Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in VAT Group (VTX:VACN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide VAT Group with the means to add long-term value to shareholders.

See our latest analysis for VAT Group

How Fast Is VAT Group Growing Its Earnings Per Share?

In the last three years VAT Group's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. VAT Group's EPS skyrocketed from CHF7.25 to CHF10.23, in just one year; a result that's bound to bring a smile to shareholders. That's a fantastic gain of 41%.

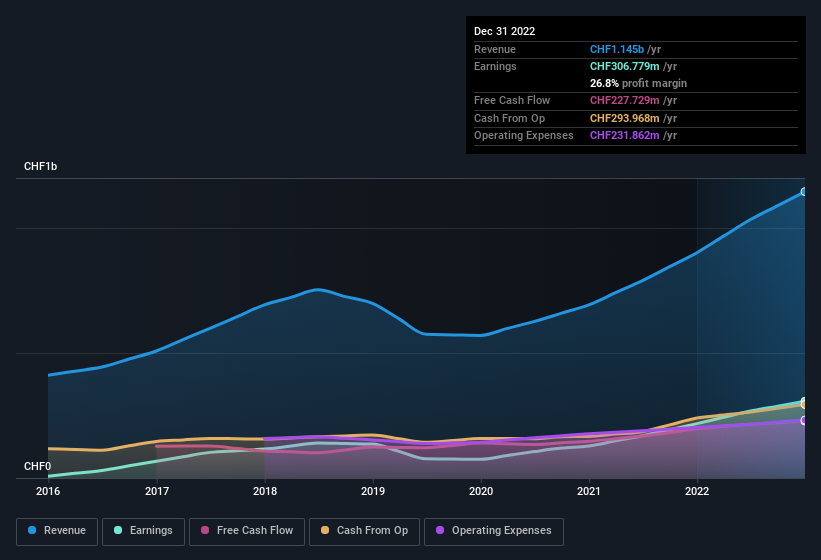

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of VAT Group shareholders is that EBIT margins have grown from 28% to 31% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for VAT Group.

Are VAT Group Insiders Aligned With All Shareholders?

Since VAT Group has a market capitalisation of CHF11b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. Notably, they have an enviable stake in the company, worth CHF1.1b. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to VAT Group, with market caps over CHF7.2b, is around CHF5.1m.

VAT Group's CEO took home a total compensation package of CHF1.5m in the year prior to December 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is VAT Group Worth Keeping An Eye On?

For growth investors, VAT Group's raw rate of earnings growth is a beacon in the night. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. The overarching message here is that VAT Group has underlying strengths that make it worth a look at. We don't want to rain on the parade too much, but we did also find 1 warning sign for VAT Group that you need to be mindful of.

Although VAT Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:VACN

VAT Group

Develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows in Switzerland, rest of Europe, the United States, Japan, Korea, Singapore, China, rest of Asia, and internationally.

Flawless balance sheet with high growth potential.