- Switzerland

- /

- Banks

- /

- SWX:VATN

Valiant Holding (SWX:VATN): Examining Valuation After a Year of Steady Share Price Gains

Reviewed by Simply Wall St

Price-to-Earnings of 13.5x: Is it justified?

Valiant Holding is currently valued at a price-to-earnings (P/E) ratio of 13.5x, which is higher than the average for European banks but below its own estimated fair P/E of 16.9x. This suggests that while the stock trades at a premium compared to sector peers, it may still be undervalued relative to its expected earnings potential.

The P/E multiple is a widely used measure for banks because it compares a company’s current share price against its earnings. For a business like Valiant Holding, which operates in a stable and regulated sector, the P/E ratio is a clear snapshot of investor expectations regarding profit growth and risk.

While investors are currently paying more for every franc of Valiant's earnings than they would for the typical European bank, the market might still be underestimating its steady performance and outlook. If profit growth continues and the business maintains its strong fundamentals, the current multiple could be well justified.

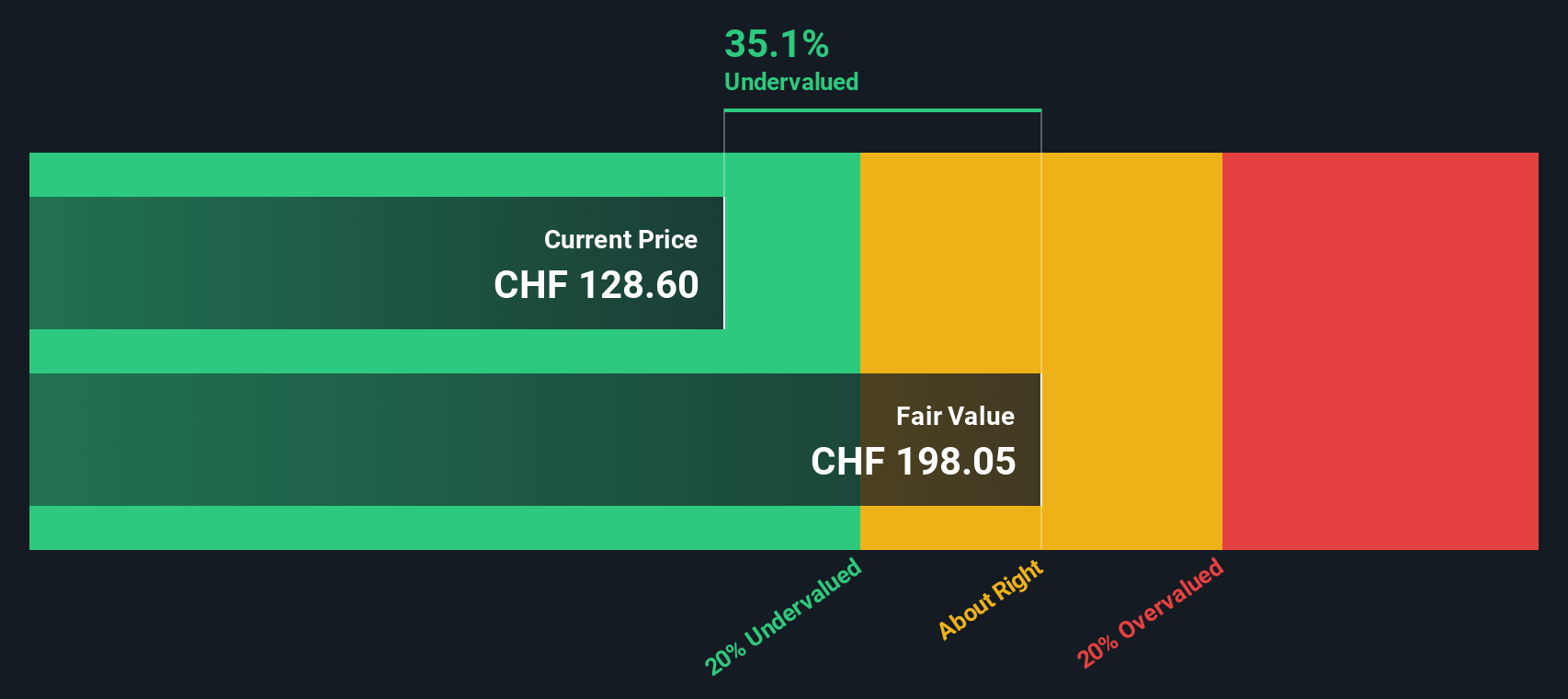

Result: Fair Value of CHF196.52 (UNDERVALUED)

See our latest analysis for Valiant Holding.However, slower annual revenue growth and a small recent price dip highlight that headwinds or a market shift could quickly challenge the current optimism.

Find out about the key risks to this Valiant Holding narrative.Another View: Our DCF Model

Looking through the lens of the SWS DCF model, things look different. This approach weighs up future cash flows and suggests Valiant Holding could be undervalued, offering a fresh perspective on the company’s true worth. Which view will prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Valiant Holding Narrative

If you’re inclined to dig into the numbers and shape a perspective of your own, it’s easy to build and share your view on Valiant Holding. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Valiant Holding.

Ready to Find More Winning Stock Ideas?

Grow your knowledge and improve your portfolio by checking out hand-picked themes you might be missing. Opportunities in the market are often short-lived.

- Tap into high-growth potential by tracking penny stocks with strong financials using our penny stocks with strong financials screener.

- Explore the momentum of artificial intelligence innovation and see what is trending among the most exciting AI-focused stocks through our AI penny stocks short-list.

- Discover attractive yields by finding companies paying over 3% dividends with our curated dividend stocks with yields > 3% selection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VATN

Valiant Holding

Provides financial products and services in the areas of financing, payments, savings, investments, and retirement planning in Switzerland.

6 star dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives