- Canada

- /

- Renewable Energy

- /

- TSXV:WEB

TSX Insights PetroTal And 2 Other Noteworthy Penny Stocks

Reviewed by Simply Wall St

The Canadian market has shown resilience, with the TSX only down 4% from its record high, buoyed by a strong performance in the materials sector. In this context of cautious optimism and potential volatility, investors often look to penny stocks for opportunities that combine affordability with growth potential. While the term 'penny stocks' might seem dated, these smaller or newer companies can offer unique value when backed by solid financials and strategic positioning.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.73 | CA$63.72M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.64 | CA$70.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.64 | CA$425.79M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.10 | CA$611.96M | ✅ 4 ⚠️ 1 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.84 | CA$205.98M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.75 | CA$288.8M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.58 | CA$503.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.55 | CA$127.49M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.43 | CA$93.62M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.49 | CA$14.04M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 931 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

PetroTal (TSX:TAL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: PetroTal Corp. is involved in the exploration, appraisal, and development of oil and natural gas in Peru, South America, with a market capitalization of CA$503.25 million.

Operations: The company generates revenue of $333.99 million from its oil and gas exploration and production activities in Peru.

Market Cap: CA$503.25M

PetroTal Corp., with a market cap of CA$503.25 million, is noteworthy for its strong financial position and production growth. The company reported first-quarter 2025 production averaging 23,280 bopd, driven by successful development drilling at the Bretana field. PetroTal's revenue reached US$333.99 million in 2024, with net income marginally increasing to US$111.45 million from the previous year. Despite a high return on equity of 21.8% and substantial cash reserves exceeding total debt, earnings growth has slowed recently compared to its five-year average. Recent board changes include appointing Denisse Abudinen as an independent director, potentially enhancing strategic direction.

- Click here to discover the nuances of PetroTal with our detailed analytical financial health report.

- Learn about PetroTal's future growth trajectory here.

Pivotree (TSXV:PVT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pivotree Inc. designs, integrates, deploys, and manages digital platforms in commerce, data management, and supply chain for retail and branded manufacturers worldwide, with a market cap of CA$30.37 million.

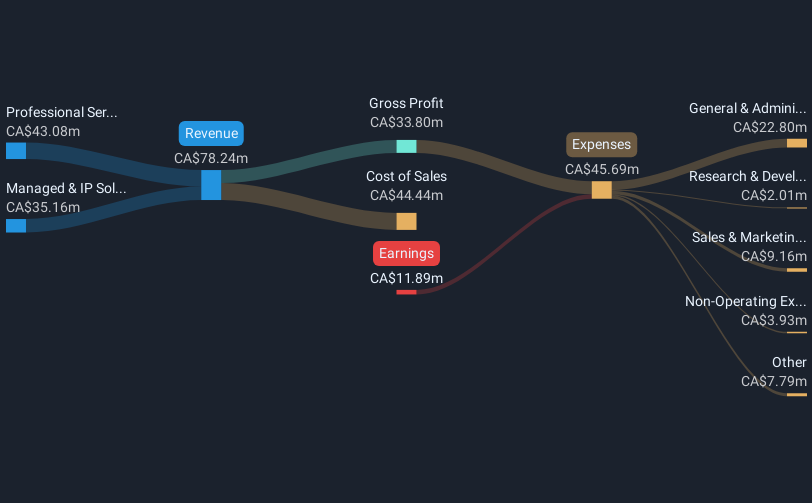

Operations: The company's revenue is derived from Professional Services, which generated CA$43.08 million, and Managed & IP Solutions along with Legacy Managed Services, contributing CA$35.16 million.

Market Cap: CA$30.37M

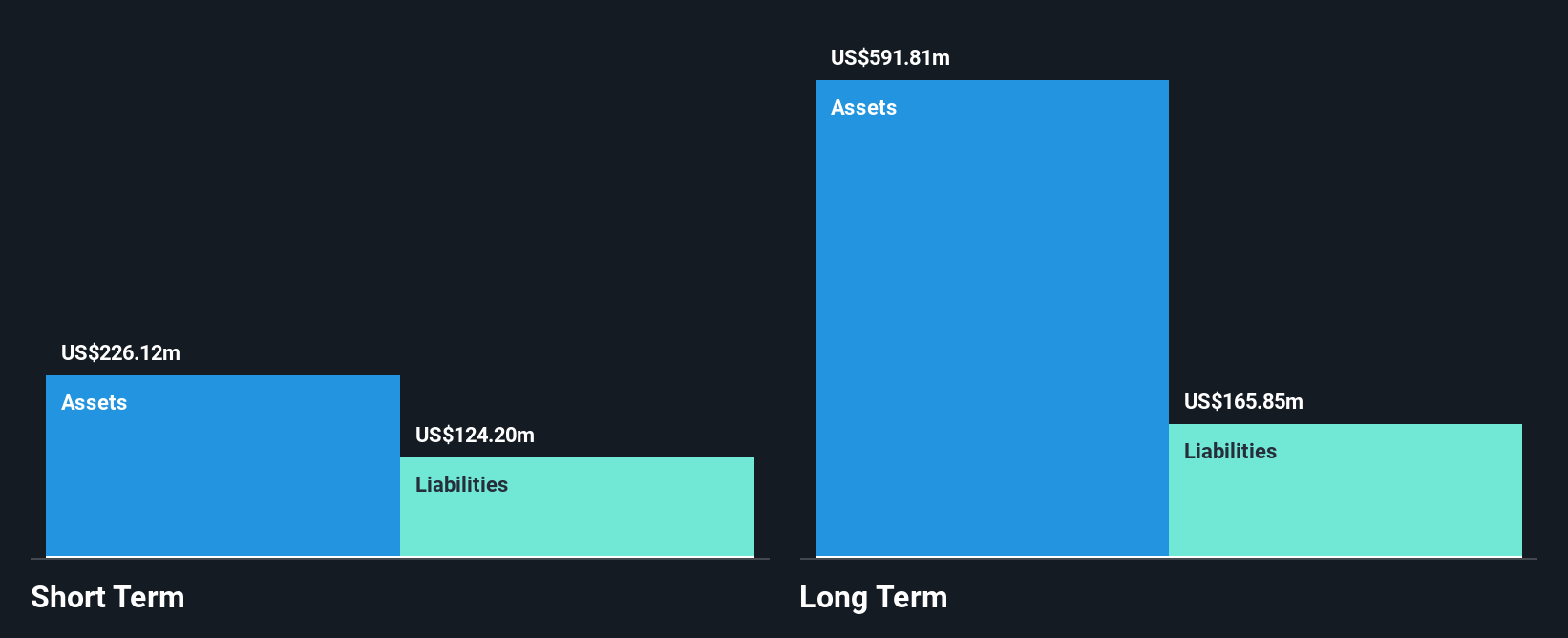

Pivotree Inc., with a market cap of CA$30.37 million, is currently unprofitable, reporting a net loss of CA$11.89 million for 2024, up from the previous year. Despite this, the company operates debt-free and has short-term assets exceeding its liabilities by a significant margin. However, it faces challenges with less than one year of cash runway based on current free cash flow levels. Pivotree's shares are trading at a substantial discount to estimated fair value and have not experienced meaningful dilution recently. Earnings are forecasted to grow significantly in the coming years despite past losses increasing annually by 15.2%.

- Dive into the specifics of Pivotree here with our thorough balance sheet health report.

- Gain insights into Pivotree's future direction by reviewing our growth report.

Westbridge Renewable Energy (TSXV:WEB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Westbridge Renewable Energy Corp. is a renewable energy company focused on acquiring and developing solar photovoltaic projects in Canada, the United States, the United Kingdom, and Italy, with a market cap of CA$63.72 million.

Operations: Currently, there are no specific revenue segments reported for Westbridge Renewable Energy Corp.

Market Cap: CA$63.72M

Westbridge Renewable Energy Corp., with a market cap of CA$63.72 million, recently reported a net income of CA$55.67 million for the year ended November 30, 2024, marking its transition to profitability from a previous net loss. The company operates debt-free and has strong asset coverage over both short and long-term liabilities. Its return on equity is outstanding at 106.5%, reflecting efficient management practices despite having less than US$1m in revenue, indicating it is pre-revenue. Shares are trading significantly below estimated fair value, offering potential upside compared to industry peers and overall market conditions.

- Take a closer look at Westbridge Renewable Energy's potential here in our financial health report.

- Explore Westbridge Renewable Energy's analyst forecasts in our growth report.

Seize The Opportunity

- Click through to start exploring the rest of the 928 TSX Penny Stocks now.

- Contemplating Other Strategies? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Westbridge Renewable Energy, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Westbridge Renewable Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:WEB

Westbridge Renewable Energy

A renewable energy company, engages in the acquisition and development of solar photovoltaic (PV) projects in Canada, the United States, the United Kingdom, and Italy.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives