- Switzerland

- /

- Commercial Services

- /

- SWX:OFN

We Discuss Why Orell Füssli AG's (VTX:OFN) CEO Compensation May Be Closely Reviewed

Key Insights

- Orell Füssli to hold its Annual General Meeting on 7th of May

- Total pay for CEO Daniel Link includes CHF414.0k salary

- The overall pay is 56% above the industry average

- Over the past three years, Orell Füssli's EPS fell by 2.4% and over the past three years, the total loss to shareholders 20%

Orell Füssli AG (VTX:OFN) has not performed well recently and CEO Daniel Link will probably need to up their game. At the upcoming AGM on 7th of May, shareholders can hear from the board including their plans for turning around performance. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. From our analysis, we think CEO compensation may need a review in light of the recent performance.

Check out our latest analysis for Orell Füssli

How Does Total Compensation For Daniel Link Compare With Other Companies In The Industry?

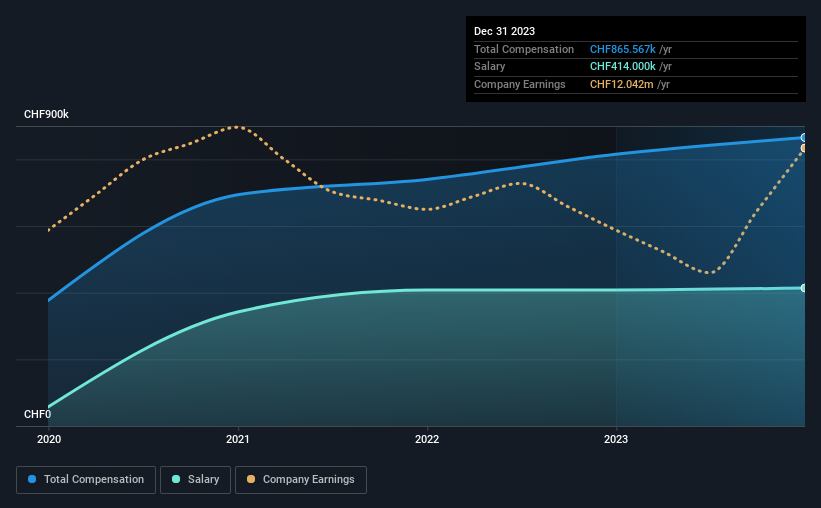

At the time of writing, our data shows that Orell Füssli AG has a market capitalization of CHF157m, and reported total annual CEO compensation of CHF866k for the year to December 2023. That's just a smallish increase of 6.2% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CHF414k.

In comparison with other companies in the Switzerland Commercial Services industry with market capitalizations ranging from CHF92m to CHF368m, the reported median CEO total compensation was CHF553k. Accordingly, our analysis reveals that Orell Füssli AG pays Daniel Link north of the industry median. Furthermore, Daniel Link directly owns CHF81k worth of shares in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CHF414k | CHF408k | 48% |

| Other | CHF452k | CHF407k | 52% |

| Total Compensation | CHF866k | CHF815k | 100% |

Talking in terms of the industry, salary represented approximately 54% of total compensation out of all the companies we analyzed, while other remuneration made up 46% of the pie. It's interesting to note that Orell Füssli allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Orell Füssli AG's Growth

Over the last three years, Orell Füssli AG has shrunk its earnings per share by 2.4% per year. Its revenue is up 6.9% over the last year.

Its a bit disappointing to see that the company has failed to grow its EPS. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Orell Füssli AG Been A Good Investment?

Given the total shareholder loss of 20% over three years, many shareholders in Orell Füssli AG are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Orell Füssli that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:OFN

Orell Füssli

Engages in security printing and technology, book retailing, and publishing business in Switzerland Germany, rest of Europe and Africa, North and South America, Asia, and Oceania.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives