- Switzerland

- /

- Machinery

- /

- SWX:OERL

The Market Doesn't Like What It Sees From OC Oerlikon Corporation AG's (VTX:OERL) Revenues Yet As Shares Tumble 27%

OC Oerlikon Corporation AG (VTX:OERL) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

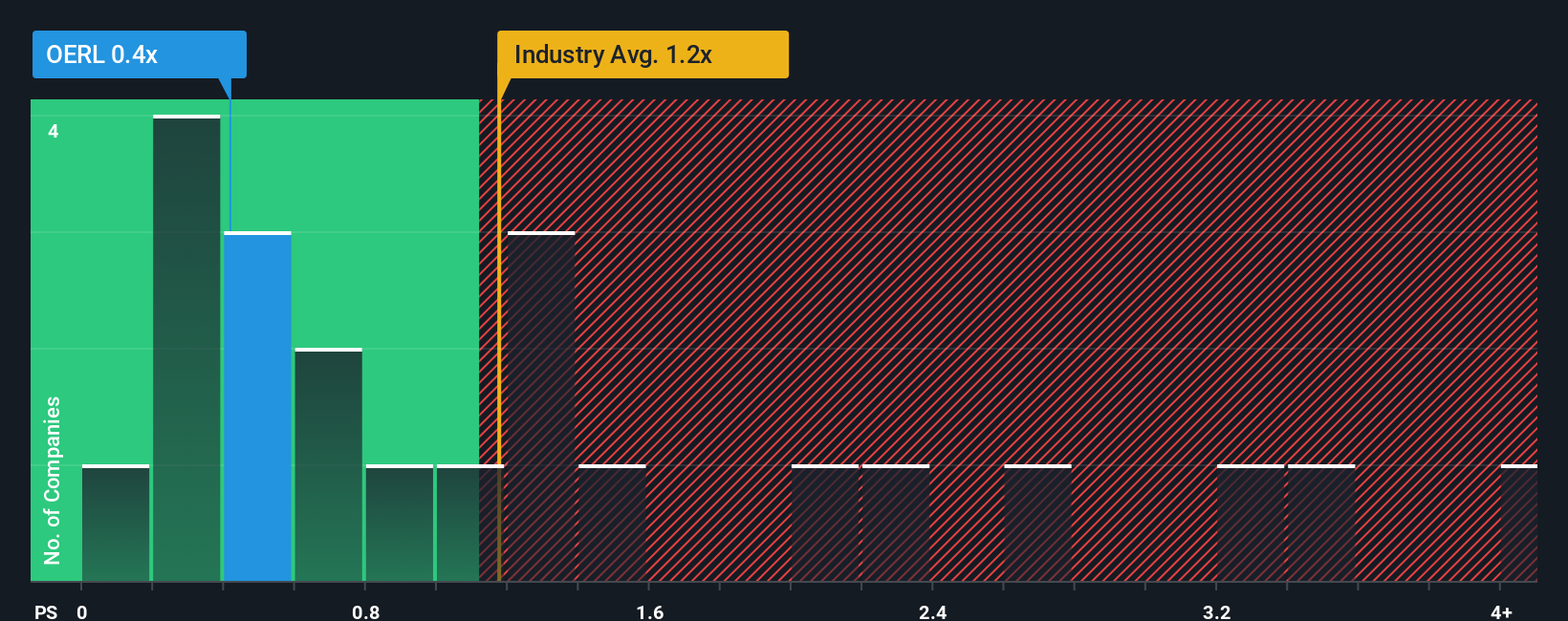

In spite of the heavy fall in price, it would still be understandable if you think OC Oerlikon is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in Switzerland's Machinery industry have P/S ratios above 1.2x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for OC Oerlikon

What Does OC Oerlikon's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, OC Oerlikon has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OC Oerlikon.How Is OC Oerlikon's Revenue Growth Trending?

In order to justify its P/S ratio, OC Oerlikon would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 20% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 8.4% each year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 5.6% growth each year, that's a disappointing outcome.

With this information, we are not surprised that OC Oerlikon is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

The southerly movements of OC Oerlikon's shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that OC Oerlikon maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 2 warning signs for OC Oerlikon that you should be aware of.

If these risks are making you reconsider your opinion on OC Oerlikon, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:OERL

OC Oerlikon

Provides surface engineering, polymer processing, and additive manufacturing services in Europe, the Americas, and the Asia-Pacific.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026