- Switzerland

- /

- Banks

- /

- SWX:GRKP

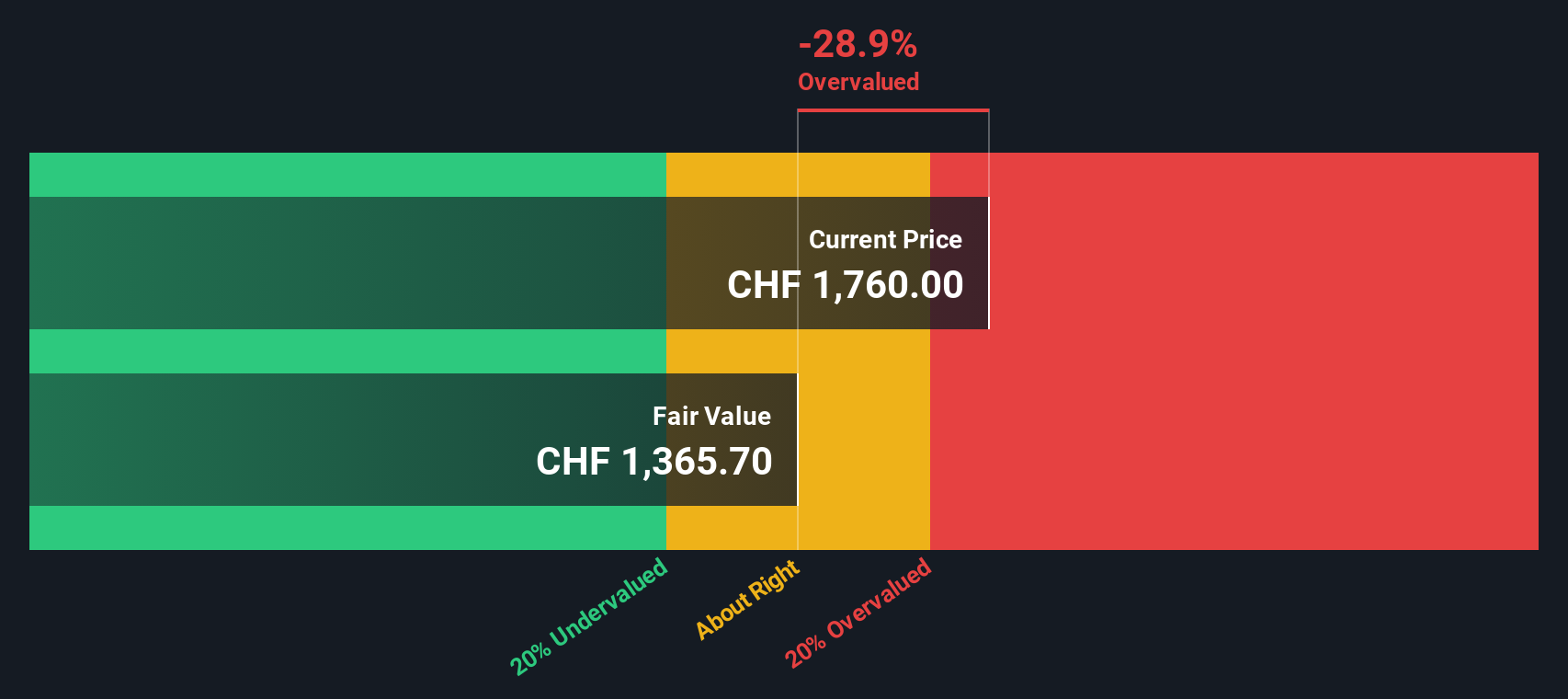

Is Graubündner Kantonalbank (SWX:GRKP) Overvalued? A Fresh Look at Current Market Pricing

Reviewed by Simply Wall St

Price-to-Earnings of 21.6x: Is it justified?

Based on its price-to-earnings ratio, Graubündner Kantonalbank currently appears overvalued in comparison to industry peers and estimated fair value benchmarks.

The price-to-earnings (P/E) ratio reflects what investors are willing to pay today for a company's earnings. For banks, it is a crucial measure of both market confidence and profit outlook, as it shows how much a buyer pays for one Swiss franc of net income.

Currently, Graubündner Kantonalbank’s P/E ratio stands at 21.6x, which is considerably higher than both its peer group average and the broader European banks industry. This premium suggests that the market expects steadier growth or lower risk. However, the company's moderate profit increases may not fully justify the higher multiple.

Result: Fair Value of CHF1384.06 (OVERVALUED)

See our latest analysis for Graubündner Kantonalbank.However, continued slow revenue growth or unexpected shifts in the European banking landscape could quickly challenge the current optimism for Graubündner Kantonalbank shares.

Find out about the key risks to this Graubündner Kantonalbank narrative.Another View: What Does the SWS DCF Model Say?

Taking a step back from market multiples, our SWS DCF model supports the view that Graubündner Kantonalbank is currently overvalued. This raises the question: could future business shifts justify the market price?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Graubündner Kantonalbank Narrative

If you have a different perspective, or want to test your own research, you can assemble your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Graubündner Kantonalbank.

Looking for more investment ideas?

Smart investors never limit their opportunities. Use the Simply Wall Street Screener to find stocks with hidden potential, high yields, and exposure to the most exciting sectors.

- Accelerate your search for growth by checking out penny stocks with strong financials with robust financials that may support their next leap forward.

- Power up your portfolio and tap into the latest breakthroughs with healthcare AI stocks, which spotlights healthcare innovation through artificial intelligence.

- Secure income streams you can rely on by browsing dividend stocks with yields > 3%, which highlights dividend yields above 3% for steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GRKP

Graubündner Kantonalbank

Provides various banking and products services to private individuals and companies primarily in Switzerland.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives