- Switzerland

- /

- Banks

- /

- SWX:BSKP

Basler Kantonalbank (SWX:BSKP) Valuation in Focus After Recent Subtle Share Price Fluctuations

Reviewed by Simply Wall St

Price-to-Earnings of 17.3x: Is it justified?

Basler Kantonalbank currently trades at a price-to-earnings (P/E) ratio of 17.3x. This figure is slightly below the Swiss market average of 19.4x, but higher compared to both its Swiss banking peers (17x) and the broader European banks sector (9.7x). Based on this preferred multiple, the stock appears somewhat expensive relative to industry peers, but more reasonably valued compared to the Swiss market as a whole.

The P/E ratio reflects how much investors are willing to pay for every franc of earnings. For a bank like Basler Kantonalbank, it offers insight into market expectations for future growth, profitability, and perceived stability. This measure is especially relevant in the financial sector, where consistent earnings and dividend policies drive long-term shareholder confidence.

Although Basler Kantonalbank’s earnings have grown at a healthy rate in recent years and its margin profile continues to improve, the stock’s premium compared to the industry average suggests that investors expect continued solid performance. However, its higher multiple compared to European peers may raise concerns about whether its fundamentals and future growth can fully justify the price tag.

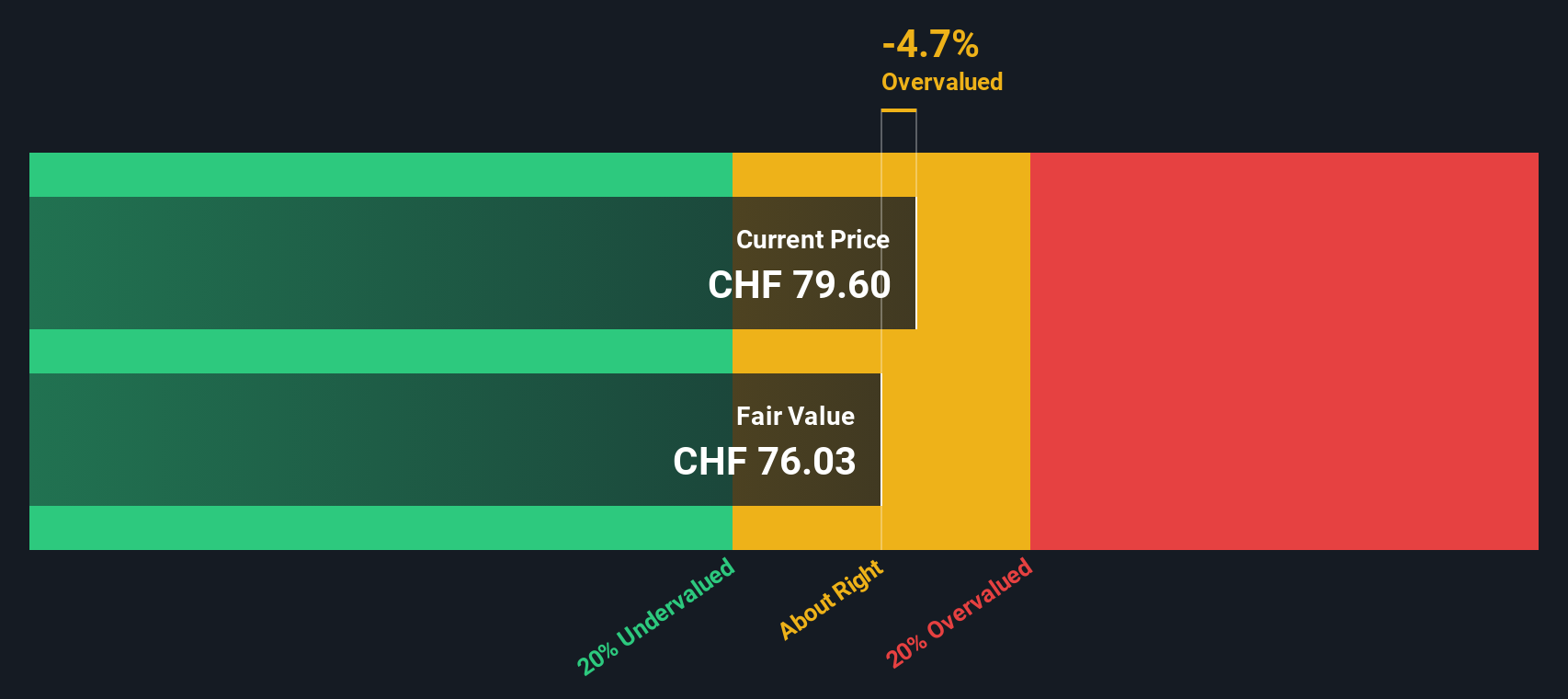

Result: Fair Value of CHF76.14 (OVERVALUED)

See our latest analysis for Basler Kantonalbank.However, risks remain, including shifts in market sentiment or unexpected changes to earnings that could challenge the current valuation narrative.

Find out about the key risks to this Basler Kantonalbank narrative.Another View: What Does the SWS DCF Model Say?

Taking a step away from the usual comparison with other banks, the SWS DCF model offers its independent take on Basler Kantonalbank’s value. Interestingly, this method also points to the stock being overvalued. Could both methods be missing something? Is this a sign to dig deeper?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Basler Kantonalbank Narrative

If you think there’s another angle to this story or want to dig into the numbers on your own, you can put together your own perspective in minutes. Do it your way

A great starting point for your Basler Kantonalbank research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors never settle for just one idea. Let yourself in on strategies that are helping others spot tomorrow’s winners, and make sure you’re not leaving potential on the table.

- Capture growth from artificial intelligence trends by reviewing companies at the forefront of tech innovation. Start with AI penny stocks in the space.

- Strengthen your portfolio with reliable income by checking out businesses offering dividend stocks with yields > 3% and a resilient track record of cash returns.

- Capitalize on undervalued opportunities others might miss by scanning for stocks identified as undervalued stocks based on cash flows right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Basler Kantonalbank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BSKP

Basler Kantonalbank

Offers various banking products and services to private and business customers in Switzerland.

Established dividend payer with proven track record.

Market Insights

Community Narratives