- Canada

- /

- Renewable Energy

- /

- TSX:TA

Do Regular Dividends Reveal TransAlta’s (TSX:TA) Evolving Capital Priorities Amid Sector Shifts?

Reviewed by Sasha Jovanovic

- TransAlta's Board of Directors has declared quarterly dividends on both common and preferred shares, with payments scheduled for late December 2025 and early January 2026 to shareholders on record as of December 1, 2025.

- This ongoing commitment to regular dividend payments highlights TransAlta's focus on financial stability and signals continued confidence in its long-term cash flow generation.

- We'll explore how TransAlta's consistent dividend declarations may reinforce its investment case amid expanding renewables and rising data center demand.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

TransAlta Investment Narrative Recap

To be a TransAlta shareholder, you need to believe in the company's ability to manage its energy portfolio profitably during the sector's shift toward renewables, while overcoming challenges from decarbonization policies and increasing competition in key markets. The recent quarterly dividend declarations reinforce management's intent to provide stability and cash returns but do not have a material effect on the biggest current catalyst, capitalizing on data center-driven electricity demand, or on the biggest risk, which remains accelerated asset transition costs and market price pressure.

Among TransAlta's recent actions, the common and preferred share dividend announcements stand out as most closely tied to the company's cash flow consistency. These regular payments could provide some reassurance as the business seeks new long-term data contracts, yet they don't shift the company's exposure to price headwinds and the pace of fleet modernization.

By contrast, investors should also be aware that rapid decarbonization mandates or unexpected regulatory changes could still force costly writedowns or sudden earnings volatility if...

Read the full narrative on TransAlta (it's free!)

TransAlta's narrative projects CA$2.0 billion revenue and CA$188.9 million earnings by 2028. This requires a 6.6% yearly revenue decline and a CA$355.9 million earnings increase from CA$-167.0 million.

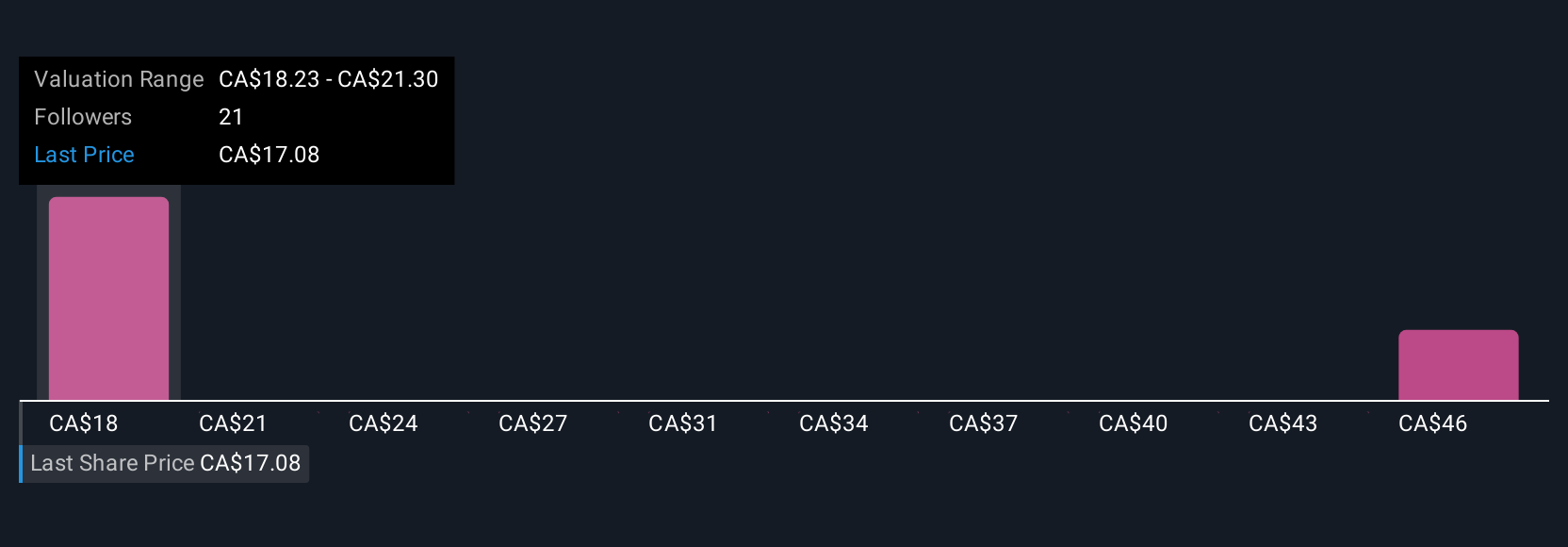

Uncover how TransAlta's forecasts yield a CA$19.77 fair value, a 16% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared two fair value estimates for TransAlta, ranging widely from CA$19.77 to CA$62.10 per share. While you weigh these views, remember that ongoing exposure to rising competition and changing regulatory frameworks may have broader implications for future earnings stability.

Explore 2 other fair value estimates on TransAlta - why the stock might be worth over 2x more than the current price!

Build Your Own TransAlta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TransAlta research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free TransAlta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TransAlta's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransAlta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TA

TransAlta

Engages in the development, production, and sale of electric energy.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives