- Switzerland

- /

- Machinery

- /

- SWX:VACN

SIX Swiss Exchange's Hidden Value Opportunities In October 2024

Reviewed by Simply Wall St

The Swiss market recently experienced a modest uptick, with the SMI index closing slightly higher after a session characterized by cautious investor behavior and limited market triggers. In this environment of narrow trading ranges and selective gains, identifying undervalued stocks on the SIX Swiss Exchange can offer potential opportunities for investors seeking value amidst broader market stability.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Swissquote Group Holding (SWX:SQN) | CHF307.60 | CHF560.19 | 45.1% |

| Georg Fischer (SWX:GF) | CHF55.10 | CHF108.30 | 49.1% |

| Julius Bär Gruppe (SWX:BAER) | CHF54.32 | CHF103.92 | 47.7% |

| Komax Holding (SWX:KOMN) | CHF115.00 | CHF203.04 | 43.4% |

| Comet Holding (SWX:COTN) | CHF298.00 | CHF525.37 | 43.3% |

| Clariant (SWX:CLN) | CHF12.55 | CHF21.52 | 41.7% |

| lastminute.com (SWX:LMN) | CHF18.00 | CHF28.97 | 37.9% |

| SGS (SWX:SGSN) | CHF91.56 | CHF151.42 | 39.5% |

| Dätwyler Holding (SWX:DAE) | CHF151.60 | CHF237.37 | 36.1% |

| Sensirion Holding (SWX:SENS) | CHF63.70 | CHF117.37 | 45.7% |

Let's review some notable picks from our screened stocks.

Comet Holding (SWX:COTN)

Overview: Comet Holding AG, with a market cap of CHF2.32 billion, offers X-ray and radio frequency power technology solutions across Europe, North America, Asia, and internationally.

Operations: The company's revenue segments include X-Ray Systems generating CHF115.34 million, Industrial X-Ray Modules contributing CHF95.90 million, and Plasma Control Technologies accounting for CHF180.62 million.

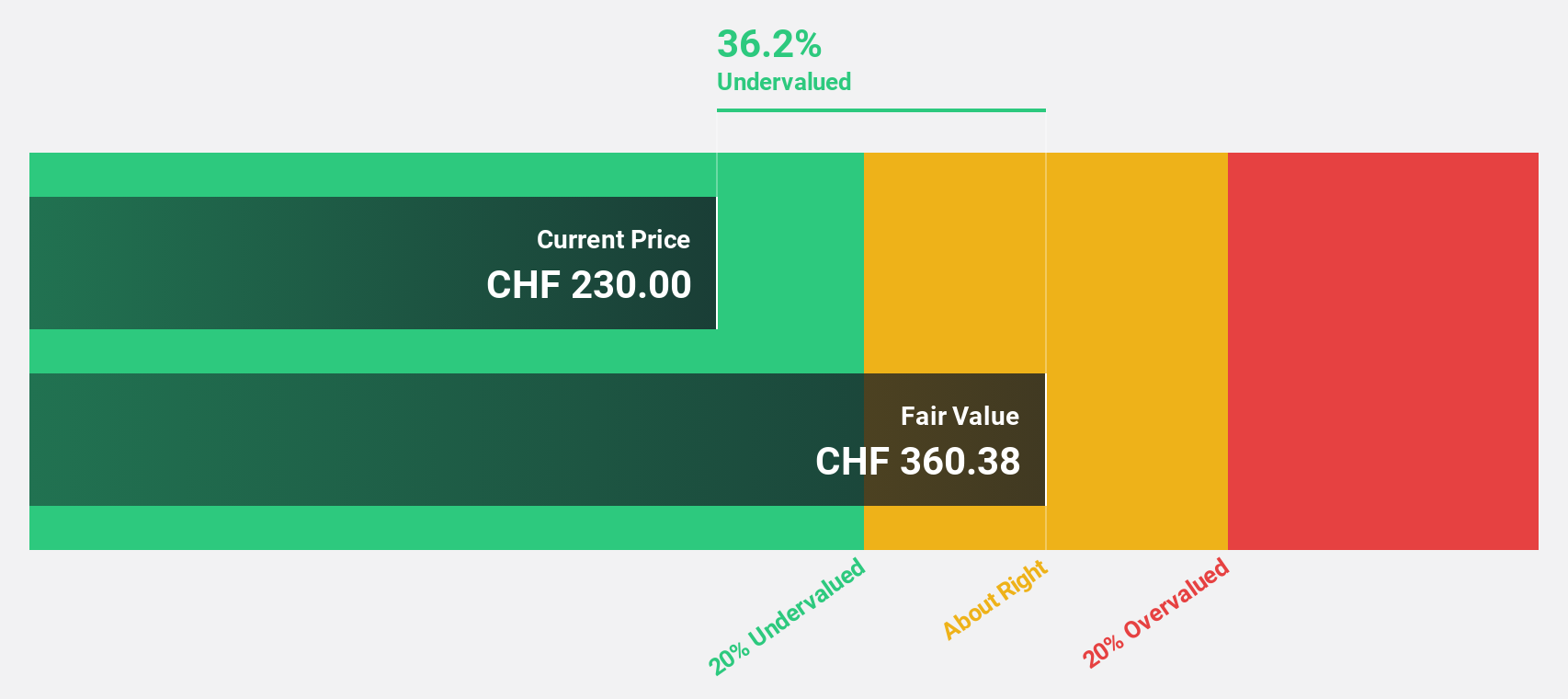

Estimated Discount To Fair Value: 43.3%

Comet Holding AG is trading at CHF298, significantly below its estimated fair value of CHF525.36, suggesting it is highly undervalued based on discounted cash flow analysis. Despite a volatile share price recently, the company shows promising growth prospects with revenue expected to grow 20.4% annually and earnings projected to rise by 48.6% per year, outpacing the Swiss market averages. However, profit margins have decreased compared to last year.

- Our growth report here indicates Comet Holding may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Comet Holding.

Swissquote Group Holding (SWX:SQN)

Overview: Swissquote Group Holding Ltd offers a range of online financial services to retail, affluent, and institutional investors globally, with a market cap of CHF4.57 billion.

Operations: The company's revenue is primarily derived from Securities Trading, contributing CHF489 million, and Leveraged Forex, generating CHF93.28 million.

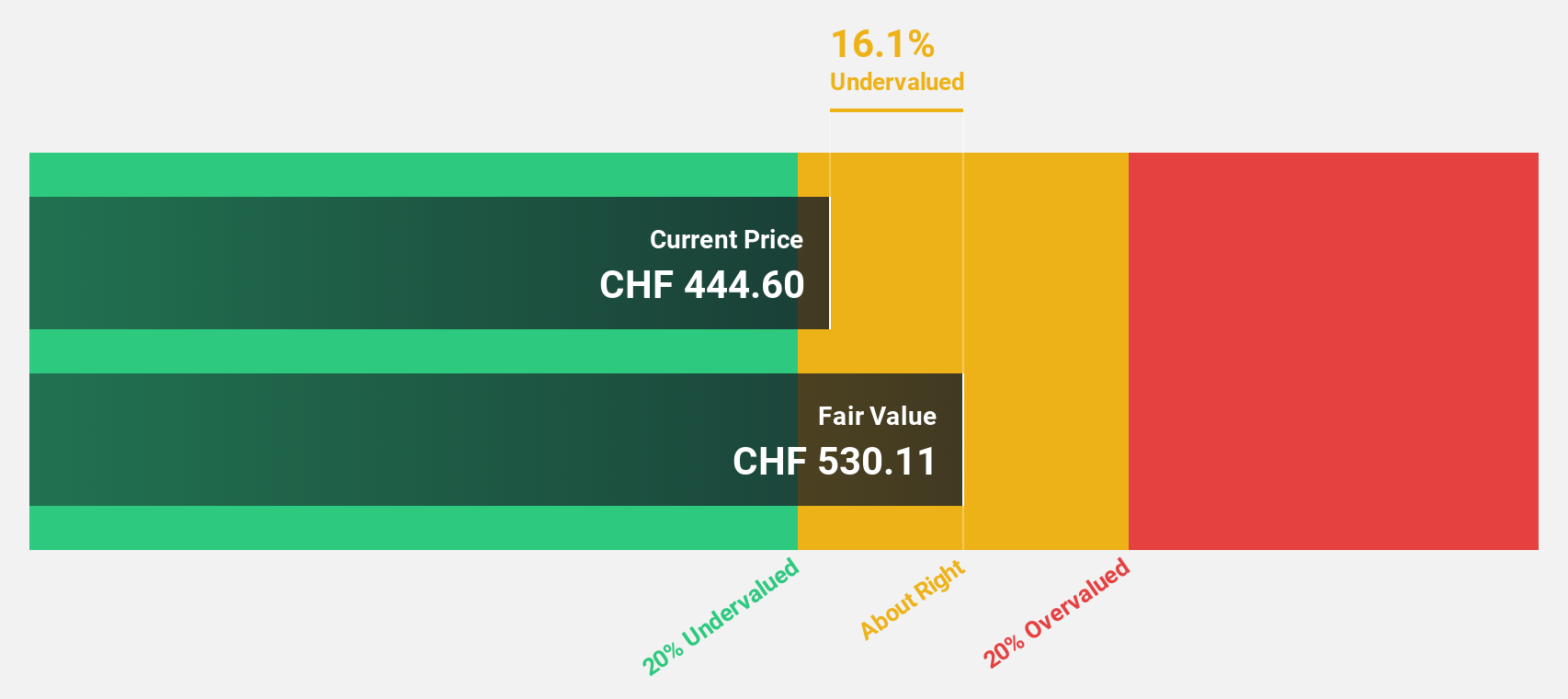

Estimated Discount To Fair Value: 45.1%

Swissquote Group Holding is trading at CHF307.6, well below its estimated fair value of CHF560.19, indicating significant undervaluation based on discounted cash flow analysis. The company's earnings grew by 36.9% over the past year, with net income reaching CHF144.56 million for the first half of 2024. Future earnings growth is forecasted at 12.6% annually, outpacing the Swiss market's 11.6%, while revenue growth is expected to be robust at 11.1% per year.

- According our earnings growth report, there's an indication that Swissquote Group Holding might be ready to expand.

- Dive into the specifics of Swissquote Group Holding here with our thorough financial health report.

VAT Group (SWX:VACN)

Overview: VAT Group AG is a company that develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows globally with a market capitalization of CHF11.03 billion.

Operations: The company generates revenue through its Valves segment with CHF783.51 million and Global Service segment with CHF163.83 million.

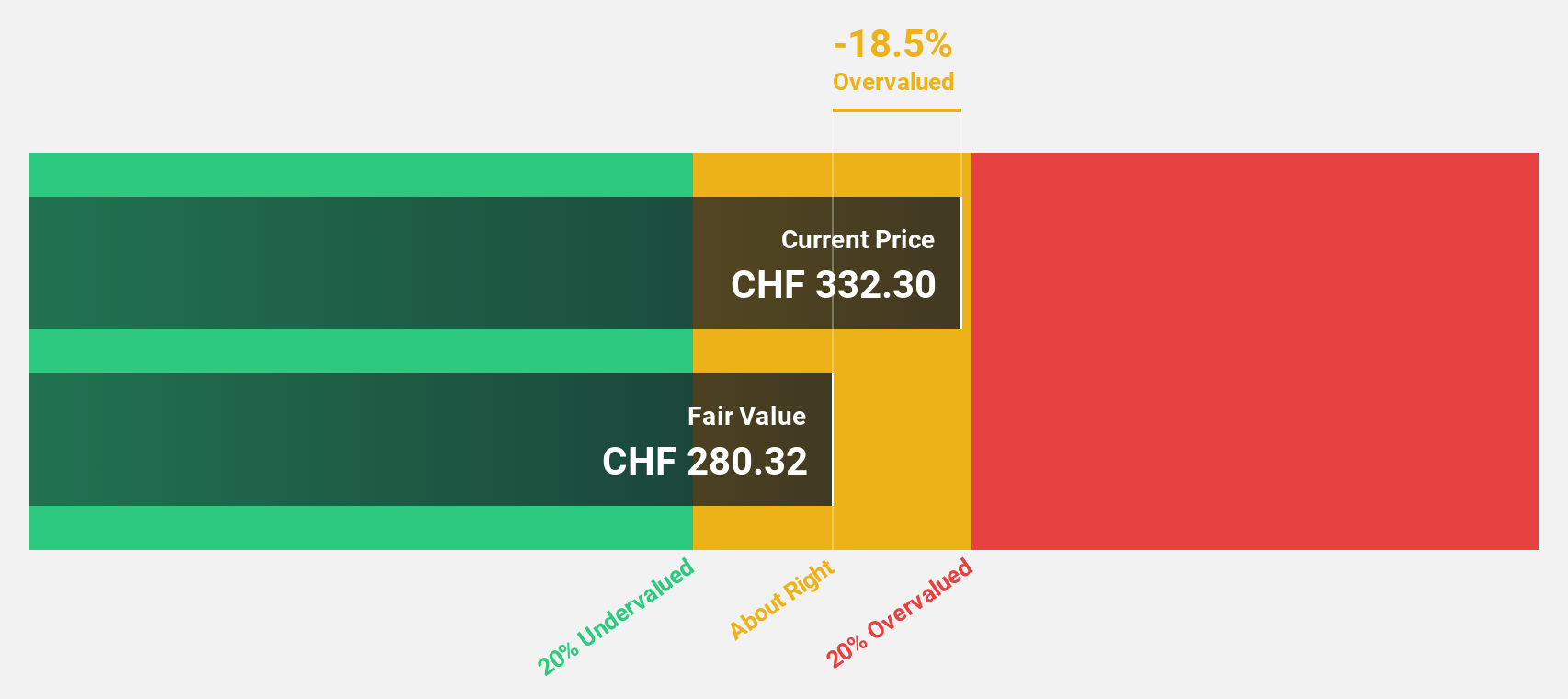

Estimated Discount To Fair Value: 31.4%

VAT Group is trading at CHF368, significantly below its estimated fair value of CHF536.49, suggesting undervaluation based on discounted cash flow analysis. The company anticipates robust earnings growth of 22.16% annually over the next three years, outpacing the Swiss market's forecasted 11.7%. Despite recent share price volatility, VAT Group's revenue is expected to grow at 18% per year, surpassing the Swiss market average of 4.1%.

- The growth report we've compiled suggests that VAT Group's future prospects could be on the up.

- Navigate through the intricacies of VAT Group with our comprehensive financial health report here.

Turning Ideas Into Actions

- Access the full spectrum of 17 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VACN

VAT Group

Develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows in Switzerland, rest of Europe, the United States, Japan, Korea, Singapore, China, rest of Asia, and internationally.

Flawless balance sheet with high growth potential.