- Switzerland

- /

- Machinery

- /

- SWX:BUCN

Bucher Industries And 2 Top Dividend Stocks On The SIX Swiss Exchange

Reviewed by Simply Wall St

The Switzerland market opened weak Friday morning and continued to drift lower, closing with a loss of over 1%. Investors remained cautious as they anticipated the Swiss National Bank's monetary policy announcement next Thursday, which is expected to include another rate cut. In such a fluctuating market environment, dividend stocks can offer stability and consistent income. This article will explore Bucher Industries and two other top dividend stocks on the SIX Swiss Exchange that may appeal to investors seeking reliable returns amidst economic uncertainty.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.12% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.70% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.62% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.94% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.87% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.35% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.57% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 4.03% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.71% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.49% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

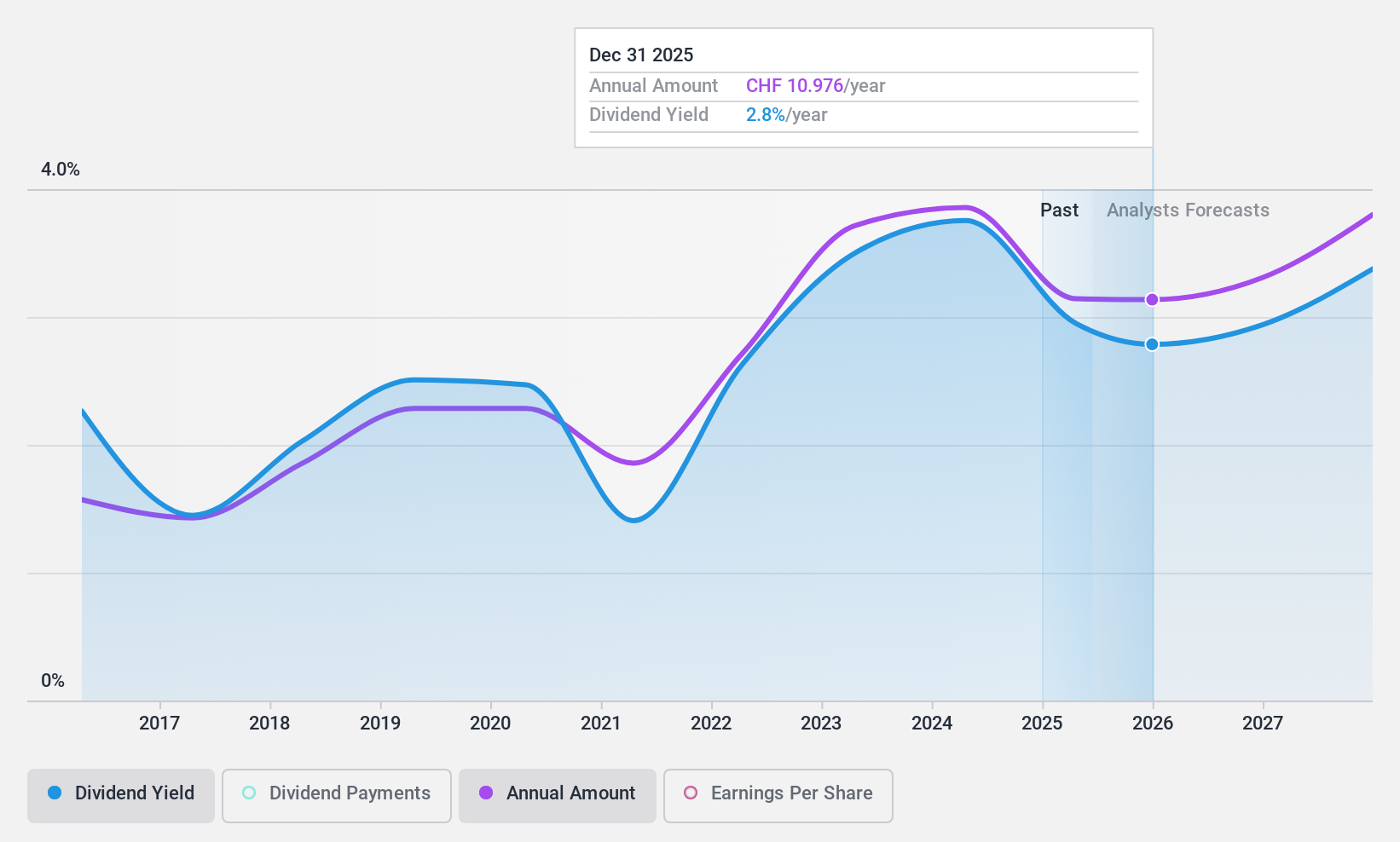

Bucher Industries (SWX:BUCN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bucher Industries AG manufactures and sells machinery, systems, and hydraulic components for agriculture, food production, packaging, and public space maintenance globally; the company has a market cap of CHF 3.76 billion.

Operations: Bucher Industries AG's revenue segments include Kuhn Group (CHF 1.27 billion), Bucher Specials (CHF 373.90 million), Bucher Municipal (CHF 593.40 million), Bucher Hydraulics (CHF 699.20 million), and Bucher Emhart Glass (CHF 502.10 million).

Dividend Yield: 3.7%

Bucher Industries has demonstrated stable and growing dividend payments over the past decade, supported by a reasonably low payout ratio of 46.4%. However, recent earnings reports show a decline in sales to CHF 1.72 billion and net income to CHF 144.1 million for H1 2024, impacting its financial performance. Additionally, with a high cash payout ratio of 102.5%, the dividends are not well covered by free cash flows, raising concerns about long-term sustainability despite trading at good relative value compared to peers.

- Click to explore a detailed breakdown of our findings in Bucher Industries' dividend report.

- Our valuation report unveils the possibility Bucher Industries' shares may be trading at a discount.

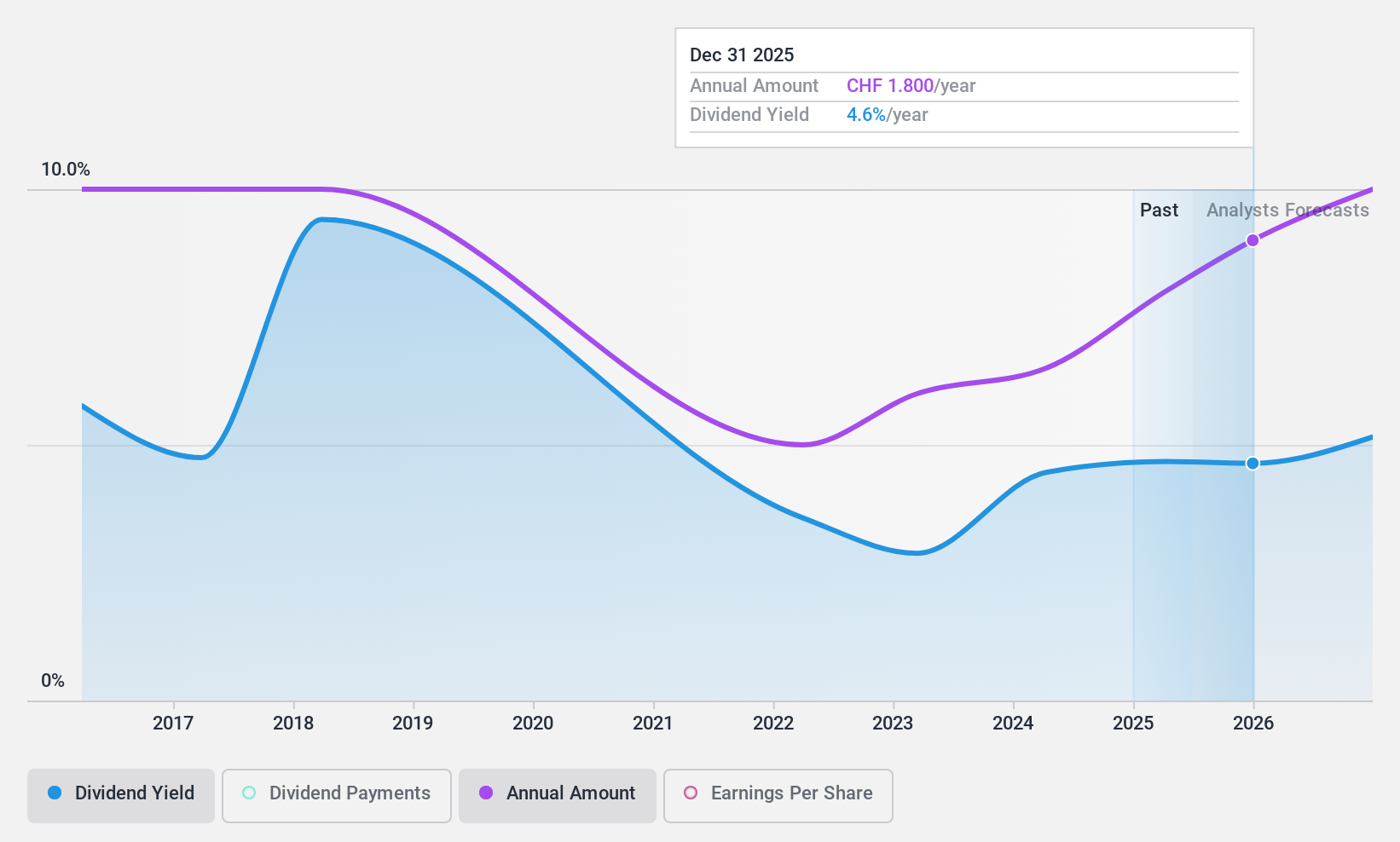

Meier Tobler Group (SWX:MTG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meier Tobler Group AG operates as a trading and services company specializing in heat generation and air conditioning systems, with a market cap of CHF282.77 million.

Operations: Meier Tobler Group AG generates revenue from two main segments: Service (CHF104.01 million) and Distribution (CHF404.27 million).

Dividend Yield: 5.2%

Meier Tobler Group's dividend yield of 5.19% is among the top 25% in the Swiss market but is not well covered by cash flows, with a high payout ratio of 179.3%. Recent earnings for H1 2024 showed a decline in sales to CHF 238.75 million and net income to CHF 8 million, impacting financial stability. Despite trading at a significant discount to its estimated fair value, its dividends have been volatile over the past decade and are not reliably covered by earnings or free cash flows.

- Navigate through the intricacies of Meier Tobler Group with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Meier Tobler Group's share price might be too pessimistic.

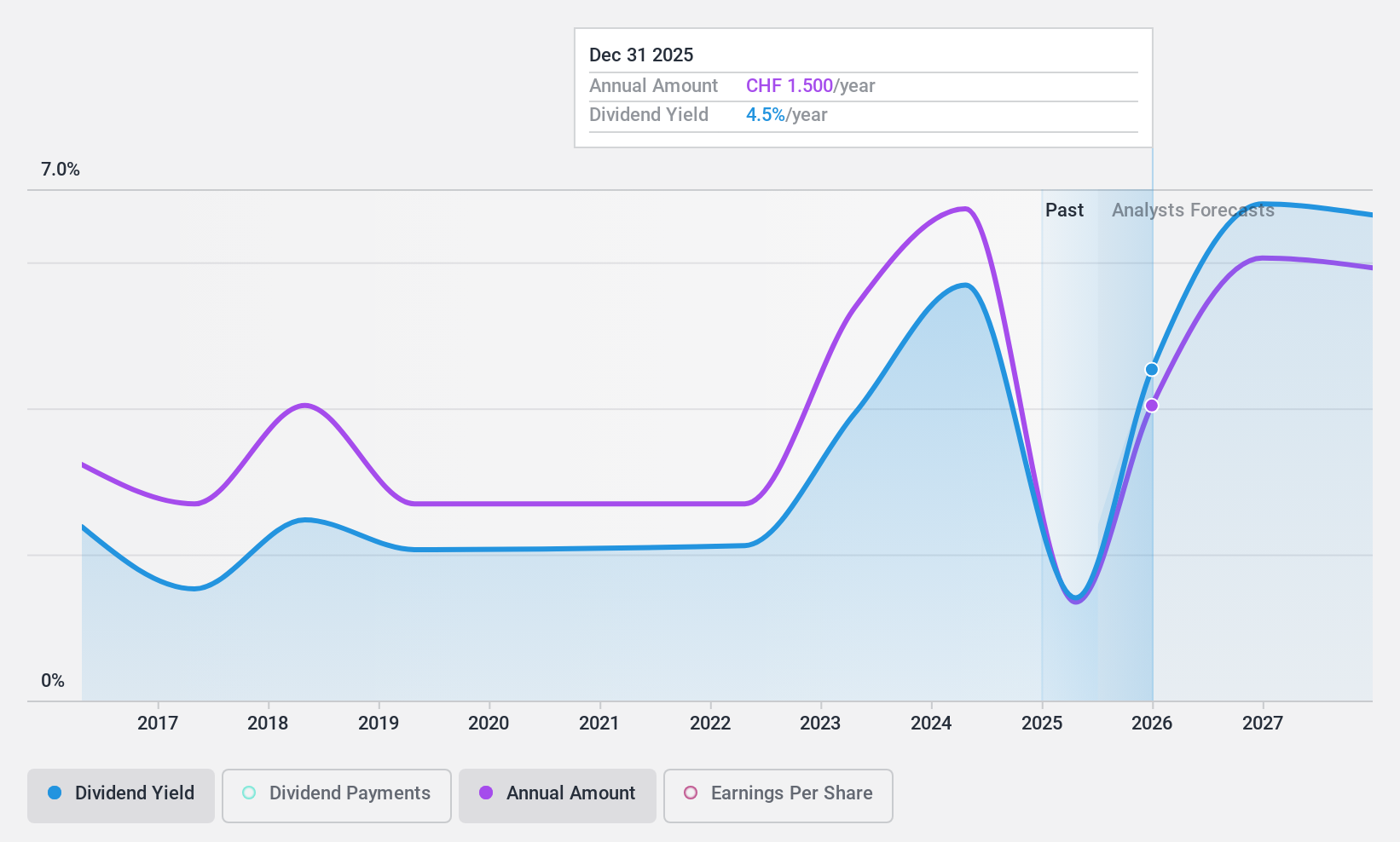

StarragTornos Group (SWX:STGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: StarragTornos Group AG, with a market cap of CHF238.10 million, develops, manufactures, and distributes precision machine tools for milling, turning, boring, grinding, and machining of metal, composite materials, and ceramics.

Operations: StarragTornos Group AG generates revenue from developing, manufacturing, and distributing precision machine tools for the milling, turning, boring, grinding, and machining of metal, composite materials, and ceramics.

Dividend Yield: 5.7%

StarragTornos Group's dividend yield of 5.71% is in the top 25% for Swiss stocks but is not covered by free cash flows, indicating potential sustainability issues. Despite a reasonable payout ratio of 62.7%, dividends have been volatile and unreliable over the past decade. Recent H1 2024 results showed sales increased to CHF 254.95 million, though net income dropped to CHF 6.57 million, reflecting financial challenges that may affect future dividend stability.

- Dive into the specifics of StarragTornos Group here with our thorough dividend report.

- Our expertly prepared valuation report StarragTornos Group implies its share price may be lower than expected.

Summing It All Up

- Delve into our full catalog of 25 Top SIX Swiss Exchange Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bucher Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BUCN

Bucher Industries

Engages in the manufacture and sale of machinery, systems, and hydraulic components for harvesting, producing and packaging food products, and keeping roads and public spaces clean and safe in Asia, the Americas, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.