- Switzerland

- /

- Machinery

- /

- SWX:PEDU

Perrot Duval Holding S.A.'s (VTX:PEDU) Shares Leap 28% Yet They're Still Not Telling The Full Story

The Perrot Duval Holding S.A. (VTX:PEDU) share price has done very well over the last month, posting an excellent gain of 28%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

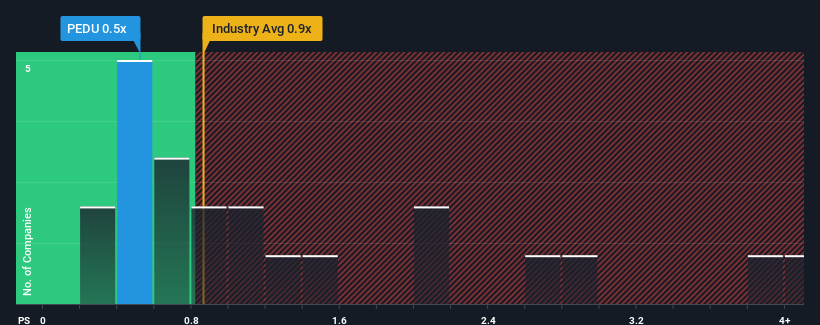

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Perrot Duval Holding's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in Switzerland is also close to 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Perrot Duval Holding

What Does Perrot Duval Holding's P/S Mean For Shareholders?

Perrot Duval Holding has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Perrot Duval Holding's earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Perrot Duval Holding?

In order to justify its P/S ratio, Perrot Duval Holding would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.5% last year. This was backed up an excellent period prior to see revenue up by 159% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 7.9%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Perrot Duval Holding's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Perrot Duval Holding's P/S

Perrot Duval Holding's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To our surprise, Perrot Duval Holding revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Before you settle on your opinion, we've discovered 3 warning signs for Perrot Duval Holding (2 shouldn't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on Perrot Duval Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:PEDU

Perrot Duval Holding

Provides automation technologies in the fields of process automation and chemical cosmetics worldwide.

Flawless balance sheet low.

Market Insights

Community Narratives