- Canada

- /

- Electric Utilities

- /

- TSX:FTS

Here's Why We Think Fortis (TSE:FTS) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Fortis (TSE:FTS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Quickly Is Fortis Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Fortis has grown EPS by 8.2% per year. That's a pretty good rate, if the company can sustain it.

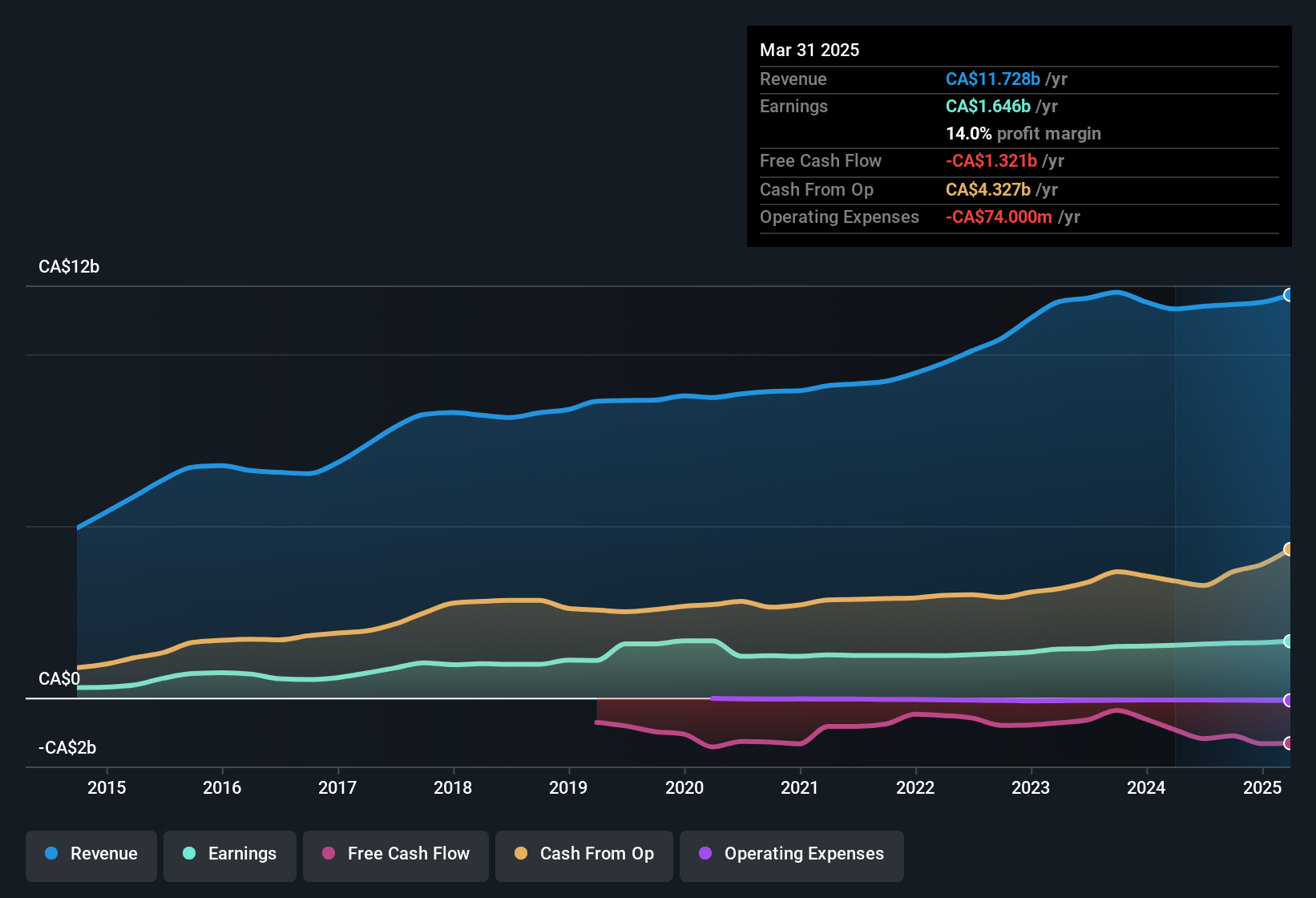

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Fortis remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 3.6% to CA$12b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

View our latest analysis for Fortis

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Fortis' future profits.

Are Fortis Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Despite some Fortis insiders disposing of some shares, we note that there was CA$76k more in buying interest among those who know the company best On balance, that's a good sign. It is also worth noting that it was President David Hutchens who made the biggest single purchase, worth CA$758k, paying CA$63.17 per share.

On top of the insider buying, it's good to see that Fortis insiders have a valuable investment in the business. To be specific, they have CA$36m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Fortis Deserve A Spot On Your Watchlist?

One positive for Fortis is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Even so, be aware that Fortis is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

The good news is that Fortis is not the only stock with insider buying. Here's a list of small cap, undervalued companies in CA with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FTS

Fortis

Operates as an electric and gas utility company in Canada, the United States, and the Caribbean countries.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success