- Switzerland

- /

- Medical Equipment

- /

- SWX:STMN

Undervalued Stock Estimates On SIX Swiss Exchange For August 2024

Reviewed by Simply Wall St

Despite a mid-session setback, the Switzerland market ended on a firm note on Tuesday as stocks found some support in late afternoon trades. The benchmark SMI ended with a gain of 54.43 points or 0.46% at 11,928.14, reflecting investor confidence despite mixed performance among individual stocks. In this context, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential growth opportunities within the Swiss market.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LEM Holding (SWX:LEHN) | CHF1184.00 | CHF1822.61 | 35% |

| Georg Fischer (SWX:GF) | CHF62.45 | CHF112.17 | 44.3% |

| Burckhardt Compression Holding (SWX:BCHN) | CHF580.00 | CHF964.11 | 39.8% |

| Swissquote Group Holding (SWX:SQN) | CHF290.40 | CHF428.16 | 32.2% |

| Clariant (SWX:CLN) | CHF12.15 | CHF21.52 | 43.5% |

| lastminute.com (SWX:LMN) | CHF19.60 | CHF30.32 | 35.4% |

| Gurit Holding (SWX:GURN) | CHF40.60 | CHF72.48 | 44% |

| SGS (SWX:SGSN) | CHF92.54 | CHF144.55 | 36% |

| Dätwyler Holding (SWX:DAE) | CHF175.20 | CHF251.45 | 30.3% |

| Arbonia (SWX:ARBN) | CHF12.20 | CHF21.24 | 42.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Partners Group Holding (SWX:PGHN)

Overview: Partners Group Holding AG is a private equity firm specializing in direct, secondary, and primary investments across private equity, real estate, infrastructure, and debt with a market cap of CHF29.73 billion.

Operations: Partners Group Holding AG generates revenue from several segments, including Real Estate (CHF186.90 million), Infrastructure (CHF379.20 million), Private Credit (CHF211.30 million), and Private Equity (CHF1.17 billion).

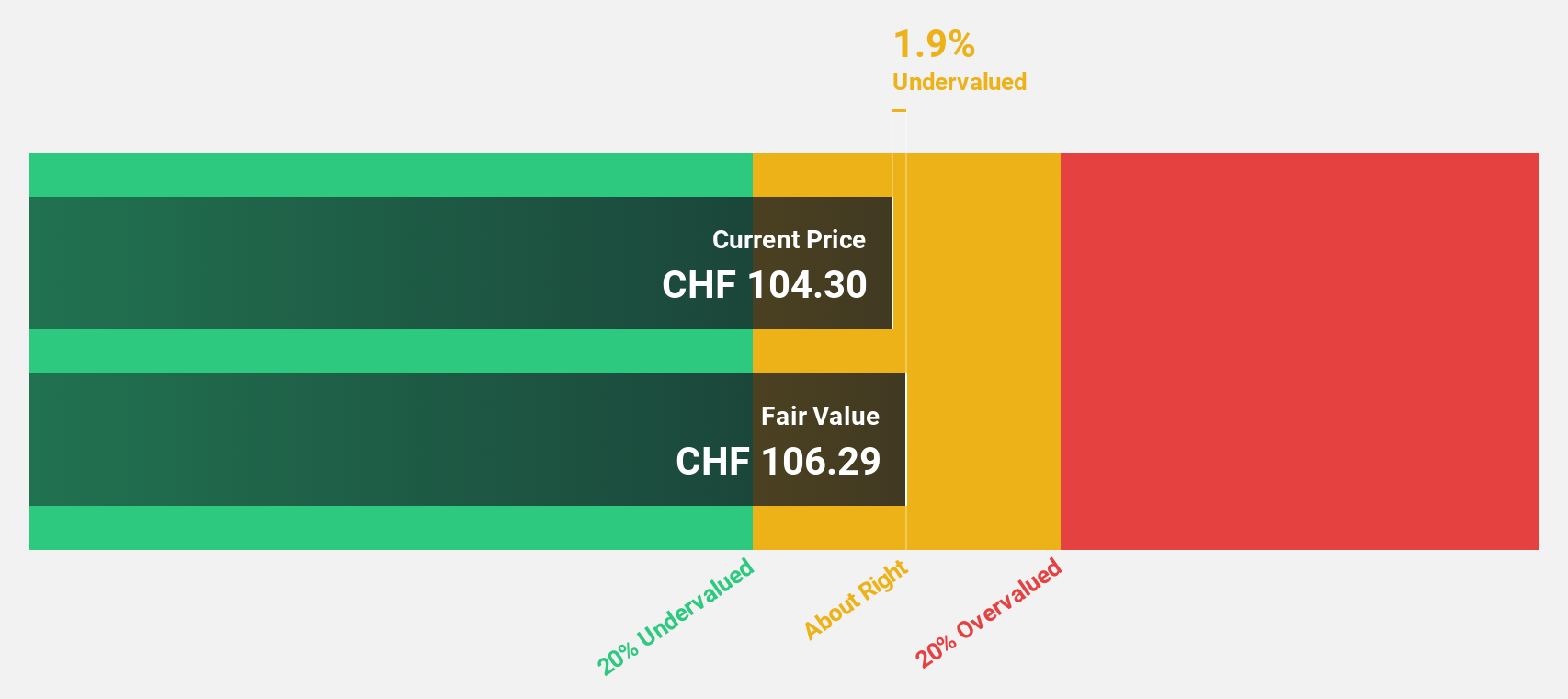

Estimated Discount To Fair Value: 12.8%

Partners Group Holding AG, trading at CHF1144.5, is 12.8% below its estimated fair value of CHF1312.53 based on discounted cash flow analysis. Despite high debt levels and a dividend yield of 3.41% not well covered by earnings or free cash flows, the company shows promising growth with forecasted earnings and revenue increases of 13.5% and 14.1% per year respectively, outpacing the Swiss market averages. Recent M&A activity includes due diligence for acquiring Lighthouse Learnings, potentially enhancing future growth prospects.

- The analysis detailed in our Partners Group Holding growth report hints at robust future financial performance.

- Click here to discover the nuances of Partners Group Holding with our detailed financial health report.

SGS (SWX:SGSN)

Overview: SGS SA offers inspection, testing, and verification services across Europe, Africa, the Middle East, the Americas, and the Asia Pacific with a market cap of CHF17.51 billion.

Operations: The company generates revenue primarily from Business Assurance, which amounts to CHF755 million, with a segment adjustment of CHF5.92 billion.

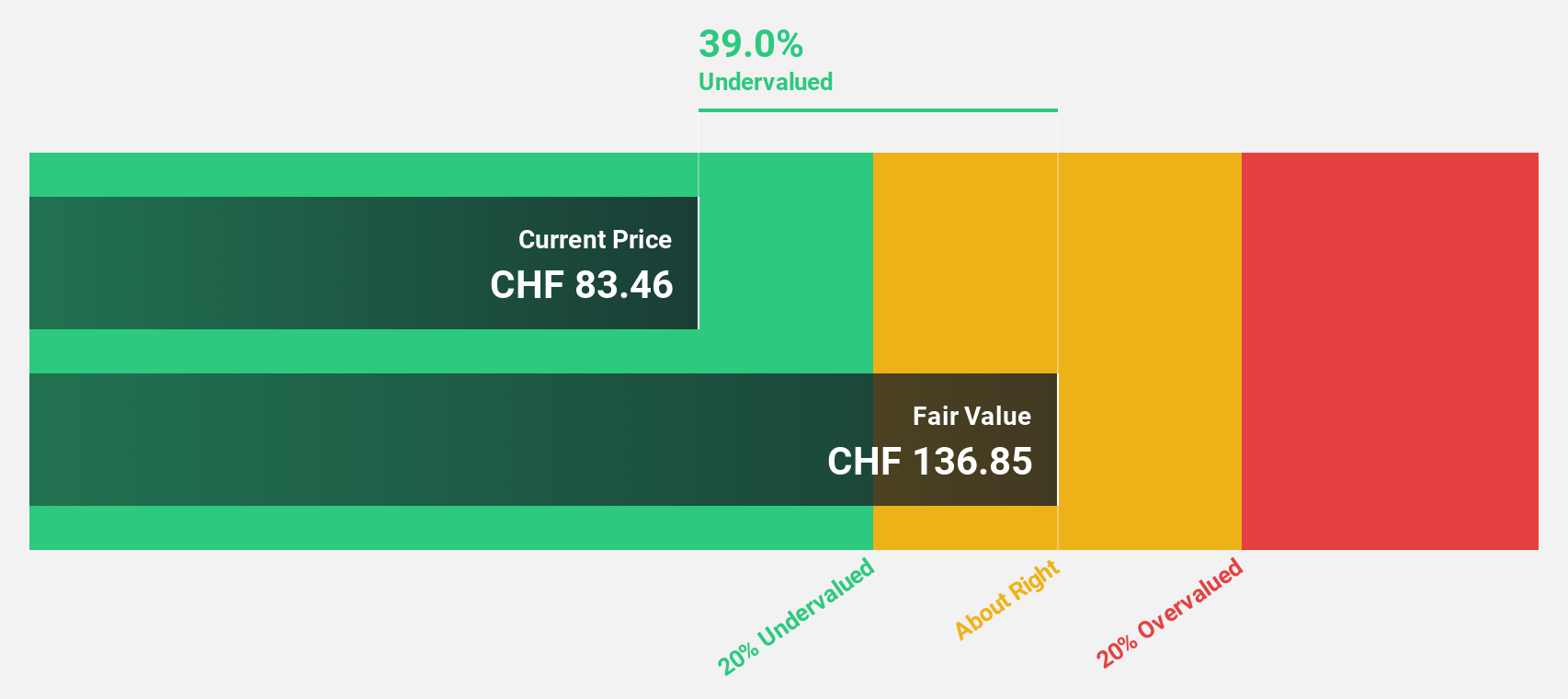

Estimated Discount To Fair Value: 36%

SGS SA, trading at CHF92.54, is 36% below its estimated fair value of CHF144.55 based on discounted cash flow analysis. Despite high debt levels and recent shareholder dilution, the company's earnings are forecast to grow faster than the Swiss market at 12.3% per year compared to 9.1%. Recent H1 2024 earnings showed minor declines in net income and EPS but steady sales growth to CHF3.34 billion from CHF3.28 billion a year ago.

- Our growth report here indicates SGS may be poised for an improving outlook.

- Get an in-depth perspective on SGS' balance sheet by reading our health report here.

Straumann Holding (SWX:STMN)

Overview: Straumann Holding AG, with a market cap of CHF17.69 billion, offers tooth replacement and orthodontic solutions globally.

Operations: Straumann Holding AG's revenue segments include CHF1.20 billion from Operations, CHF451.27 million from Sales in Asia Pacific (APAC), CHF793.05 million from Sales in North America (NAM), CHF265.82 million from Sales in Latin America (LATAM), and CHF1.17 billion from Sales in Europe, Middle East, and Africa (EMEA).

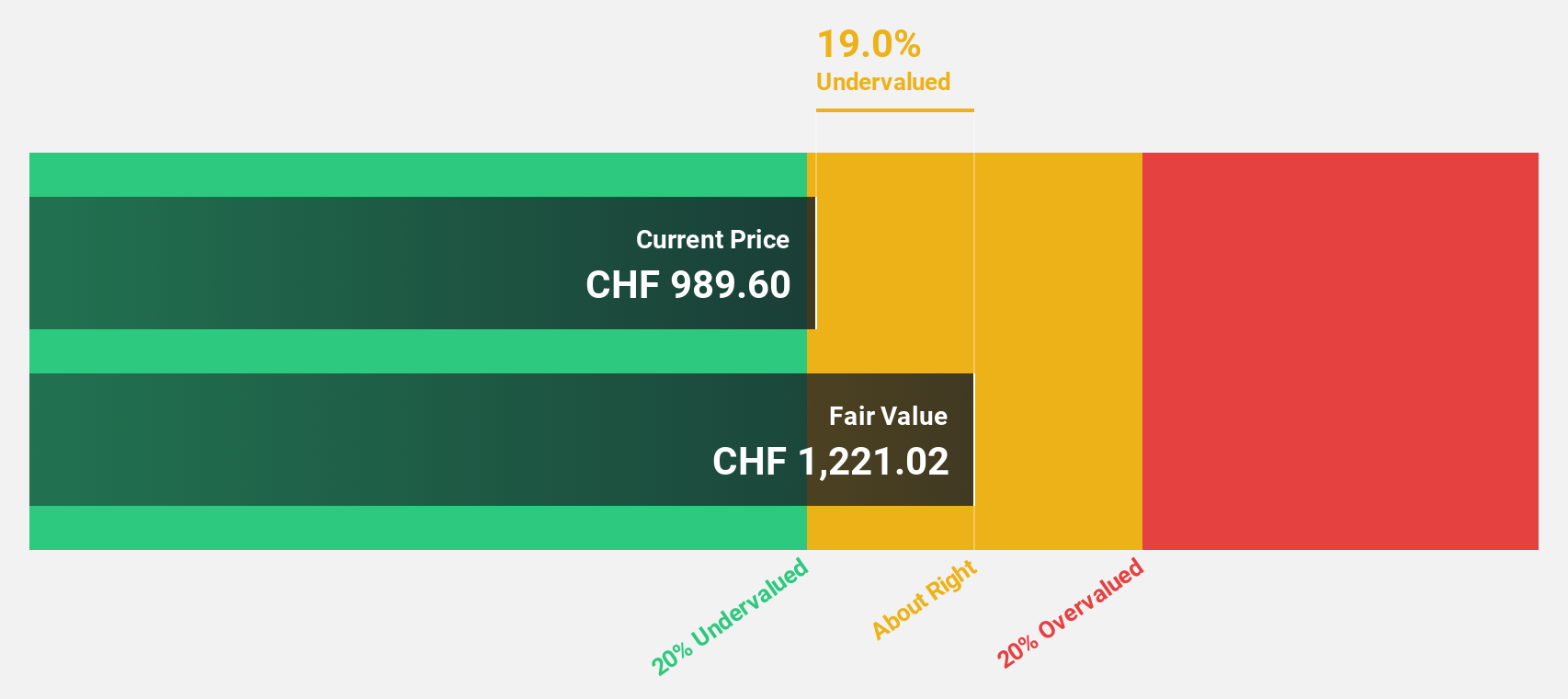

Estimated Discount To Fair Value: 20.9%

Straumann Holding, trading at CHF110.95, is 20.9% below its estimated fair value of CHF140.24 based on discounted cash flow analysis. Earnings are expected to grow significantly over the next three years at 20.84% annually, outpacing the Swiss market's 9.1%. Despite lower profit margins (10.2%) compared to last year (18.7%), revenue growth is forecasted at 9.8%, higher than the market average of 4.4%.

- Our comprehensive growth report raises the possibility that Straumann Holding is poised for substantial financial growth.

- Navigate through the intricacies of Straumann Holding with our comprehensive financial health report here.

Turning Ideas Into Actions

- Explore the 19 names from our Undervalued SIX Swiss Exchange Stocks Based On Cash Flows screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:STMN

Straumann Holding

Provides tooth replacement and orthodontic solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives