- Canada

- /

- Renewable Energy

- /

- TSX:TA

Earnings Beat: TransAlta Corporation (TSE:TA) Just Beat Analyst Forecasts, And Analysts Have Been Lifting Their Forecasts

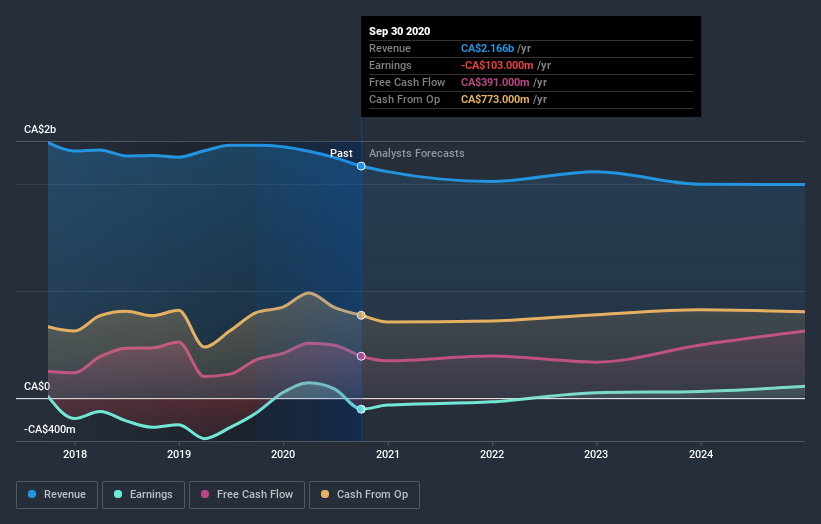

Investors in TransAlta Corporation (TSE:TA) had a good week, as its shares rose 5.7% to close at CA$8.35 following the release of its quarterly results. The results don't look great, especially considering that statutory losses grew 1,150% toCA$0.50 per share. Revenues of CA$514m did beat expectations by 5.6%, but it looks like a bit of a cold comfort. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

View our latest analysis for TransAlta

Taking into account the latest results, the current consensus, from the five analysts covering TransAlta, is for revenues of CA$2.02b in 2021, which would reflect a measurable 6.6% reduction in TransAlta's sales over the past 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 66% to CA$0.13. Before this earnings announcement, the analysts had been modelling revenues of CA$1.91b and losses of CA$0.19 per share in 2021. So it seems there's been a definite increase in optimism about TransAlta's future following the latest consensus numbers, with a the loss per share forecasts in particular.

Despite these upgrades,the analysts have not made any major changes to their price target of CA$10.67, implying that their latest estimates don't have a long term impact on what they think the stock is worth. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic TransAlta analyst has a price target of CA$17.00 per share, while the most pessimistic values it at CA$8.00. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. One more thing stood out to us about these estimates, and it's the idea that TransAlta'sdecline is expected to accelerate, with revenues forecast to fall 6.6% next year, topping off a historical decline of 0.5% a year over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 8.1% per year. So while a broad number of companies are forecast to decline, unfortunately TransAlta is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. They also upgraded their revenue estimates for next year, even though sales are expected to grow slower than the wider industry. The consensus price target held steady at CA$10.67, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple TransAlta analysts - going out to 2024, and you can see them free on our platform here.

Before you take the next step you should know about the 1 warning sign for TransAlta that we have uncovered.

If you decide to trade TransAlta, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if TransAlta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:TA

TransAlta

Engages in the development, production, and sale of electric energy.

Good value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026