- Canada

- /

- Renewable Energy

- /

- TSX:INE

Why Innergex Renewable Energy Inc.'s (TSE:INE) High P/E Ratio Isn't Necessarily A Bad Thing

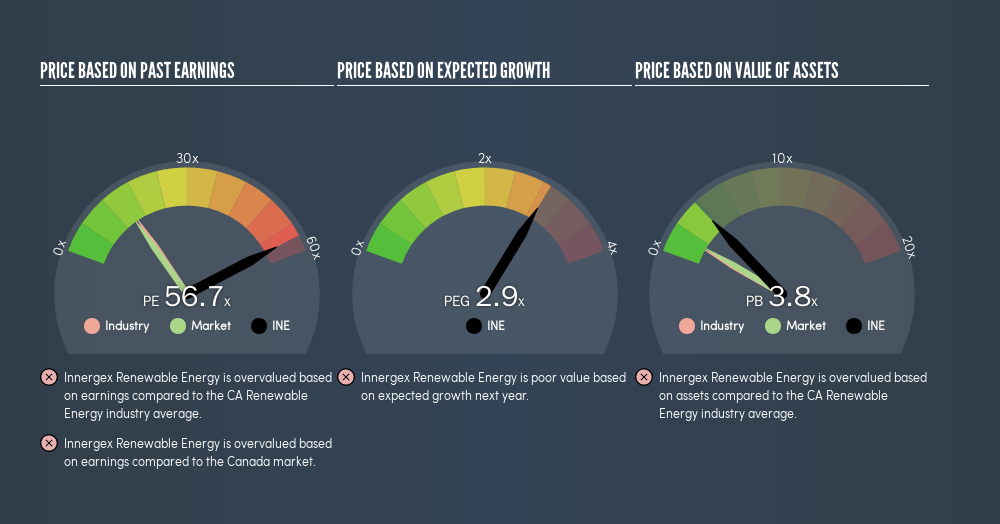

The goal of this article is to teach you how to use price to earnings ratios (P/E ratios). We'll look at Innergex Renewable Energy Inc.'s (TSE:INE) P/E ratio and reflect on what it tells us about the company's share price. Innergex Renewable Energy has a price to earnings ratio of 56.72, based on the last twelve months. That is equivalent to an earnings yield of about 1.8%.

See our latest analysis for Innergex Renewable Energy

How Do You Calculate A P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price ÷ Earnings per Share (EPS)

Or for Innergex Renewable Energy:

P/E of 56.72 = CA$14.26 ÷ CA$0.25 (Based on the trailing twelve months to December 2018.)

Is A High Price-to-Earnings Ratio Good?

A higher P/E ratio implies that investors pay a higher price for the earning power of the business. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.'

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. When earnings grow, the 'E' increases, over time. Therefore, even if you pay a high multiple of earnings now, that multiple will become lower in the future. Then, a lower P/E should attract more buyers, pushing the share price up.

Most would be impressed by Innergex Renewable Energy earnings growth of 13% in the last year. And earnings per share have improved by 39% annually, over the last five years. This could arguably justify a relatively high P/E ratio.

How Does Innergex Renewable Energy's P/E Ratio Compare To Its Peers?

The P/E ratio essentially measures market expectations of a company. As you can see below, Innergex Renewable Energy has a much higher P/E than the average company (15.6) in the renewable energy industry.

Innergex Renewable Energy's P/E tells us that market participants think the company will perform better than its industry peers, going forward. Clearly the market expects growth, but it isn't guaranteed. So investors should delve deeper. I like to check if company insiders have been buying or selling.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

Don't forget that the P/E ratio considers market capitalization. In other words, it does not consider any debt or cash that the company may have on the balance sheet. In theory, a company can lower its future P/E ratio by using cash or debt to invest in growth.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Innergex Renewable Energy's Balance Sheet

Innergex Renewable Energy's net debt is considerable, at 244% of its market cap. If you want to compare its P/E ratio to other companies, you must keep in mind that these debt levels would usually warrant a relatively low P/E.

The Verdict On Innergex Renewable Energy's P/E Ratio

Innergex Renewable Energy's P/E is 56.7 which is way above average (14.9) in the CA market. While the meaningful level of debt does limit its options, it has achieved solid growth over the last year. It seems the market believes growth will continue, judging by the P/E ratio.

When the market is wrong about a stock, it gives savvy investors an opportunity. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. So this freevisualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

But note: Innergex Renewable Energy may not be the best stock to buy. So take a peek at this freelist of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:INE

Innergex Renewable Energy

Operates as an independent renewable power producer in Canada, the United States, France, and Chile.

Low with questionable track record.

Similar Companies

Market Insights

Community Narratives