- Switzerland

- /

- Luxury

- /

- SWX:UHR

3 Stocks That May Be Trading Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

In the current global market landscape, characterized by volatile U.S. stock performance amid AI competition fears and mixed economic signals from central banks, investors are keenly observing opportunities for potential undervalued stocks. As markets react to these developments, identifying stocks that may be trading below their estimated intrinsic value can offer a strategic edge in navigating this complex environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$527.62 | 49.9% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥100.70 | 49.8% |

| Gaming Realms (AIM:GMR) | £0.358 | £0.71 | 49.7% |

| GlobalData (AIM:DATA) | £1.78 | £3.55 | 49.9% |

| Zhaojin Mining Industry (SEHK:1818) | HK$12.14 | HK$24.15 | 49.7% |

| Bufab (OM:BUFAB) | SEK467.40 | SEK928.96 | 49.7% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥25.94 | 49.7% |

| Prodways Group (ENXTPA:PWG) | €0.576 | €1.15 | 49.8% |

| South32 (ASX:S32) | A$3.36 | A$6.70 | 49.8% |

| Gold Royalty (NYSEAM:GROY) | US$1.32 | US$2.63 | 49.9% |

We're going to check out a few of the best picks from our screener tool.

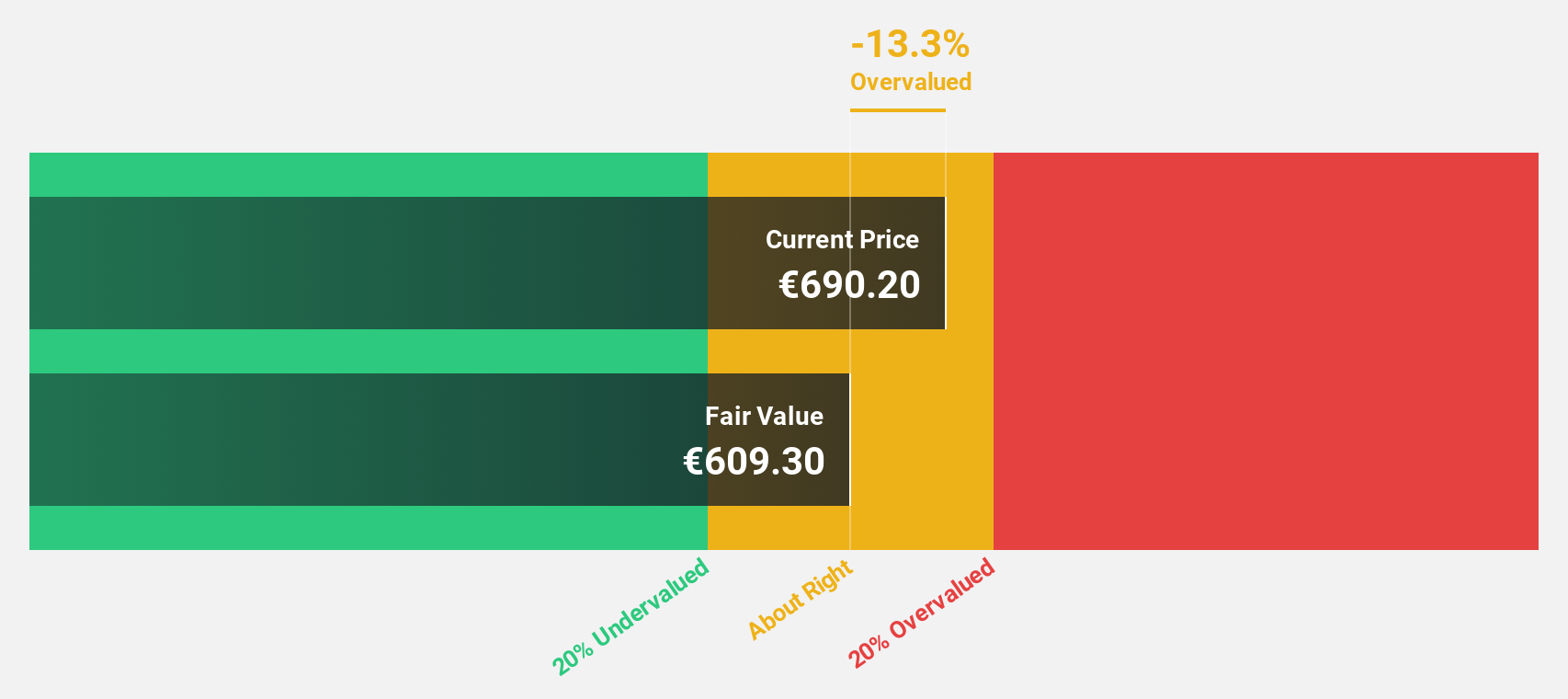

ASML Holding (ENXTAM:ASML)

Overview: ASML Holding N.V. develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers and has a market cap of approximately €284.62 billion.

Operations: The company's revenue primarily comes from its Semiconductor Equipment and Services segment, which generated €28.26 billion.

Estimated Discount To Fair Value: 16.9%

ASML Holding's recent earnings report shows a slight revenue increase to €28.26 billion, yet net income declined, reflecting challenges in the semiconductor market and tighter export regulations to China. Despite these hurdles, ASML is trading at €722.7 per share, 16.9% below its estimated fair value of €869.53 based on discounted cash flow analysis. The company's forecasted earnings growth outpaces the Dutch market but remains below significant thresholds, highlighting moderate undervaluation potential amidst volatility and legal issues.

- Upon reviewing our latest growth report, ASML Holding's projected financial performance appears quite optimistic.

- Take a closer look at ASML Holding's balance sheet health here in our report.

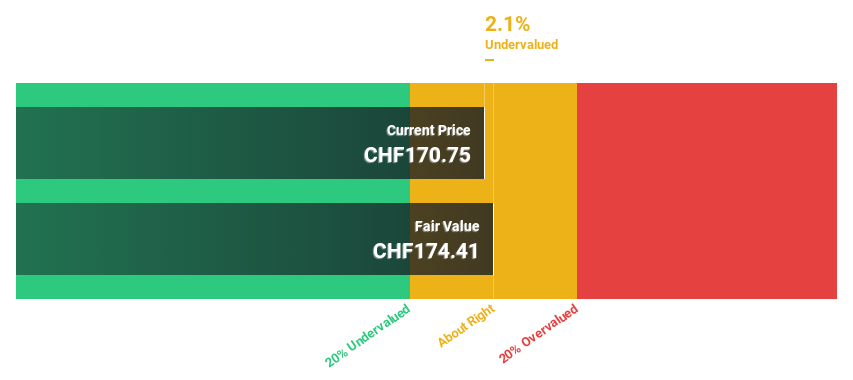

Swatch Group (SWX:UHR)

Overview: The Swatch Group AG is a global company that designs, manufactures, and sells finished watches, jewelry, and watch movements and components with a market cap of CHF8.73 billion.

Operations: The company's revenue is primarily derived from its Watches & Jewelry segment, which accounts for CHF6.42 billion, and its Electronic Systems segment, contributing CHF330 million.

Estimated Discount To Fair Value: 31.7%

Swatch Group's recent earnings report revealed a drop in sales to CHF 6.73 billion and net income to CHF 193 million, reflecting operational challenges. Despite this, the stock trades at CHF 169.5, significantly below its fair value estimate of CHF 248.27 based on discounted cash flow analysis, presenting potential undervaluation opportunities. While earnings are expected to grow substantially by 39.6% annually, the low forecasted return on equity and unsustainable dividend coverage remain concerns for investors.

- The analysis detailed in our Swatch Group growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Swatch Group stock in this financial health report.

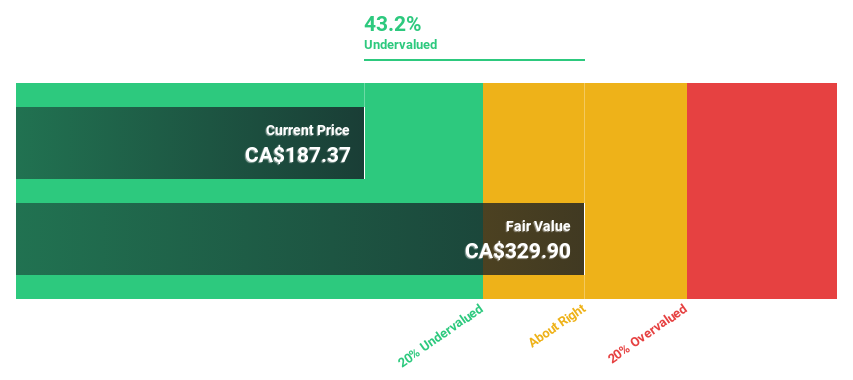

Celestica (TSX:CLS)

Overview: Celestica Inc. offers supply chain solutions across North America, Europe, and Asia with a market cap of CA$20.88 billion.

Operations: Revenue segments for Celestica include Advanced Technology Solutions at $2.56 billion and Connectivity & Cloud Solutions at $3.14 billion.

Estimated Discount To Fair Value: 21.2%

Celestica's recent earnings report showed a robust increase in sales to US$2.55 billion and net income to US$151.7 million, indicating strong financial performance. The stock is trading at CA$179.43, significantly below its fair value estimate of CA$227.77 based on discounted cash flow analysis, suggesting it is undervalued by over 20%. Earnings are expected to grow annually by 17.44%, outpacing the Canadian market average and highlighting potential investment appeal despite moderate revenue growth forecasts.

- Our growth report here indicates Celestica may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Celestica's balance sheet health report.

Seize The Opportunity

- Navigate through the entire inventory of 919 Undervalued Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:UHR

Swatch Group

Designs, manufactures, and sells finished watches, jewelry, and watch movements and components in Switzerland, rest of Europe, Greater China, rest of Asia, America, Oceania, and Africa.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives