- Sweden

- /

- Medical Equipment

- /

- OM:VIMIAN

November 2024's Estimated Undervalued Stock Opportunities

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes nearing record highs and positive sentiment buoyed by strong labor market data, investors are keenly observing potential undervalued stock opportunities amid the broad-based gains. In this context, identifying stocks that may be undervalued involves analyzing their intrinsic value relative to current market prices, especially in sectors or regions experiencing unique economic pressures or growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.08 | US$99.93 | 49.9% |

| Truecaller (OM:TRUE B) | SEK47.98 | SEK95.84 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK172.40 | SEK344.25 | 49.9% |

| Kitron (OB:KIT) | NOK31.18 | NOK62.32 | 50% |

| CS Wind (KOSE:A112610) | ₩41600.00 | ₩83136.08 | 50% |

| PLAIDInc (TSE:4165) | ¥1604.00 | ¥3207.80 | 50% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.86 | 49.9% |

| Neosperience (BIT:NSP) | €0.57 | €1.14 | 50% |

| BATM Advanced Communications (LSE:BVC) | £0.188 | £0.38 | 50% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2905.00 | ¥5793.18 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

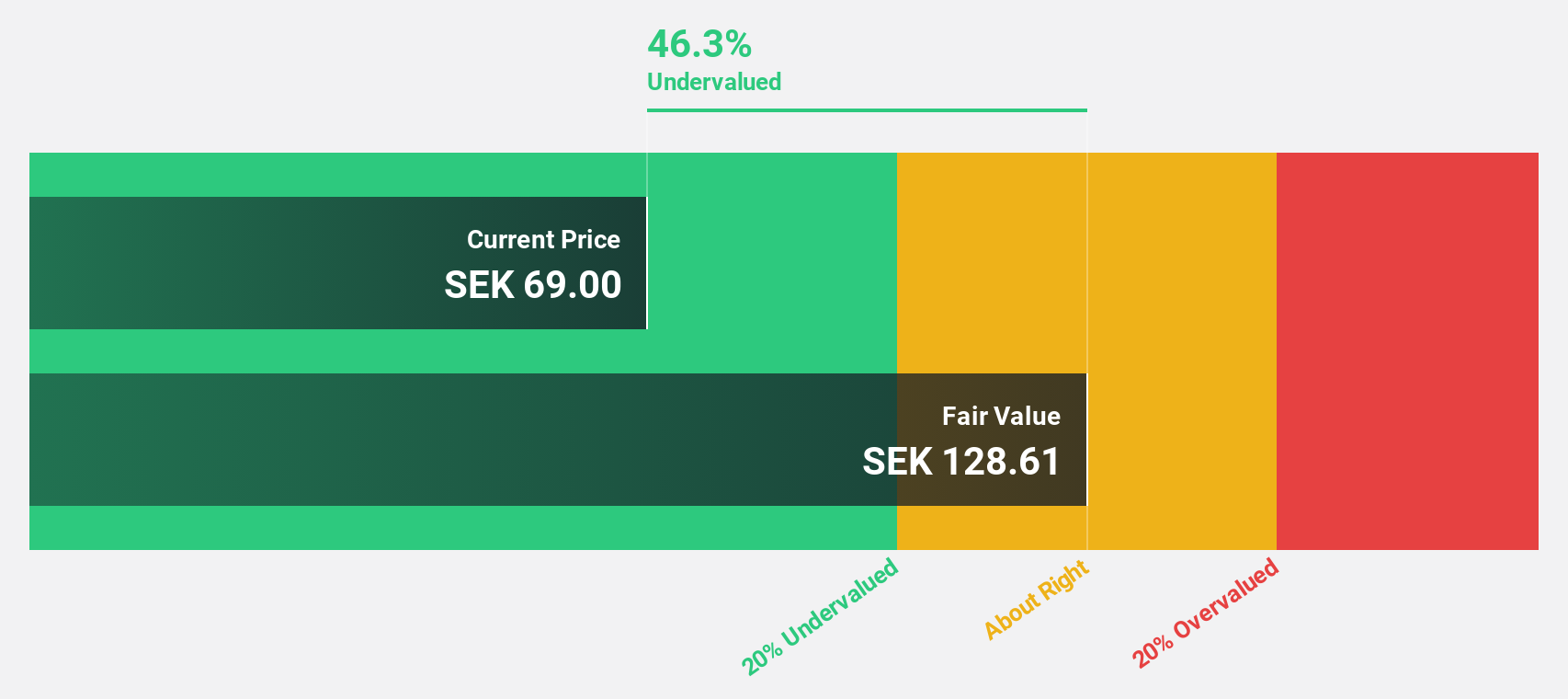

Electrolux Professional (OM:EPRO B)

Overview: Electrolux Professional AB (publ) offers food service, beverage, and laundry products and solutions to various service facilities such as restaurants, hotels, healthcare, and educational institutions with a market cap of SEK18.99 billion.

Operations: The company generates revenue from its Laundry segment, which accounts for SEK4.70 billion, and its Food & Beverage segment, contributing SEK7.53 billion.

Estimated Discount To Fair Value: 32%

Electrolux Professional is trading 32% below its estimated fair value, suggesting it may be undervalued based on cash flows. Despite a high debt level, earnings are expected to grow significantly at 20.3% annually, outpacing the Swedish market's growth. Recent Q3 results show sales increased to SEK 2.93 billion from SEK 2.75 billion year-on-year, with net income rising to SEK 187 million from SEK 159 million. The launch of the NeoBlue Touch dishwasher could drive further revenue growth.

- Our earnings growth report unveils the potential for significant increases in Electrolux Professional's future results.

- Click to explore a detailed breakdown of our findings in Electrolux Professional's balance sheet health report.

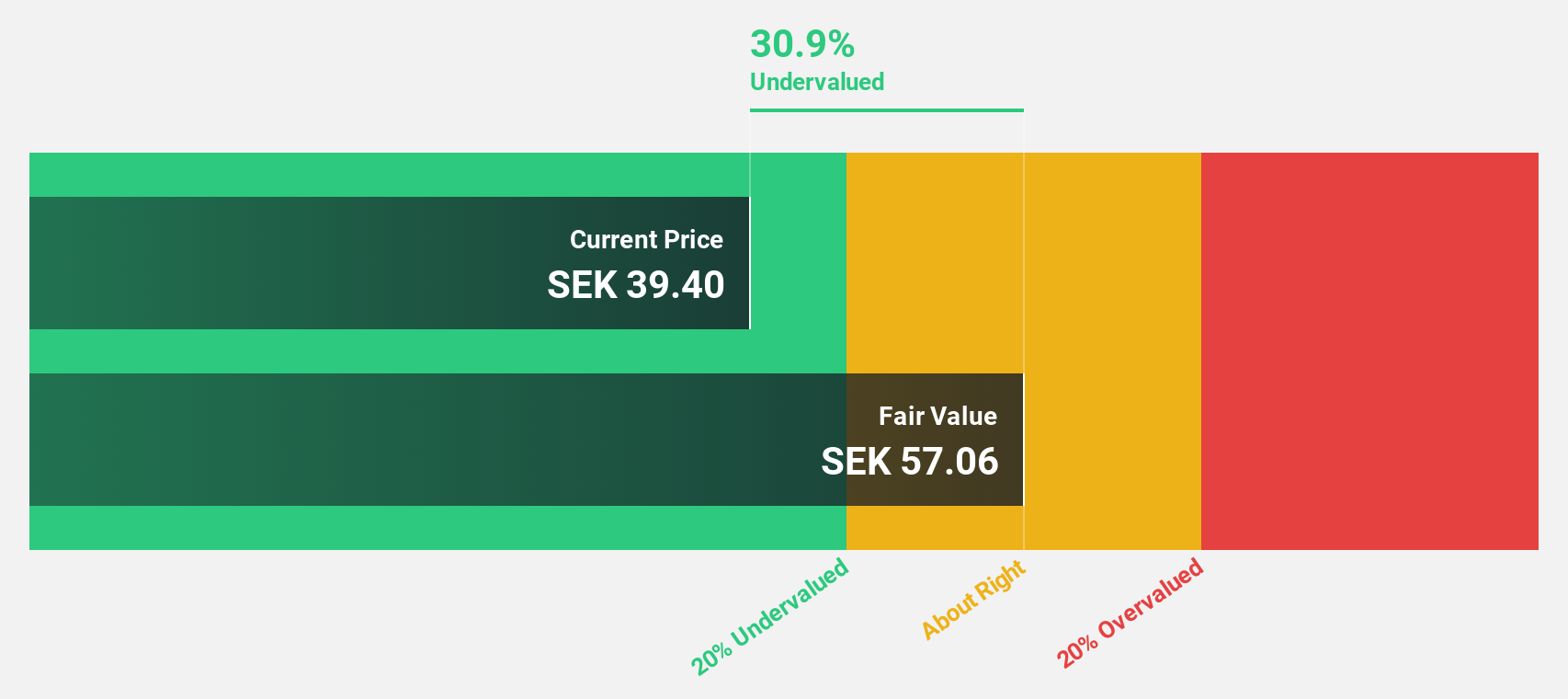

Vimian Group (OM:VIMIAN)

Overview: Vimian Group AB (publ) operates in the global animal health sector and has a market capitalization of SEK23.18 billion.

Operations: The company generates revenue from several segments, including Medtech (€112.75 million), Diagnostics (€20.32 million), Specialty Pharma (€163.45 million), and Veterinary Services (€56.11 million).

Estimated Discount To Fair Value: 22.8%

Vimian Group is trading 22.8% below its estimated fair value of SEK57.39, highlighting potential undervaluation based on cash flows. Despite recent earnings challenges, with a net loss of EUR 2.13 million in Q3 compared to a profit last year, Vimian's earnings are forecast to grow significantly at 89.8% annually, surpassing the Swedish market's growth rate. Revenue is also expected to increase by 14.1% per year, indicating robust future prospects despite current setbacks.

- The analysis detailed in our Vimian Group growth report hints at robust future financial performance.

- Click here to discover the nuances of Vimian Group with our detailed financial health report.

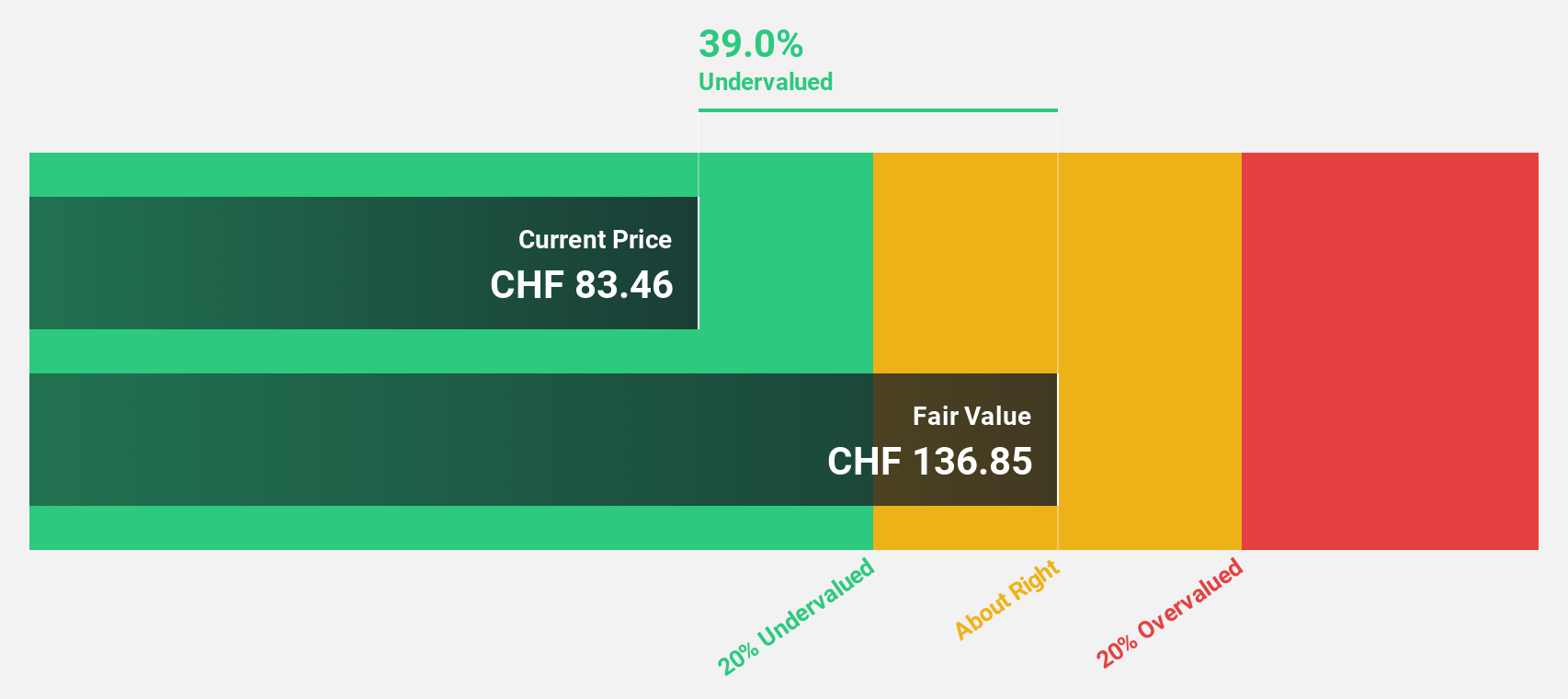

SGS (SWX:SGSN)

Overview: SGS SA is a global company offering inspection, testing, and verification services across Europe, Africa, the Middle East, the Americas, and the Asia Pacific with a market cap of CHF16.26 billion.

Operations: The company's revenue segments include Business Assurance, which generated CHF755 million.

Estimated Discount To Fair Value: 32.4%

SGS SA is currently trading at CHF87.24, significantly below its estimated fair value of CHF129.1, suggesting undervaluation based on cash flows. The company plans strategic bolt-on acquisitions to enhance margins and achieve a double-digit ROIC by year 5. Despite high debt levels, SGS's revenue and earnings are forecast to grow faster than the Swiss market, with earnings projected to increase by 11.9% annually and a very high return on equity expected in three years.

- Our growth report here indicates SGS may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of SGS stock in this financial health report.

Summing It All Up

- Click here to access our complete index of 914 Undervalued Stocks Based On Cash Flows.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VIMIAN

Good value with reasonable growth potential.