- Canada

- /

- Electric Utilities

- /

- TSX:EMA

Dividend Announcement Might Change The Case For Investing In Emera (TSX:EMA)

Reviewed by Simply Wall St

- On July 11, 2025, Emera Inc. declared a quarterly dividend of CA$0.7250 per common share and specified dividend amounts for its series of preferred shares, all payable on or after August 15, 2025 to shareholders of record as of August 1, 2025.

- This move underscores Emera’s commitment to delivering shareholder returns across both common and preferred shares, with detailed payouts aligning with its ongoing financial policies.

- We'll explore how the reaffirmed dividend program strengthens confidence in Emera’s stability and shapes its evolving investment narrative.

Emera Investment Narrative Recap

Emera’s investment appeal centers on stable, regulated utility operations, particularly in Florida, where recent rate-base growth has supported earnings. The July dividend affirmation, while positive for yield-focused shareholders, does not materially shift the critical short-term catalyst: constructive rate case outcomes that potentially drive revenue and earnings growth. However, it also does not mitigate the main risk to the business, escalating capital requirements that could pressure margins and stretch dividend sustainability if not carefully managed.

Among the recent announcements, the May 8 Q1 2025 results stand out. Emera reported strong year-over-year increases in sales and net income, reflecting solid performance across its core segments. For income-focused investors, these results reinforce the significance of ongoing regulatory support and rate adjustments in underpinning financial results through changing market conditions.

Yet, investors should not overlook that, despite the dividend reaffirmation, capital investment pressures may test Emera’s cash flow and payout ratios if costs continue to climb...

Read the full narrative on Emera (it's free!)

Emera's outlook anticipates CA$8.7 billion in revenue and CA$1.1 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 6.7% and an earnings increase of CA$606 million from the current CA$493.6 million.

Uncover how Emera's forecasts yield a CA$64.81 fair value, a 3% upside to its current price.

Exploring Other Perspectives

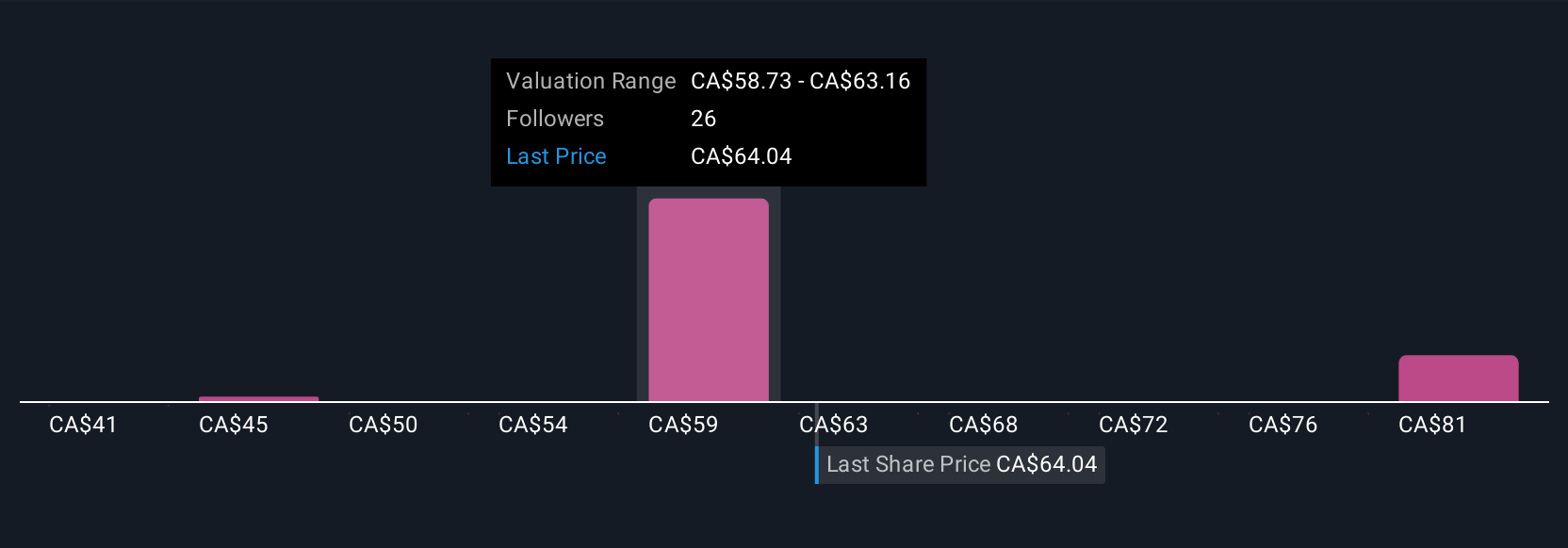

Six individual fair value estimates from the Simply Wall St Community span CA$41 to CA$85,308, capturing a broad spectrum of expectations. Some participants emphasize ongoing capital investment needs as a major consideration that could influence profitability and future distributions, so be sure to review the range of opinions and underlying logic.

Build Your Own Emera Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Emera research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Emera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Emera's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 26 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emera might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EMA

Emera

An energy and services company, invests in generation, transmission, and distribution of electricity in the United States, Canada, Barbados, and the Bahamas.

Solid track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives