Today we'll look at Fortis Inc. (TSE:FTS) and reflect on its potential as an investment. Specifically, we're going to calculate its Return On Capital Employed (ROCE), in the hopes of getting some insight into the business.

First, we'll go over how we calculate ROCE. Next, we'll compare it to others in its industry. And finally, we'll look at how its current liabilities are impacting its ROCE.

Understanding Return On Capital Employed (ROCE)

ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. All else being equal, a better business will have a higher ROCE. In brief, it is a useful tool, but it is not without drawbacks. Renowned investment researcher Michael Mauboussin has suggested that a high ROCE can indicate that 'one dollar invested in the company generates value of more than one dollar'.

So, How Do We Calculate ROCE?

Analysts use this formula to calculate return on capital employed:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

Or for Fortis:

0.048 = CA$2.4b ÷ (CA$53b - CA$4.3b) (Based on the trailing twelve months to December 2018.)

Therefore, Fortis has an ROCE of 4.8%.

View our latest analysis for Fortis

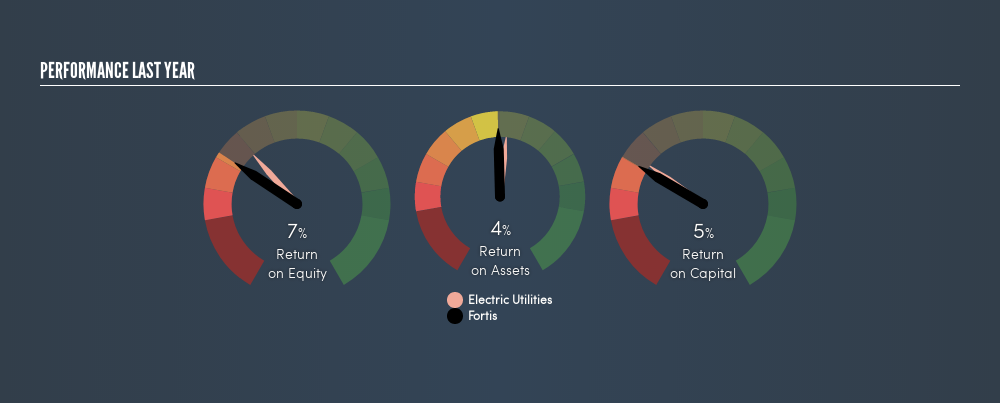

Is Fortis's ROCE Good?

ROCE can be useful when making comparisons, such as between similar companies. Using our data, Fortis's ROCE appears to be around the 4.8% average of the Electric Utilities industry. Independently of how Fortis compares to its industry, its ROCE in absolute terms is low; especially compared to the ~1.9% available in government bonds. There are potentially more appealing investments elsewhere.

When considering ROCE, bear in mind that it reflects the past and does not necessarily predict the future. ROCE can be misleading for companies in cyclical industries, with returns looking impressive during the boom times, but very weak during the busts. This is because ROCE only looks at one year, instead of considering returns across a whole cycle. What happens in the future is pretty important for investors, so we have prepared a freereport on analyst forecasts for Fortis.

What Are Current Liabilities, And How Do They Affect Fortis's ROCE?

Current liabilities include invoices, such as supplier payments, short-term debt, or a tax bill, that need to be paid within 12 months. Due to the way ROCE is calculated, a high level of current liabilities makes a company look as though it has less capital employed, and thus can (sometimes unfairly) boost the ROCE. To check the impact of this, we calculate if a company has high current liabilities relative to its total assets.

Fortis has total assets of CA$53b and current liabilities of CA$4.3b. Therefore its current liabilities are equivalent to approximately 8.0% of its total assets. With barely any current liabilities, there is minimal impact on Fortis's admittedly low ROCE.

What We Can Learn From Fortis's ROCE

Nonetheless, there may be better places to invest your capital. Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this freelist of companies with modest (or no) debt, trading on a P/E below 20.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:FTS

Fortis

Operates as an electric and gas utility company in Canada, the United States, and the Caribbean countries.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)