- Switzerland

- /

- Banks

- /

- SWX:LLBN

Does Liechtensteinische Landesbank’s Middle East Exit Signal a Shift in Global Focus for SWX:LLBN?

Reviewed by Simply Wall St

- Liechtensteinische Landesbank AG recently announced its decision to withdraw from its operations in Dubai and Abu Dhabi after 20 years in the Middle East.

- This move signals a realignment of the bank's international presence and may reflect changing priorities in its global strategy.

- We’ll explore what this geographic exit means for Liechtensteinische Landesbank’s investment case, especially as it reconsiders its focus areas.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Liechtensteinische Landesbank's Investment Narrative?

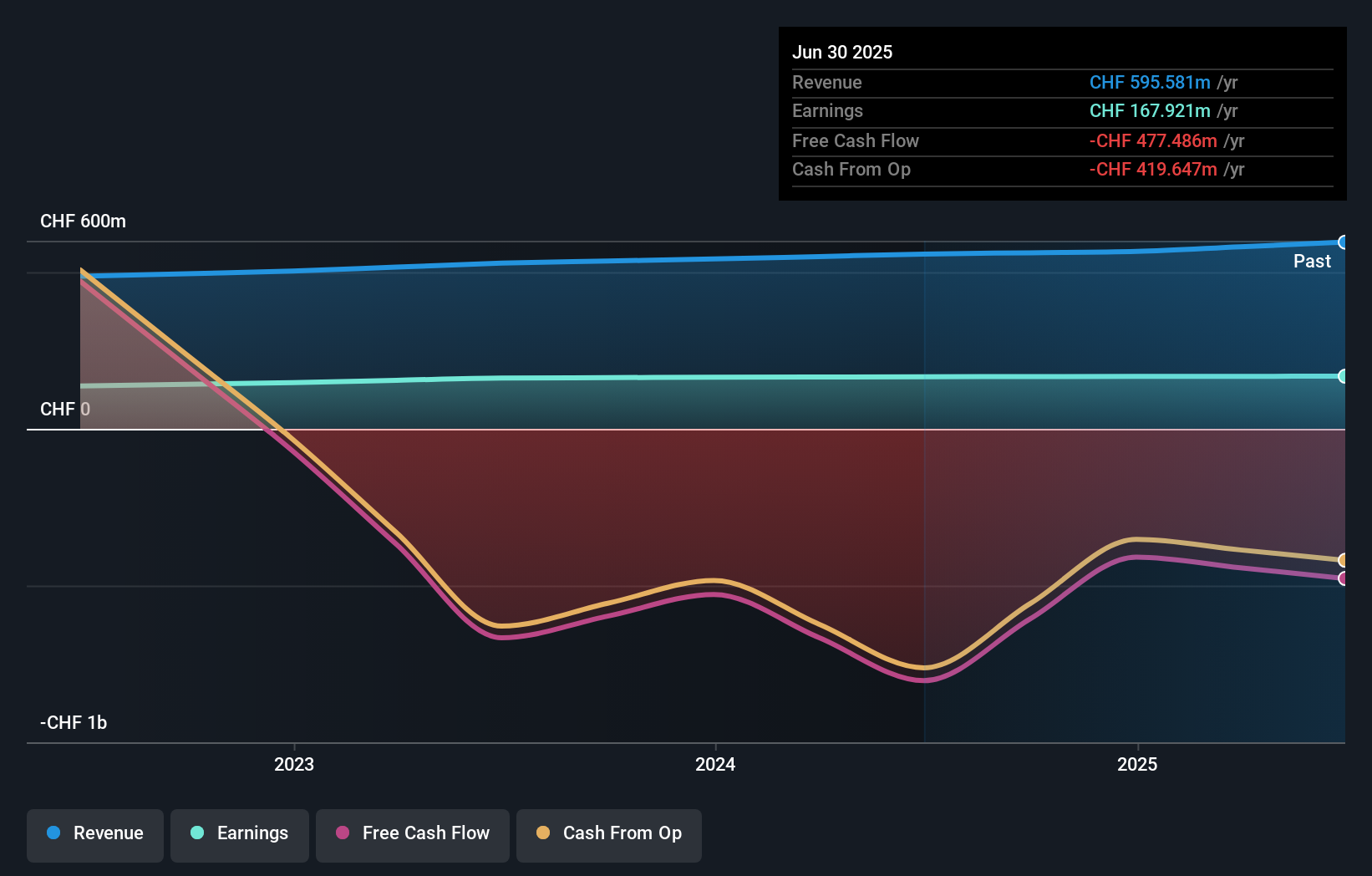

For many who see themselves as potential shareholders in Liechtensteinische Landesbank, the big picture rests on the bank’s ability to maintain resilient earnings and decent dividends, even as revenue shows a modest 2% decline over the past year and future revenue is forecast to slip further. After years of gradual earnings growth and stable board leadership, the company’s decision to leave the Middle East marks a shift in its global ambitions, but, for now, does not appear material to its main short-term catalysts, namely, the continued share buyback and sector outperformance in total returns. The longer-term risk profile may change, with geographic concentration back in Europe possibly heightening exposure to market or regulatory pressures at home. While management transitions and a below-average return on equity remain high on the list of risks, the impact of the Middle East exit looks limited based on current analysis and muted share price reaction.

On the other hand, executive turnover is a risk shareholders should not ignore. Liechtensteinische Landesbank's shares have been on the rise but are still potentially undervalued by 23%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Liechtensteinische Landesbank - why the stock might be worth 28% less than the current price!

Build Your Own Liechtensteinische Landesbank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Liechtensteinische Landesbank research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Liechtensteinische Landesbank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Liechtensteinische Landesbank's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LLBN

Liechtensteinische Landesbank

Provides banking products and services in Liechtenstein, Switzerland, Germany, and Austria.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives