Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like Emera (TSE:EMA), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Emera

How Quickly Is Emera Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Over the last three years, Emera has grown EPS by 9.4% per year. That growth rate is fairly good, assuming the company can keep it up.

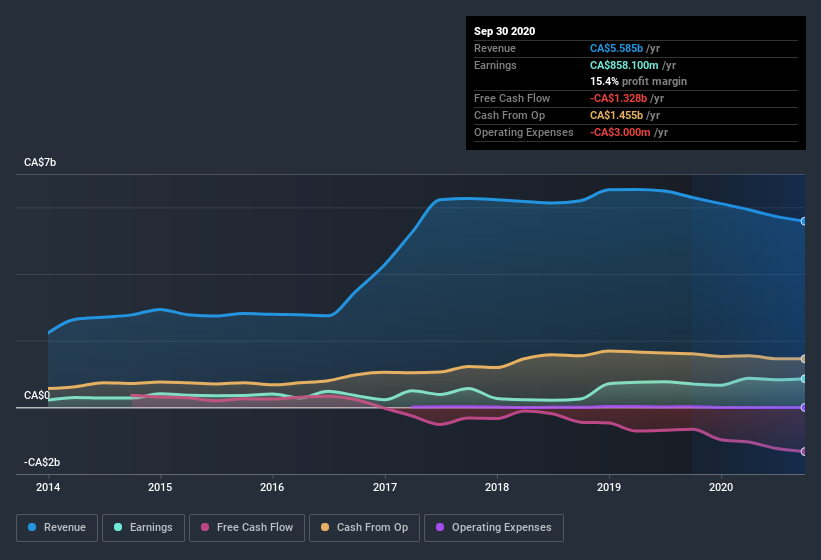

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While Emera may have maintained EBIT margins over the last year, revenue has fallen. And that does make me a little more cautious of the stock.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Emera.

Are Emera Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. I discovered that the median total compensation for the CEOs of companies like Emera, with market caps over CA$10b, is about CA$9.0m.

The Emera CEO received CA$6.7m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Emera Worth Keeping An Eye On?

One positive for Emera is that it is growing EPS. That's nice to see. On top of that, my faith in the board of directors is strengthened by the fact of the reasonable CEO pay. So all in all I think it's worth at least considering for your watchlist. We should say that we've discovered 3 warning signs for Emera (1 doesn't sit too well with us!) that you should be aware of before investing here.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Emera or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Emera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:EMA

Emera

An energy and services company, invests in generation, transmission, and distribution of electricity in the United States, Canada, Barbados, and the Bahamas.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026