- China

- /

- Construction

- /

- SZSE:002929

Global Growth Companies With High Insider Ownership And 42% Earnings Growth

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, recent developments have shown signs of resilience, with major U.S. stock indexes climbing for the second week in a row and positive sentiment surrounding AI-related stocks boosting the information technology sector. Meanwhile, international markets are responding to economic shifts such as the European Central Bank's easing monetary policy and China's potential stimulus measures amid trade tensions. In this environment, growth companies with high insider ownership can be particularly appealing as they often demonstrate strong alignment between management and shareholder interests. This article will explore three such companies that have achieved an impressive 42% earnings growth, highlighting their potential in today's fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.1% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.4% | 23.5% |

| Schooinc (TSE:264A) | 30.6% | 68.9% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.2% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Let's uncover some gems from our specialized screener.

Ningbo Deye Technology Group (SHSE:605117)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ningbo Deye Technology Group Co., Ltd. specializes in the production and sales of heat exchangers, inverters, and dehumidifiers across China, the UK, the US, Germany, India, and internationally with a market cap of CN¥53.78 billion.

Operations: Ningbo Deye Technology Group's revenue is primarily derived from its production and sales of heat exchangers, inverters, and dehumidifiers across various international markets including China, the UK, the US, Germany, and India.

Insider Ownership: 23.1%

Earnings Growth Forecast: 20.1% p.a.

Ningbo Deye Technology Group is trading at a compelling value, 31.2% below its estimated fair value, with analysts predicting a 31.4% price increase. Revenue growth is robust, forecasted at 22.2% annually, outpacing the market's 12.4%. Despite slower earnings growth compared to the market, profits are expected to rise significantly over three years. Recent financials show strong performance with Q1 sales reaching CNY 2.57 billion and net income at CNY 705.54 million, alongside an active share buyback program of up to CNY 200 million for future equity incentives.

- Unlock comprehensive insights into our analysis of Ningbo Deye Technology Group stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Ningbo Deye Technology Group shares in the market.

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VAT Group AG, along with its subsidiaries, specializes in the development, manufacturing, and sale of vacuum and gas inlet valves, multi-valve modules, motion components, and edge-welded metal bellows with a market capitalization of CHF9.76 billion.

Operations: The company's revenue segments consist of Valves at CHF842.76 million and Global Service at CHF167.53 million.

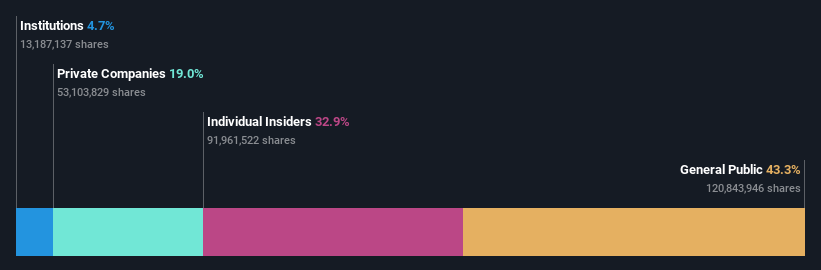

Insider Ownership: 10.2%

Earnings Growth Forecast: 17.1% p.a.

VAT Group's revenue is projected to grow at 11.6% annually, outpacing the Swiss market's 4.2%, with earnings expected to rise by 17.1% per year. Despite a high forecasted return on equity of 38.7%, recent guidance lowered sales expectations for 2027 to CHF 1.5-1.7 billion from CHF 1.8-2.2 billion, reflecting potential challenges ahead amid volatile share prices and an unchanged dividend of CHF 6.25 per share approved in April.

- Click to explore a detailed breakdown of our findings in VAT Group's earnings growth report.

- Our valuation report here indicates VAT Group may be overvalued.

Runjian (SZSE:002929)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Runjian Co., Ltd. is a communication technology service company involved in the construction and maintenance of communication networks in China, with a market cap of CN¥14.05 billion.

Operations: Runjian Co., Ltd. generates its revenue primarily from the construction and maintenance of communication networks within China.

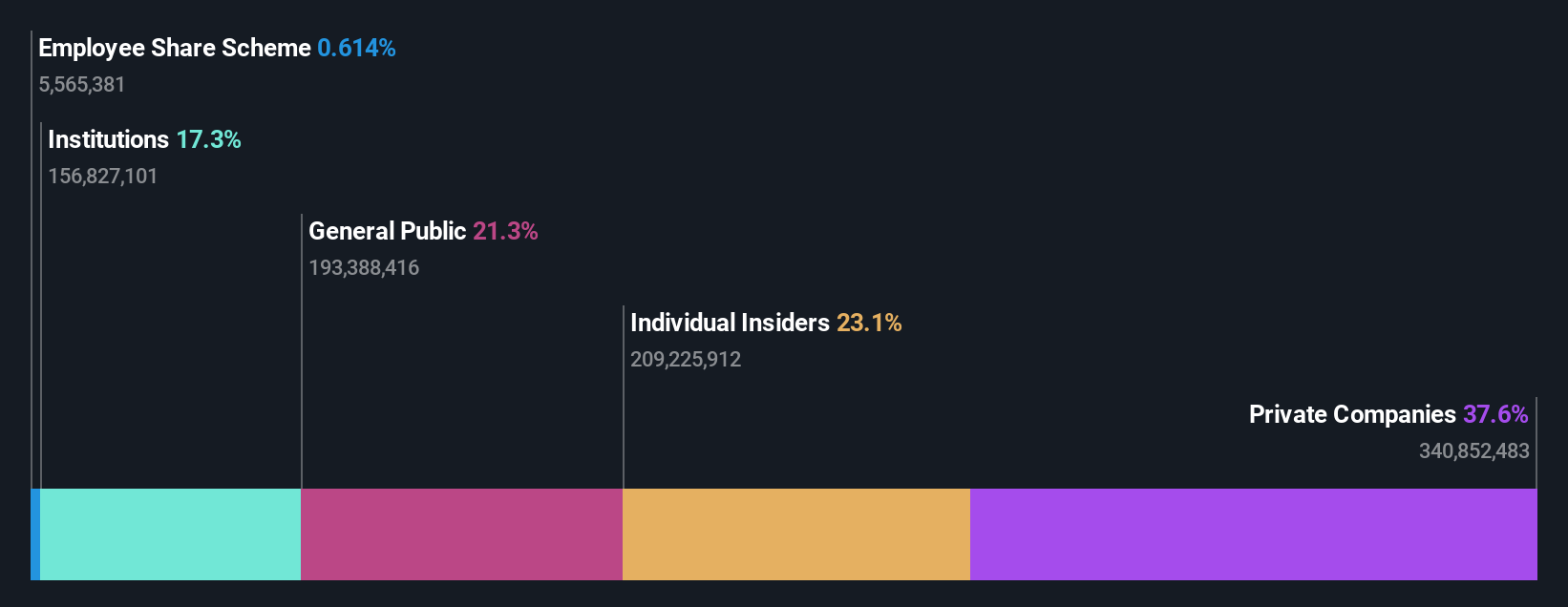

Insider Ownership: 32.7%

Earnings Growth Forecast: 42.4% p.a.

Runjian's earnings are expected to grow significantly at 42.4% annually, outpacing the Chinese market average of 23.3%, although revenue growth is slower at 15.3%. Despite this strong earnings forecast, recent financials show declining profit margins and net income, with a drop in basic earnings per share from CNY 0.89 to CNY 0.25 year-over-year for Q1 2025. The company has also decreased its dividend payout to CNY 1.30 per ten shares for 2024 amidst volatile share prices.

- Take a closer look at Runjian's potential here in our earnings growth report.

- Our expertly prepared valuation report Runjian implies its share price may be too high.

Make It Happen

- Investigate our full lineup of 839 Fast Growing Global Companies With High Insider Ownership right here.

- Looking For Alternative Opportunities? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002929

Runjian

A communication technology service company, operates as a digital intelligent operation and maintenance (AIOps) service provider in China.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives