- Switzerland

- /

- Medical Equipment

- /

- SWX:VBSN

Phoenix Mecano And 2 Other Hidden Swiss Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

The Switzerland market ended modestly higher on Monday despite staying sluggish till mid-morning, as investors made cautious moves ahead of the Swiss National Bank's interest rate decision and fresh economic data from the U.S. and Europe. With the central bank expected to ease its monetary policy for the third time, reducing it to 1%, small-cap stocks are gaining attention for their potential resilience and growth opportunities. In this context, identifying high-quality yet under-the-radar stocks can be a strategic move to enhance your portfolio. Phoenix Mecano and two other hidden Swiss gems offer promising prospects amid these evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Phoenix Mecano (SWX:PMN)

Simply Wall St Value Rating: ★★★★★★

Overview: Phoenix Mecano AG, along with its subsidiaries, manufactures and sells components for industrial customers globally and has a market cap of CHF423.09 million.

Operations: Phoenix Mecano AG generates revenue primarily from three segments: Enclosure Systems (€218.16 million), Industrial Components (€197.28 million), and Dewertokin Technology Group (€348 million).

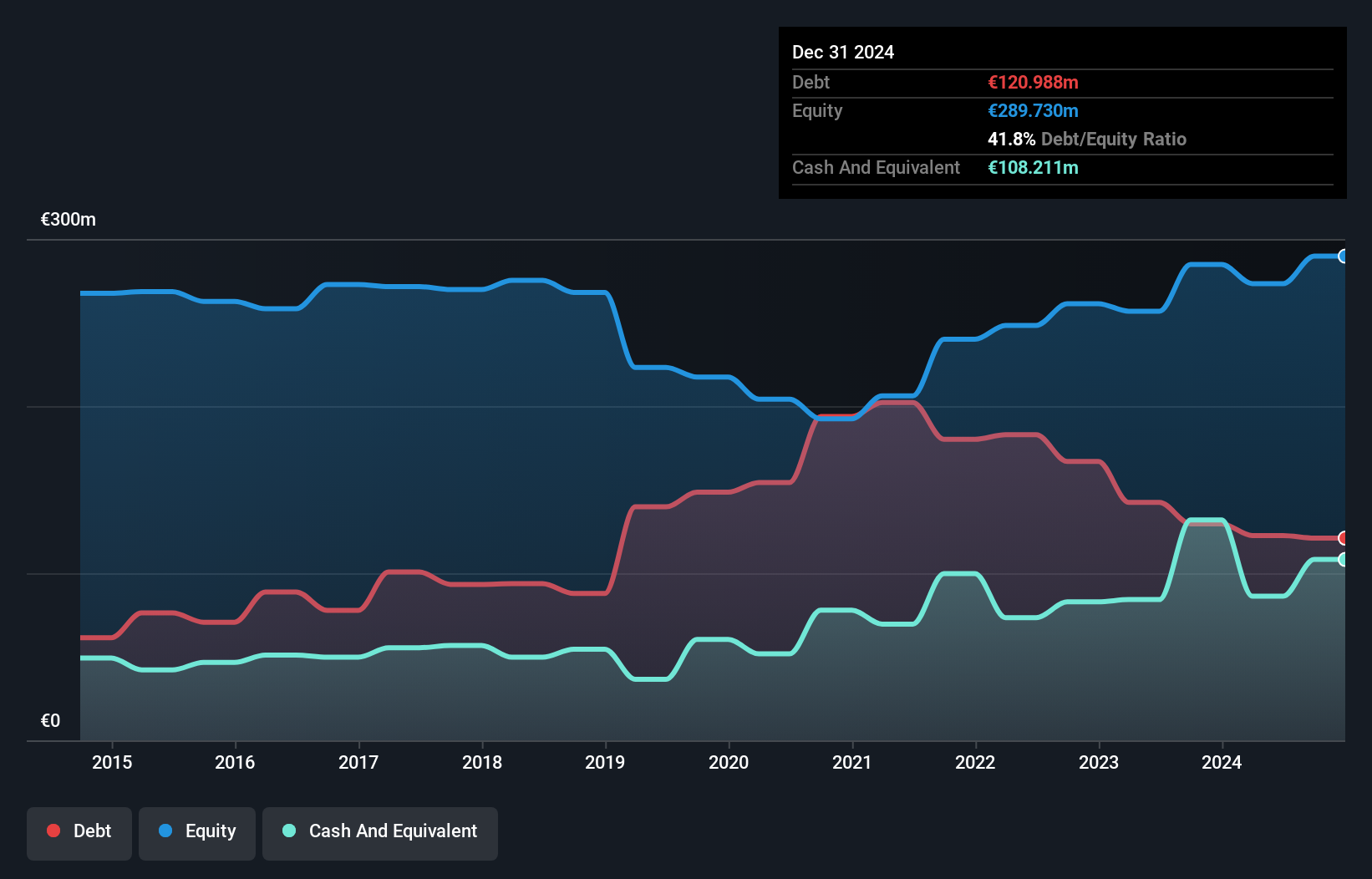

Phoenix Mecano, a Swiss small-cap company, has seen its earnings grow by 0.7% over the past year, outpacing the Electrical industry’s -11.1%. The firm trades at a price-to-earnings ratio of 10.6x, notably below the Swiss market average of 21x, indicating good value. Over five years, their debt to equity ratio dropped from 62.6% to 44.8%, showing improved financial health. Recent half-year sales were EUR382.8 million with net income at EUR17.2 million compared to EUR19.9 million last year.

- Dive into the specifics of Phoenix Mecano here with our thorough health report.

Examine Phoenix Mecano's past performance report to understand how it has performed in the past.

Vaudoise Assurances Holding (SWX:VAHN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vaudoise Assurances Holding SA offers a range of insurance products and services primarily in Switzerland, with a market cap of CHF1.36 billion.

Operations: Vaudoise Assurances Holding SA generates revenue primarily through its insurance products and services in Switzerland. The company has a market cap of CHF1.36 billion.

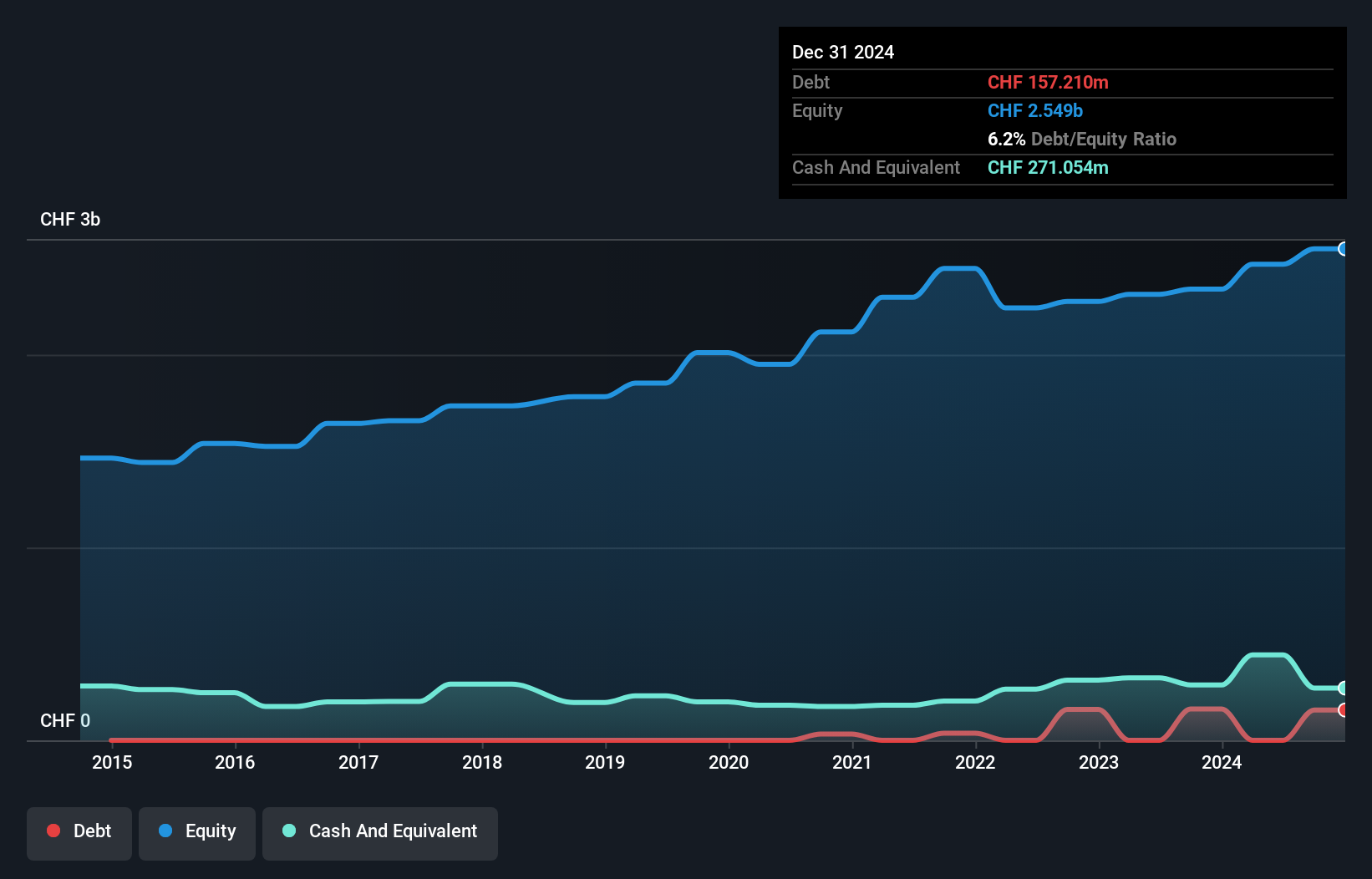

Vaudoise Assurances Holding, a promising player in the Swiss insurance sector, has shown robust performance. The company reported net income of CHF 81.17 million for the first half of 2024, up from CHF 70.02 million last year. Trading at 64.8% below its estimated fair value and boasting no debt, VAHN's earnings grew by 7.1%, surpassing the industry average of 6.7%. With high-quality past earnings and a solid financial footing, it remains an attractive investment prospect in Switzerland's market landscape.

- Take a closer look at Vaudoise Assurances Holding's potential here in our health report.

Understand Vaudoise Assurances Holding's track record by examining our Past report.

IVF Hartmann Holding (SWX:VBSN)

Simply Wall St Value Rating: ★★★★★★

Overview: IVF Hartmann Holding AG, with a market cap of CHF333.43 million, specializes in providing medical consumer goods both within Switzerland and internationally.

Operations: IVF Hartmann Holding AG generates revenue primarily from Wound Care (CHF40.21 million), Infection Management (CHF54.18 million), and Incontinence Management (CHF32.11 million). The company has a market cap of CHF333.43 million.

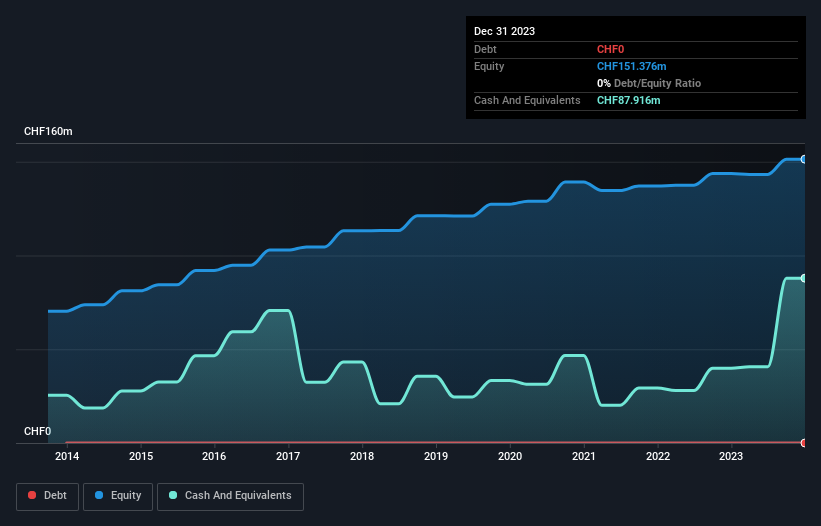

IVF Hartmann Holding, a notable player in the Swiss medical equipment sector, has seen its earnings grow by 34.9% over the past year, significantly outpacing the industry average of -2.4%. Despite a 4.3% annual decline in earnings over five years, it trades at an attractive valuation, currently 88.2% below estimated fair value. The company is debt-free and consistently generates positive free cash flow, with recent figures showing CHF 17.50M as of June 2023.

- Get an in-depth perspective on IVF Hartmann Holding's performance by reading our health report here.

Explore historical data to track IVF Hartmann Holding's performance over time in our Past section.

Summing It All Up

- Dive into all 18 of the SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VBSN

IVF Hartmann Holding

Provides medical consumer goods in Switzerland and internationally.

Flawless balance sheet with solid track record and pays a dividend.