- Switzerland

- /

- Building

- /

- SWX:DOKA

Why We're Not Concerned About dormakaba Holding AG's (VTX:DOKA) Share Price

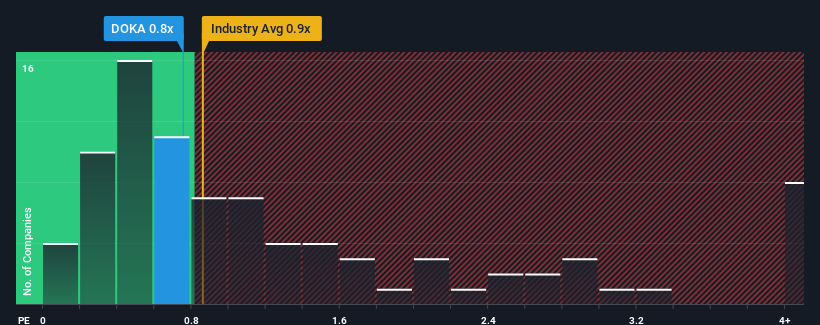

There wouldn't be many who think dormakaba Holding AG's (VTX:DOKA) price-to-sales (or "P/S") ratio of 0.8x is worth a mention when the median P/S for the Building industry in Switzerland is similar at about 1.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for dormakaba Holding

How Has dormakaba Holding Performed Recently?

Recent times have been more advantageous for dormakaba Holding as its revenue hasn't fallen as much as the rest of the industry. It might be that many expect the comparatively superior revenue performance to vanish, which has kept the P/S from rising. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. But at the very least, you'd be hoping the company doesn't fall back into the pack if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think dormakaba Holding's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

dormakaba Holding's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 18% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, revenue is anticipated to climb by 3.3% each year during the coming three years according to the six analysts following the company. That's shaping up to be similar to the 4.4% per year growth forecast for the broader industry.

With this in mind, it makes sense that dormakaba Holding's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at dormakaba Holding's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for dormakaba Holding that you should be aware of.

If these risks are making you reconsider your opinion on dormakaba Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:DOKA

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives