- Switzerland

- /

- Machinery

- /

- SWX:RIEN

Earnings Update: Here's Why Analysts Just Lifted Their Rieter Holding AG (VTX:RIEN) Price Target To CHF140

Shareholders might have noticed that Rieter Holding AG (VTX:RIEN) filed its half-year result this time last week. The early response was not positive, with shares down 5.4% to CHF109 in the past week. Results look mixed - while revenue fell marginally short of analyst estimates at CHF421m, statutory earnings were in line with expectations, at CHF16.47 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Rieter Holding

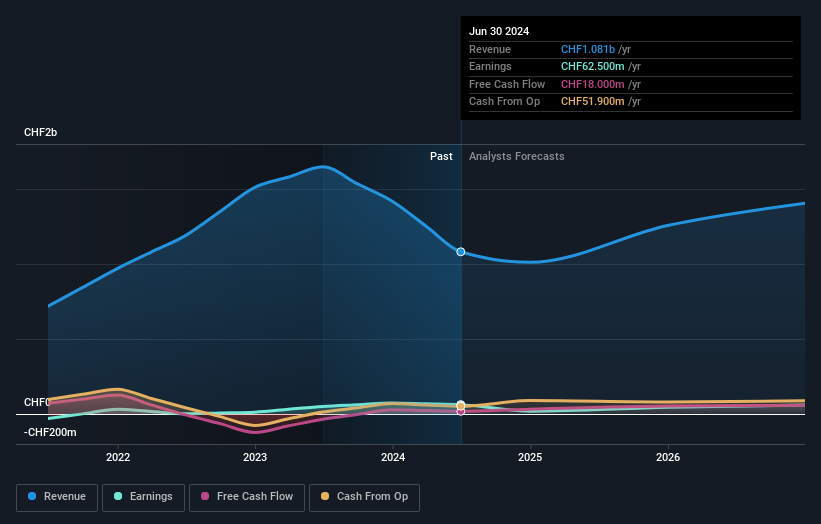

Taking into account the latest results, the current consensus, from the six analysts covering Rieter Holding, is for revenues of CHF1.01b in 2024. This implies a small 6.5% reduction in Rieter Holding's revenue over the past 12 months. Statutory earnings per share are expected to crater 69% to CHF4.30 in the same period. Before this earnings report, the analysts had been forecasting revenues of CHF1.02b and earnings per share (EPS) of CHF4.55 in 2024. So it looks like there's been a small decline in overall sentiment after the recent results - there's been no major change to revenue estimates, but the analysts did make a small dip in their earnings per share forecasts.

Althoughthe analysts have revised their earnings forecasts for next year, they've also lifted the consensus price target 11% to CHF140, suggesting the revised estimates are not indicative of a weaker long-term future for the business. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Rieter Holding at CHF180 per share, while the most bearish prices it at CHF96.00. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Rieter Holding's past performance and to peers in the same industry. We would highlight that revenue is expected to reverse, with a forecast 13% annualised decline to the end of 2024. That is a notable change from historical growth of 17% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 6.7% per year. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Rieter Holding is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Rieter Holding analysts - going out to 2026, and you can see them free on our platform here.

It is also worth noting that we have found 4 warning signs for Rieter Holding (1 makes us a bit uncomfortable!) that you need to take into consideration.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:RIEN

Rieter Holding

Supplies systems for manufacturing yarn from staple fibers in spinning mills in Switzerland and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026