- Switzerland

- /

- Machinery

- /

- SWX:DAE

3 Undervalued Stocks On SIX Swiss Exchange With Estimated Discounts Up To 47.3%

Reviewed by Simply Wall St

The Swiss market recently experienced a slight downturn, with the SMI index closing marginally lower amid fluctuating sessions and an uptick in unemployment rates. In such an environment, identifying undervalued stocks can be crucial as they may offer potential value opportunities despite broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Swissquote Group Holding (SWX:SQN) | CHF303.60 | CHF575.76 | 47.3% |

| Georg Fischer (SWX:GF) | CHF62.65 | CHF111.78 | 44% |

| ALSO Holding (SWX:ALSN) | CHF263.00 | CHF368.83 | 28.7% |

| lastminute.com (SWX:LMN) | CHF18.54 | CHF29.69 | 37.6% |

| Clariant (SWX:CLN) | CHF12.86 | CHF21.60 | 40.5% |

| Comet Holding (SWX:COTN) | CHF319.50 | CHF534.15 | 40.2% |

| SGS (SWX:SGSN) | CHF93.64 | CHF150.61 | 37.8% |

| Barry Callebaut (SWX:BARN) | CHF1533.00 | CHF2287.69 | 33% |

| Dätwyler Holding (SWX:DAE) | CHF164.00 | CHF240.22 | 31.7% |

| Sensirion Holding (SWX:SENS) | CHF72.40 | CHF119.14 | 39.2% |

Here we highlight a subset of our preferred stocks from the screener.

Dätwyler Holding (SWX:DAE)

Overview: Dätwyler Holding AG produces and sells elastomer components for various industries, including health care and mobility, across multiple continents, with a market cap of CHF2.79 billion.

Operations: The company's revenue segments include Healthcare Solutions, generating CHF445.90 million, and Industrial Solutions, contributing CHF679.80 million.

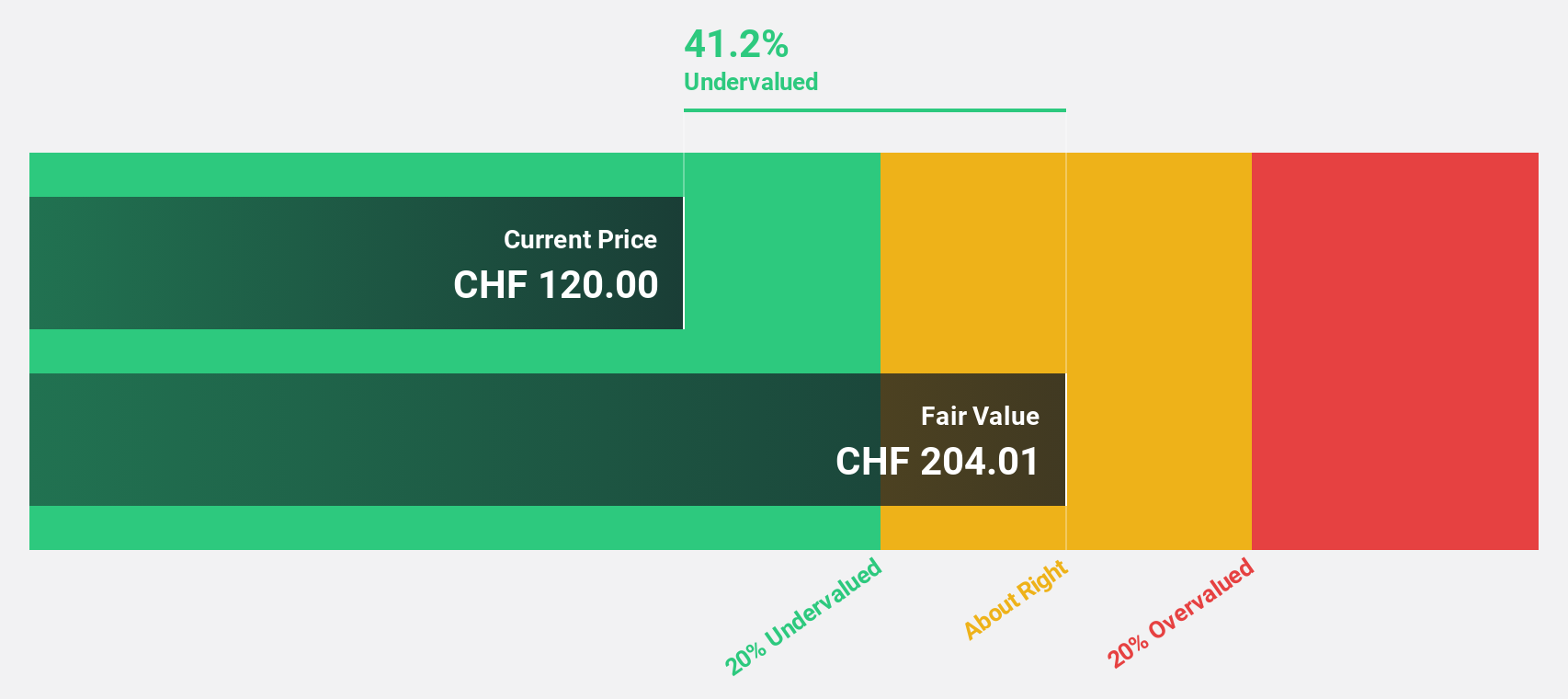

Estimated Discount To Fair Value: 31.7%

Dätwyler Holding is trading at CHF164, significantly below its estimated fair value of CHF240.22, indicating potential undervaluation based on cash flows. Despite a drop in sales to CHF572.5 million for the first half of 2024, net income increased to CHF38.6 million, reflecting improved profitability with earnings per share rising to CHF2.27 from CHF1.89 year-over-year. However, the company carries a high level of debt and has an unstable dividend track record.

- Our expertly prepared growth report on Dätwyler Holding implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Dätwyler Holding's balance sheet by reading our health report here.

Swissquote Group Holding (SWX:SQN)

Overview: Swissquote Group Holding Ltd offers a range of online financial services to retail, affluent, and professional institutional investors globally, with a market cap of CHF4.51 billion.

Operations: The company's revenue is derived from Leveraged Forex, which accounts for CHF93.28 million, and Securities Trading, contributing CHF488.98 million.

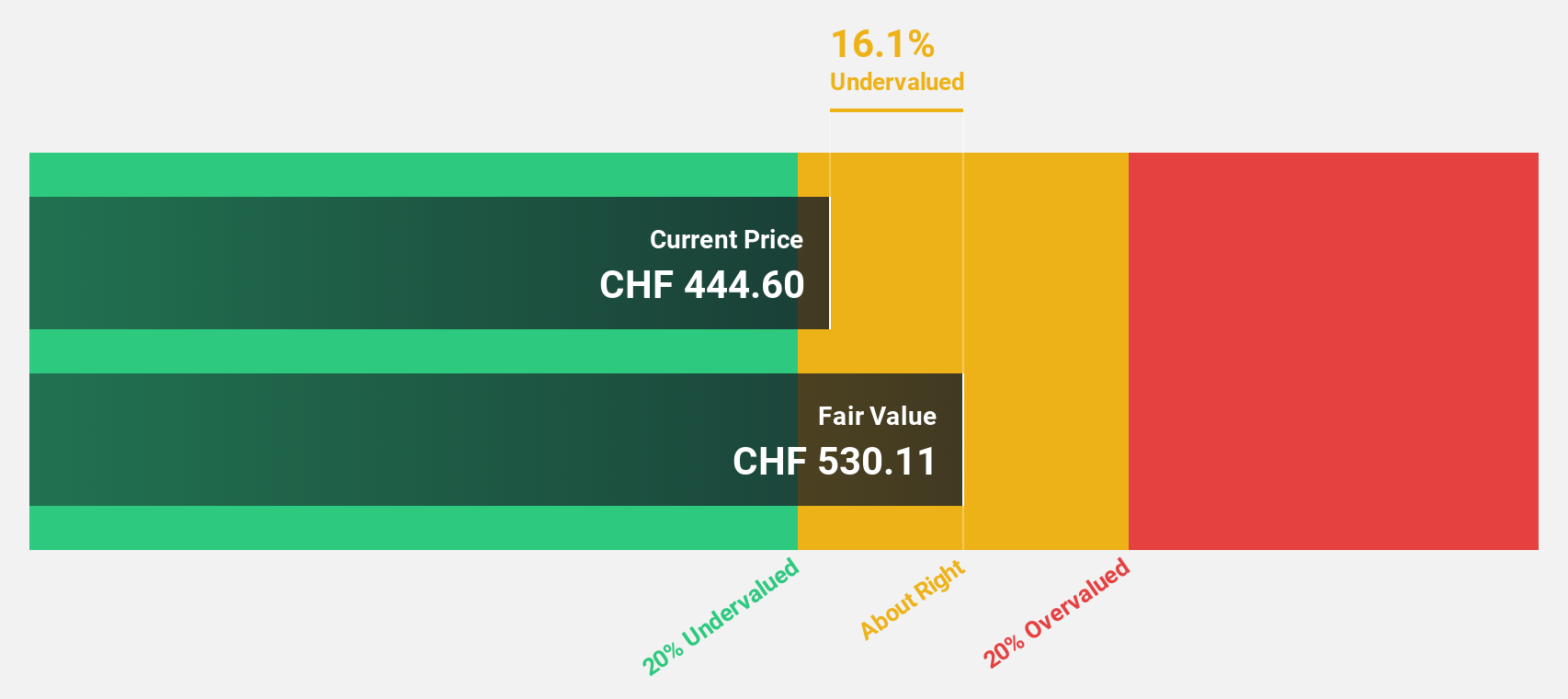

Estimated Discount To Fair Value: 47.3%

Swissquote Group Holding's current trading price of CHF303.6 is significantly below its estimated fair value of CHF575.76, highlighting potential undervaluation based on cash flows. The company reported a net income increase to CHF144.56 million for the first half of 2024, up from CHF106.53 million the previous year, with basic earnings per share rising to CHF9.69 from CHF7.15 year-over-year, underscoring robust profitability amidst strong revenue and earnings growth forecasts above the Swiss market average.

- In light of our recent growth report, it seems possible that Swissquote Group Holding's financial performance will exceed current levels.

- Take a closer look at Swissquote Group Holding's balance sheet health here in our report.

Zehnder Group (SWX:ZEHN)

Overview: Zehnder Group AG, with a market cap of CHF580.46 million, develops, manufactures, and sells indoor climate systems across Europe, North America, and China.

Operations: The company's revenue is derived from two main segments: Radiators, contributing €299.90 million, and Ventilation, generating €399.90 million.

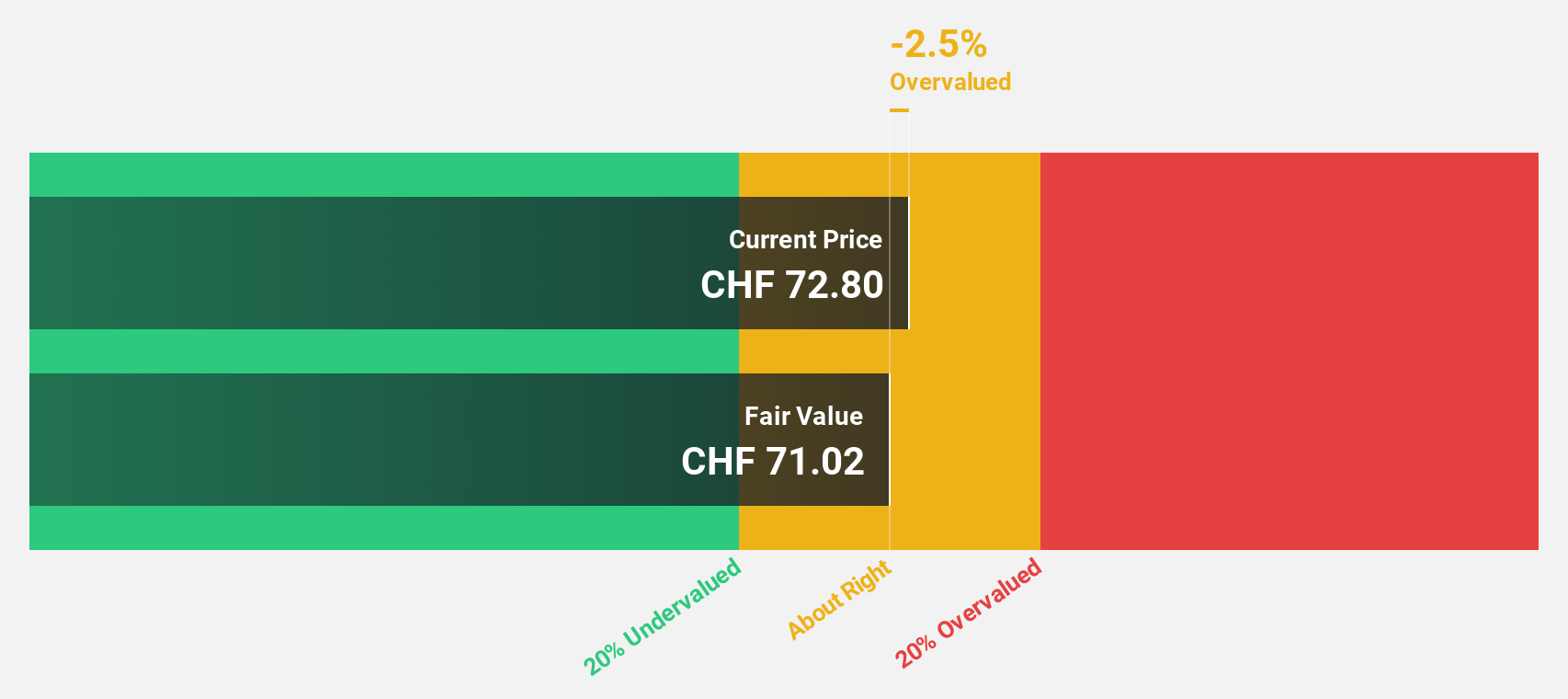

Estimated Discount To Fair Value: 11.2%

Zehnder Group's current price of CHF53.2 is below its estimated fair value of CHF59.88, suggesting undervaluation based on cash flows. Despite a challenging first half in 2024 with sales dropping to EUR346.1 million and net income falling to EUR6.6 million from EUR27 million the previous year, earnings are forecasted to grow significantly at 32.3% annually, outpacing the Swiss market average growth rate and indicating potential for future profitability improvement despite recent margin pressures.

- Our earnings growth report unveils the potential for significant increases in Zehnder Group's future results.

- Delve into the full analysis health report here for a deeper understanding of Zehnder Group.

Summing It All Up

- Take a closer look at our Undervalued SIX Swiss Exchange Stocks Based On Cash Flows list of 16 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:DAE

Dätwyler Holding

Engages in the production and sale of elastomer components for health care, mobility, connectors, general, and food and beverage industries in Europe, North America, South America, Australia, and Asia.

High growth potential average dividend payer.