- Switzerland

- /

- Transportation

- /

- SWX:JFN

Bucher Industries And Two More Top Dividend Stocks From SIX Swiss Exchange

Reviewed by Simply Wall St

The Swiss market exhibited a cautious tone on Monday, influenced by global events including upcoming major U.S. tech earnings and key monetary policy announcements from several central banks. This cautious sentiment was reflected in the slight decline of the SMI, despite it spending much of the session in positive territory. In such a market environment, identifying robust dividend stocks can offer investors potential stability and consistent returns, making them an attractive consideration amidst prevailing uncertainties.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.24% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.37% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 5.47% | ★★★★★☆ |

| EFG International (SWX:EFGN) | 4.37% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 4.84% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.44% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.31% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.71% | ★★★★★☆ |

| Berner Kantonalbank (SWX:BEKN) | 4.27% | ★★★★★☆ |

We'll examine a selection from our screener results.

Bucher Industries (SWX:BUCN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bucher Industries AG, a global company, manufactures and sells machinery and systems for food production, packaging, and harvesting, as well as hydraulic components for maintaining clean and safe public spaces, with a market cap of CHF 3.60 billion.

Operations: Bucher Industries AG's revenue is generated through five primary segments: Kuhn Group (CHF 1.27 billion), Bucher Specials (CHF 373.90 million), Bucher Municipal (CHF 593.40 million), Bucher Hydraulics (CHF 699.20 million), and Bucher Emhart Glass (CHF 502.10 million).

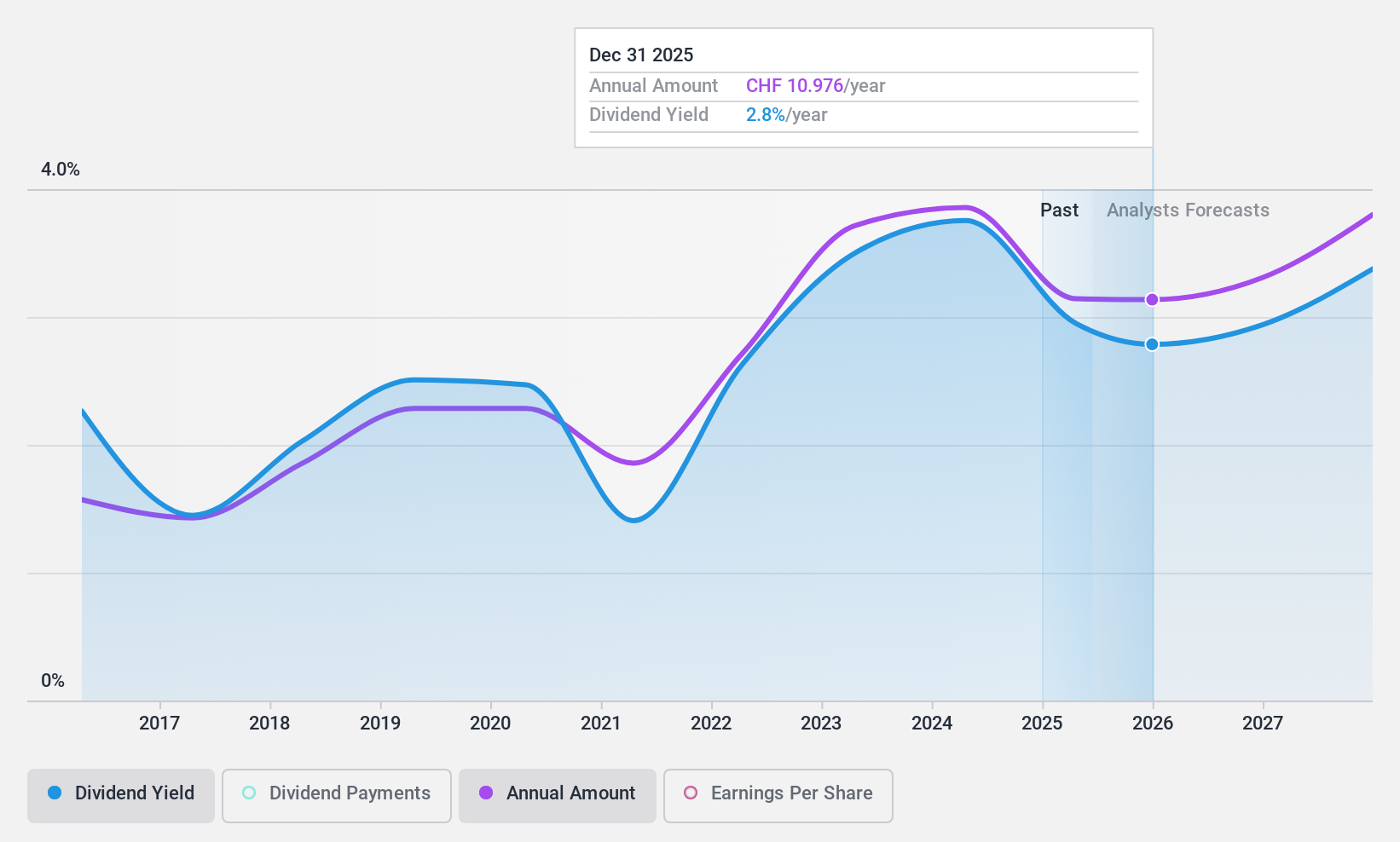

Dividend Yield: 3.8%

Bucher Industries AG saw a decline in sales and net income in the first half of 2024, with revenues dropping to CHF 1.72 billion from CHF 1.94 billion year-over-year and net income falling to CHF 144.1 million from CHF 198.1 million. Despite a stable dividend history over the past decade and an increase in dividend payments, the current yield of 3.84% trails behind top Swiss dividend payers. Additionally, both earnings forecasts predict a slight decline, and high cash payout ratios suggest dividends are not fully covered by free cash flow, raising concerns about sustainability amidst financial underperformance.

- Click to explore a detailed breakdown of our findings in Bucher Industries' dividend report.

- The valuation report we've compiled suggests that Bucher Industries' current price could be quite moderate.

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG operates cogwheel railways and winter sports facilities in the Jungfrau region of Switzerland, with a market capitalization of CHF 1.12 billion.

Operations: Jungfraubahn Holding AG generates revenue primarily through three segments: CHF 188.24 million from Jungfraujoch - TOP of Europe, CHF 45.94 million from Experience Mountains, and CHF 41.26 million from Winter Sports.

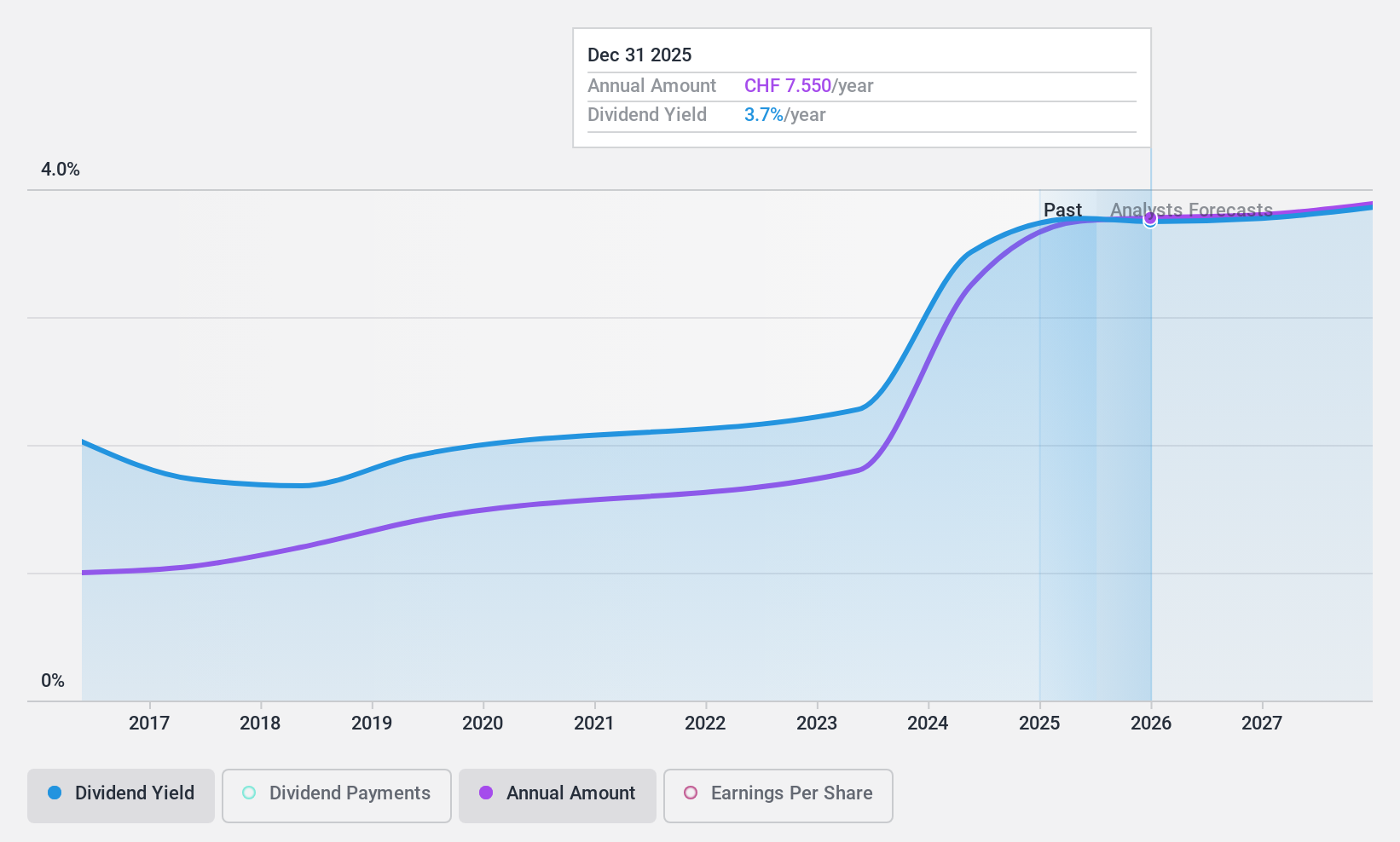

Dividend Yield: 3.2%

Jungfraubahn Holding's dividend sustainability is questionable due to a volatile history over the past decade, despite a low payout ratio of 47.8% and cash payout ratio of 61.7%, suggesting coverage by earnings and cash flows. Dividends have increased, yet with an unreliable pattern, and the current yield of 3.23% is below the top quartile in Switzerland. Earnings growth remains modest at an expected annual rate of 2.6%, with recent performance showing an 81.6% increase last year, which supports short-term dividend feasibility more than long-term stability.

- Dive into the specifics of Jungfraubahn Holding here with our thorough dividend report.

- Our valuation report unveils the possibility Jungfraubahn Holding's shares may be trading at a premium.

StarragTornos Group (SWX:STGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: StarragTornos Group AG specializes in developing, manufacturing, and distributing precision machine tools for various machining processes including milling, turning, boring, and grinding of metal, composite materials, and ceramics; it has a market capitalization of CHF 267.46 million.

Operations: StarragTornos Group AG generates CHF 409 million from its machine tools segment.

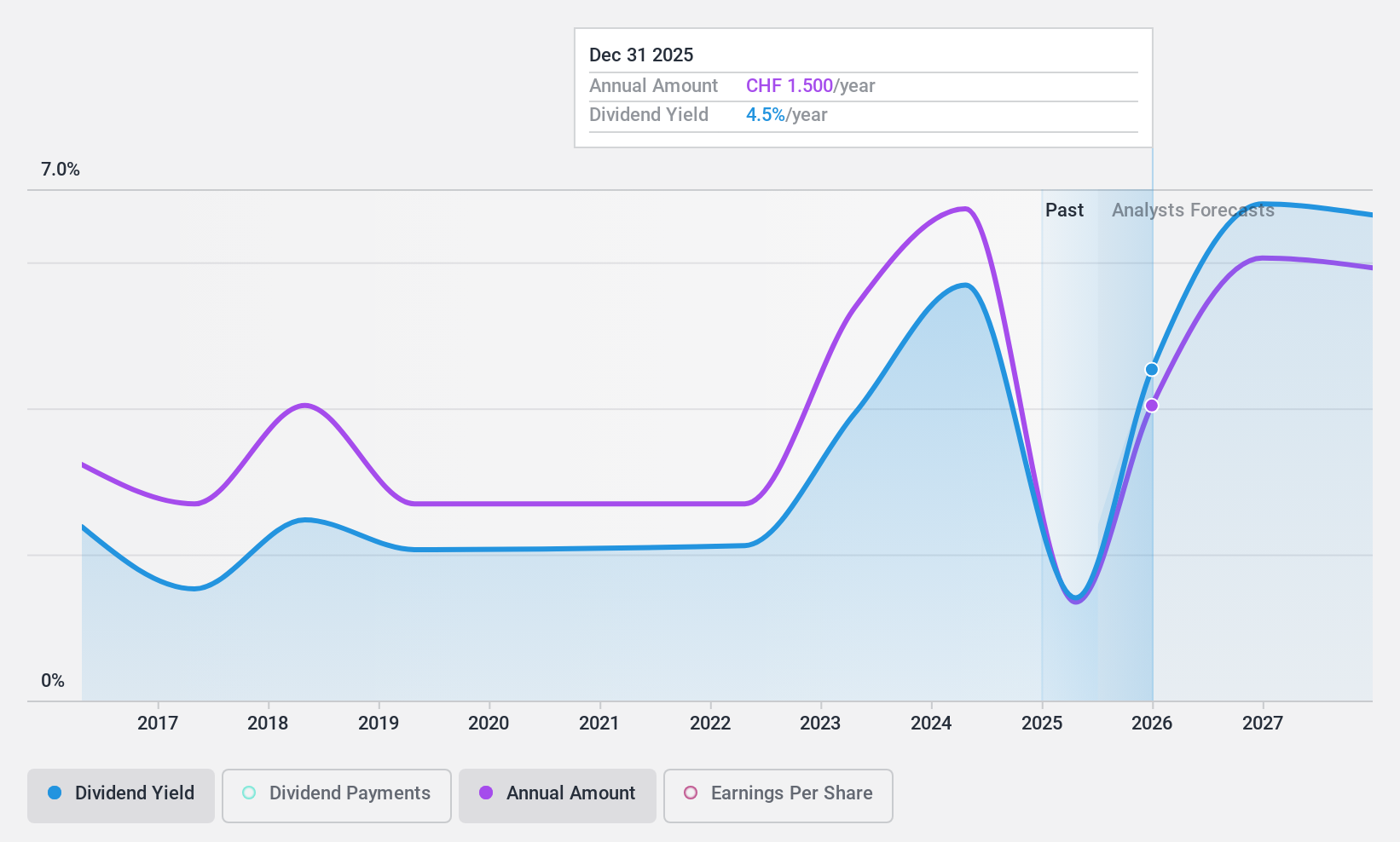

Dividend Yield: 5.1%

StarragTornos Group has seen a 126.5% earnings increase over the past year, with dividends growing despite a 10-year history of volatility and unreliability. Its dividend yield of 5.08% ranks well above the Swiss market average, supported by a low price-to-earnings ratio of 10.6x compared to the market's 21.7x. However, challenges remain as its high cash payout ratio of 110.6% indicates that dividends are not well covered by free cash flows, questioning long-term sustainability despite a reasonable earnings coverage with a payout ratio of 34.7%.

- Delve into the full analysis dividend report here for a deeper understanding of StarragTornos Group.

- Our valuation report here indicates StarragTornos Group may be overvalued.

Taking Advantage

- Embark on your investment journey to our 25 Top SIX Swiss Exchange Dividend Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:JFN

Jungfraubahn Holding

Operates cogwheel railway and winter sports related facilities in Jungfrau region, Switzerland.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives