and net income growth have contributed to this stronger longer-term trajectory. This mix of subdued short-term trading and strong year-on-year results creates a puzzling setup for anyone following the stock’s valuation story.

With Julius Bär Gruppe’s recent performance in mind, is there unrecognized value on the table, or is the market already looking ahead and pricing in every bit of future growth?

Most Popular Narrative: 5.6% Undervalued

According to the most widely followed narrative, Julius Bär Gruppe’s shares are undervalued at current levels, trading below their estimated fair value by 5.6%. This assessment reflects a blend of future earnings growth expectations, improving profit margins, and calculated risk factors.

“Progress in cost efficiency, as evidenced by the lower cost-income ratio and ahead-of-plan CHF 130 million cost savings target, suggests sustained improvement in operational margins and profitability going forward. The robust balance sheet and ongoing investment in risk management position the company to capitalize on increased demand for reputable and compliant private banks amid global regulatory scrutiny. This may aid client retention and support net new money inflows.”

Want to know what’s driving this valuation? Find out which future growth levers and bold profit forecasts are built into the analyst consensus. The numbers behind the headline might surprise you. Which hidden catalysts are underpinning this double-digit upside? The answer lies in the details of the narrative’s growth roadmap.

Result: Fair Value of CHF 60.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant credit risks and a lack of major expansion could derail growth and challenge the assumptions behind Julius Bär Gruppe’s fair value case.

Find out about the key risks to this Julius Bär Gruppe narrative.Another View: Discounted Cash Flow Perspective

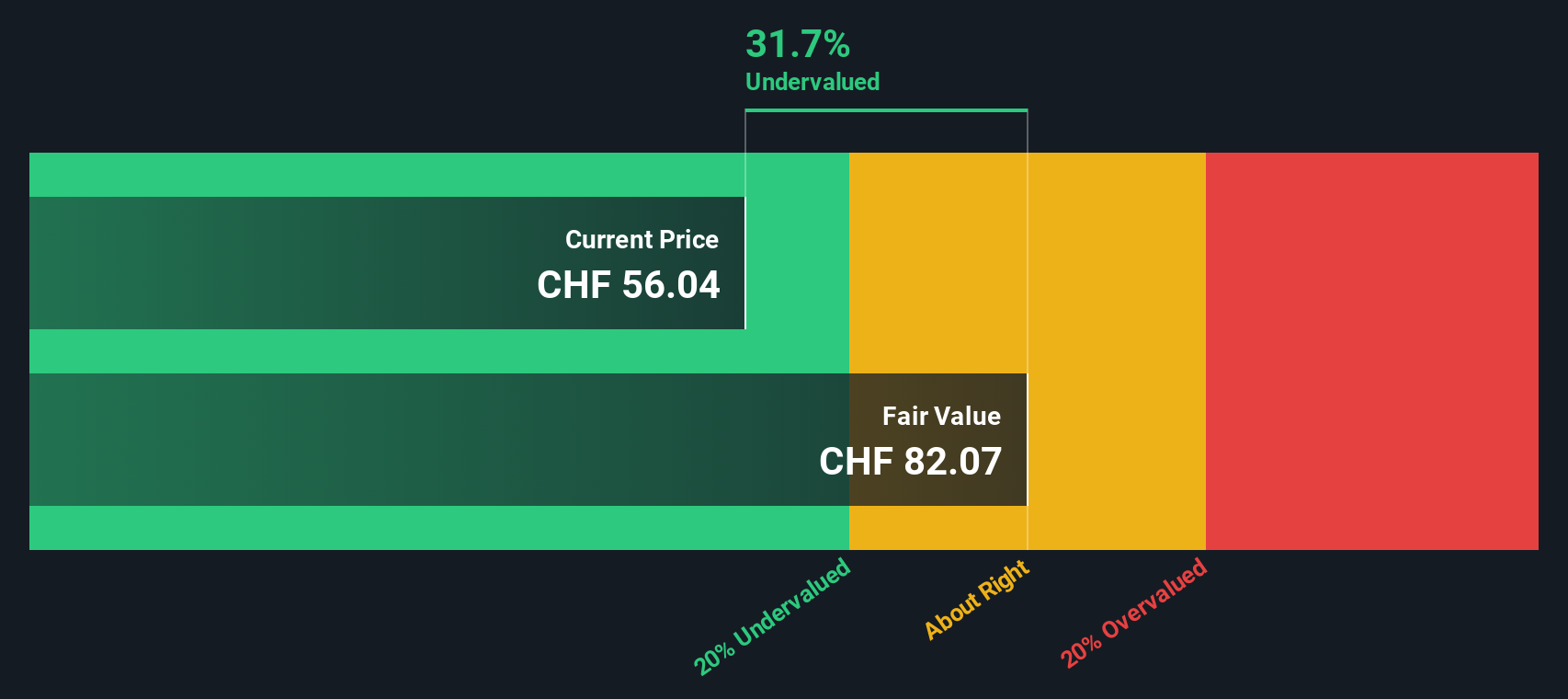

Looking at Julius Bär Gruppe through the lens of our SWS DCF model offers a fresh angle. The numbers suggest the shares could be trading below what the company is really worth. However, could this model be missing something crucial, or does it unlock a value investors have yet to price in?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Julius Bär Gruppe Narrative

If the current valuations or narratives leave you unconvinced, dive into the figures yourself and shape your own story in just a few minutes. Do it your way.

A great starting point for your Julius Bär Gruppe research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next opportunity pass you by. If you want your portfolio ahead of the curve, here are three powerful ways to spot your next smart investment:

- Boost your returns by targeting shares with robust income potential using our list of dividend stocks with yields > 3% that consistently yield over 3%.

- Jump on the AI revolution and uncover tomorrow’s tech leaders among AI penny stocks, businesses at the cutting edge of artificial intelligence innovation.

- Accelerate your search for bargains by zeroing in on undervalued stocks based on cash flows that the market may be overlooking based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SWX:BAER

Julius Bär Gruppe

Provides wealth management solutions in Switzerland, Europe, the Americas, Asia, and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives