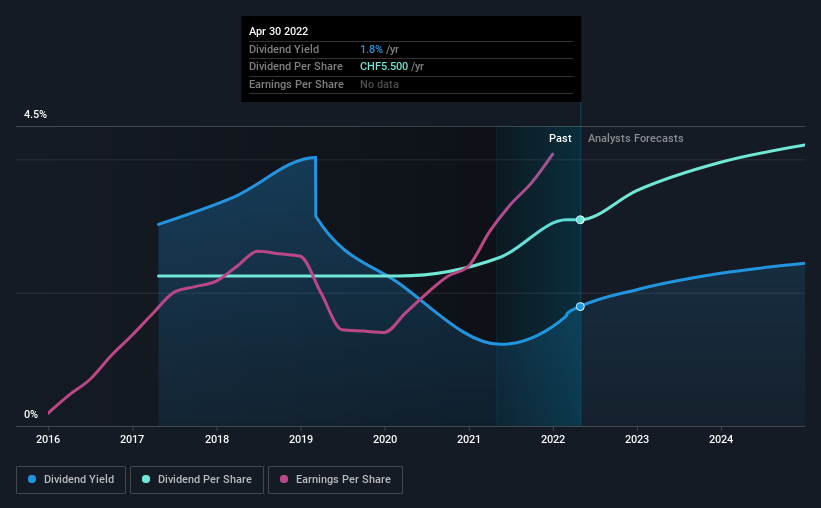

The board of VAT Group AG (VTX:VACN) has announced that it will be increasing its dividend on the 24th of May to CHF5.50. Even though the dividend went up, the yield is still quite low at only 1.8%.

Check out our latest analysis for VAT Group

VAT Group's Payment Has Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. Prior to this announcement, VAT Group was paying out 76% of earnings and more than 75% of free cash flows. This indicates that the company is more focused on returning cash to shareholders than growing the business, but we don't think that there are necessarily signs that the dividend might be unsustainable.

The next year is set to see EPS grow by 24.8%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 63% which brings it into quite a comfortable range.

VAT Group Is Still Building Its Track Record

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. Since 2017, the first annual payment was CHF4.00, compared to the most recent full-year payment of CHF5.50. This works out to be a compound annual growth rate (CAGR) of approximately 6.6% a year over that time. The dividend has been growing as a reasonable rate, which we like. However, investors will probably want to see a longer track record before they consider VAT Group to be a consistent dividend paying stock.

VAT Group Might Find It Hard To Grow Its Dividend

Investors could be attracted to the stock based on the quality of its payment history. VAT Group has seen EPS rising for the last five years, at 24% per annum. EPS is growing rapidly, although the company is also paying out a large portion of its profits as dividends. If earnings keep growing, the dividend may be sustainable, but generally we'd prefer to see a fast growing company reinvest in further growth.

Our Thoughts On VAT Group's Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. In general, the distributions are a little bit higher than we would like, but we can't ignore the fact the quickly growing earnings gives this stock great potential in the future. We don't think VAT Group is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for VAT Group that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:VACN

VAT Group

Develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows in Switzerland, rest of Europe, the United States, Japan, Korea, Singapore, China, rest of Asia, and internationally.

Flawless balance sheet with high growth potential.