- Switzerland

- /

- Banks

- /

- SWX:LUKN

How Investors Are Reacting To Luzerner Kantonalbank (SWX:LUKN) Rising Net Income and Interest Revenue

Reviewed by Sasha Jovanovic

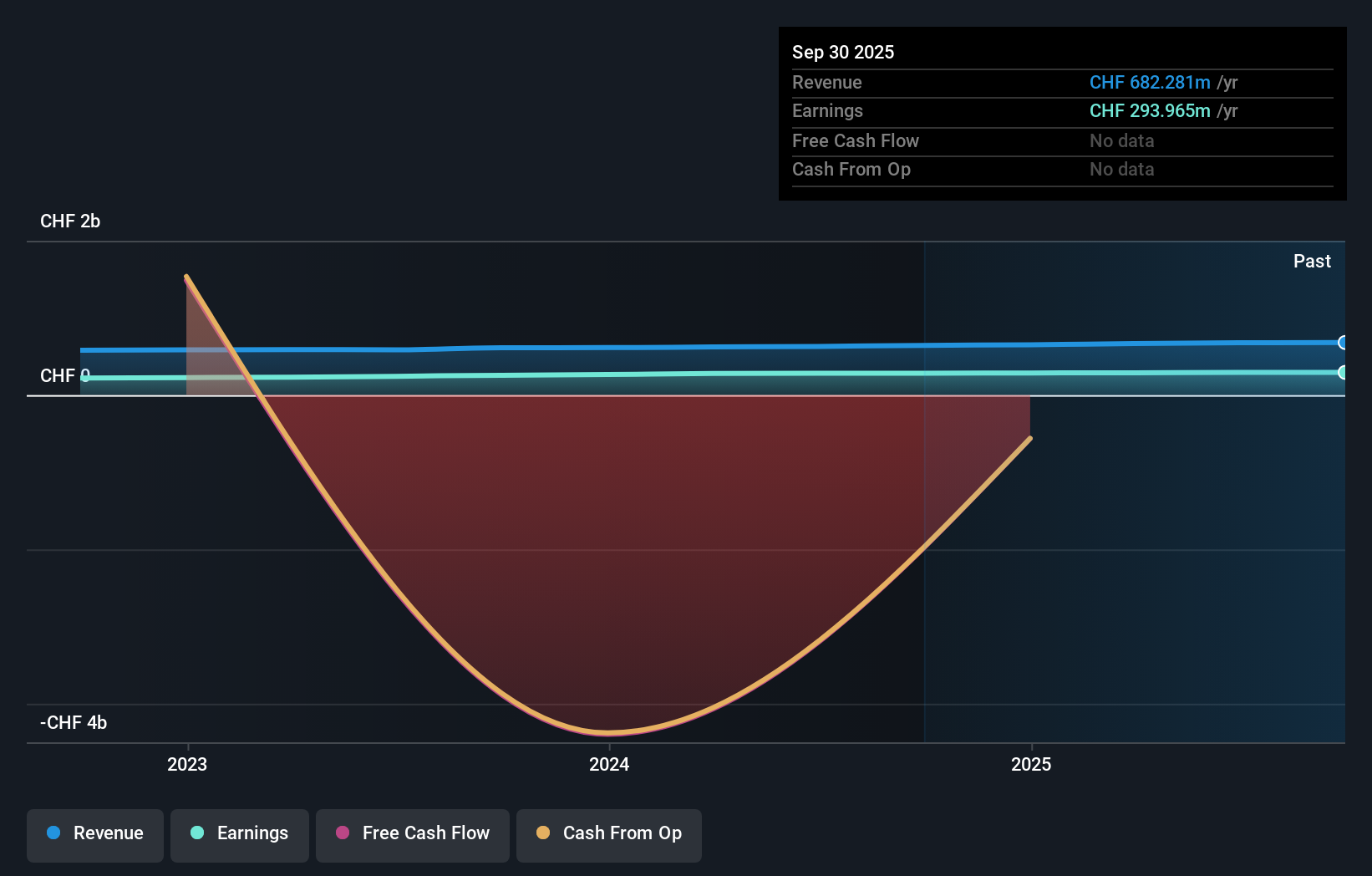

- Luzerner Kantonalbank AG announced earnings results for the nine months ended September 30, 2025, posting net interest income of CHF 353.17 million and net income of CHF 223.34 million, both higher than the same period last year.

- This steady rise in both key profit and revenue measures underscores the bank's consistent financial performance over the ongoing period.

- We'll examine how robust growth in net interest income shapes Luzerner Kantonalbank's investment narrative going forward.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Luzerner Kantonalbank's Investment Narrative?

To be invested in Luzerner Kantonalbank, you have to believe in the durability of its cautious, consistent banking model and its ability to generate stable profits even as sector trends change. The newest results, with net interest income and net income both picking up compared to last year, reinforce a track record of resilience, even as return on equity remains modest and its price-to-earnings ratio shows it is more expensive than the typical European bank. The past analysis pointed to reliable dividend payouts and steady, if not rapid, profit growth as key short-term catalysts, with lower net profit margins and limited evidence of significant revenue acceleration acting as watchpoints. Following the latest earnings, nothing appears to have disrupted those near-term forces; the performance simply solidifies the bank’s image as a steady but relatively low-growth player. However, as economic conditions shift and banking margins worldwide remain under scrutiny, long-term profit potential remains a focal risk for anyone considering the shares. But, with profit margins trending lower, investors should keep a close eye on future earnings quality.

Luzerner Kantonalbank's shares have been on the rise but are still potentially undervalued by 28%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Luzerner Kantonalbank - why the stock might be worth 32% less than the current price!

Build Your Own Luzerner Kantonalbank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Luzerner Kantonalbank research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Luzerner Kantonalbank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Luzerner Kantonalbank's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LUKN

Luzerner Kantonalbank

Provides various banking products and services in Switzerland.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives