- Switzerland

- /

- Machinery

- /

- SWX:VACN

Three Growth Companies On SIX Swiss Exchange With High Insider Ownership And At Least 10% Earnings Growth

Reviewed by Simply Wall St

The Swiss market has shown a consistent performance over the past year, maintaining stability with expectations of earnings growth at an annual rate of 8.4% in the coming years. In this context, companies with high insider ownership and strong earnings growth stand out as potentially resilient investments.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 21.2% |

| Straumann Holding (SWX:STMN) | 32.7% | 21% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.3% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| LEM Holding (SWX:LEHN) | 34.5% | 10.1% |

| Sonova Holding (SWX:SOON) | 17.7% | 10.4% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 78.3% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

We'll examine a selection from our screener results.

Sonova Holding (SWX:SOON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sonova Holding AG is a company that specializes in manufacturing and distributing hearing care solutions across various regions including the United States, Europe, the Middle East, Africa, and the Asia Pacific, with a market capitalization of approximately CHF 17.19 billion.

Operations: Sonova generates revenue primarily through two segments: Cochlear Implants, which brought in CHF 282.40 million, and Hearing Instruments, contributing CHF 3.36 billion.

Insider Ownership: 17.7%

Earnings Growth Forecast: 10.4% p.a.

Sonova Holding AG, a key player in the Swiss market, reported robust full-year earnings with sales reaching CHF 3.63 billion and net income at CHF 609.5 million as of March 2024. Despite high levels of debt, the company is trading at a significant discount to fair value and shows promising growth prospects with revenue expected to increase by 7.1% annually, outpacing the Swiss market's 4.4%. However, its share price has been highly volatile recently. Forecasted earnings growth is also strong at an annual rate of 10.42%, better than the market forecast of 8.4%.

- Click to explore a detailed breakdown of our findings in Sonova Holding's earnings growth report.

- According our valuation report, there's an indication that Sonova Holding's share price might be on the cheaper side.

Swissquote Group Holding (SWX:SQN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swissquote Group Holding Ltd operates globally, offering a range of online financial services to retail, affluent, and institutional clients, with a market capitalization of approximately CHF 4.08 billion.

Operations: The company generates its revenue primarily through leveraged Forex and securities trading, contributing CHF 101.09 million and CHF 429.78 million respectively.

Insider Ownership: 11.4%

Earnings Growth Forecast: 14.3% p.a.

Swissquote Group Holding Ltd, a Swiss growth company with high insider ownership, has shown impressive financial performance with a 38.3% earnings increase over the past year and net income rising to CHF 217.63 million from CHF 157.39 million previously. Despite trading at a 23.7% discount to its estimated fair value, revenue is expected to grow at 10.6% annually, surpassing the Swiss market's average of 4.4%. However, its earnings growth forecast of 14.3% per year, though above the market average of 8.4%, is not considered significantly high.

- Take a closer look at Swissquote Group Holding's potential here in our earnings growth report.

- According our valuation report, there's an indication that Swissquote Group Holding's share price might be on the expensive side.

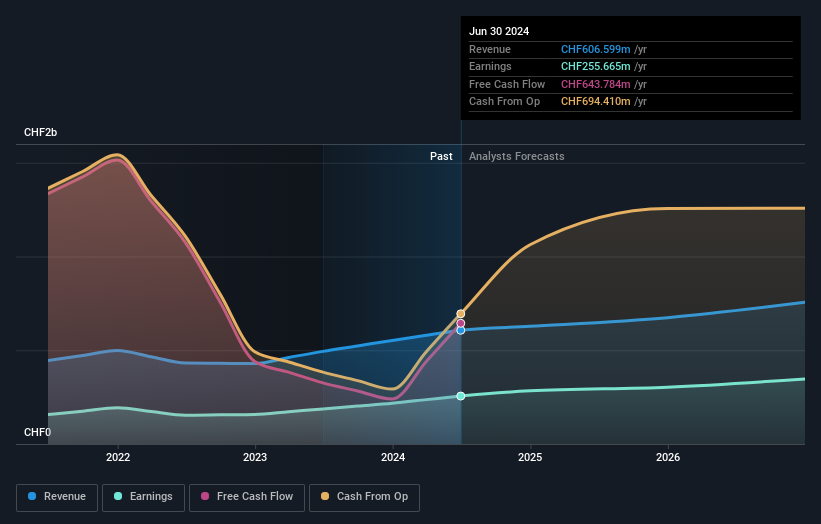

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VAT Group AG is a Switzerland-based company that specializes in developing, manufacturing, and supplying vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows globally, with a market capitalization of approximately CHF 14.51 billion.

Operations: VAT Group's revenue is divided into two main segments: Valves, which generated CHF 782.74 million, and Global Service, contributing CHF 172.87 million.

Insider Ownership: 10.2%

Earnings Growth Forecast: 21.2% p.a.

VAT Group AG, a Swiss company with significant insider ownership, is poised for robust growth. Its earnings are expected to grow by 21.2% annually over the next three years, outpacing the Swiss market's 8.4%. Similarly, its revenue growth forecast at 15.5% annually also exceeds Switzerland's average of 4.4%. However, it faces high share price volatility and its revenue growth rate falls short of the significant 20% threshold. Recent engagements include presenting at the Berenberg European Conference and announcing annual results with a notable decline in net income from CHF 306.78 million to CHF 190.31 million year-over-year.

- Delve into the full analysis future growth report here for a deeper understanding of VAT Group.

- In light of our recent valuation report, it seems possible that VAT Group is trading beyond its estimated value.

Summing It All Up

- Take a closer look at our Fast Growing SIX Swiss Exchange Companies With High Insider Ownership list of 17 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade VAT Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VACN

VAT Group

Develops, manufactures, and sells vacuum and gas inlet valves, multi-valve modules, motion components, and edge-welded metal bellows.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives