- Canada

- /

- Renewable Energy

- /

- TSX:CPX

We Think That There Are More Issues For Capital Power (TSE:CPX) Than Just Sluggish Earnings

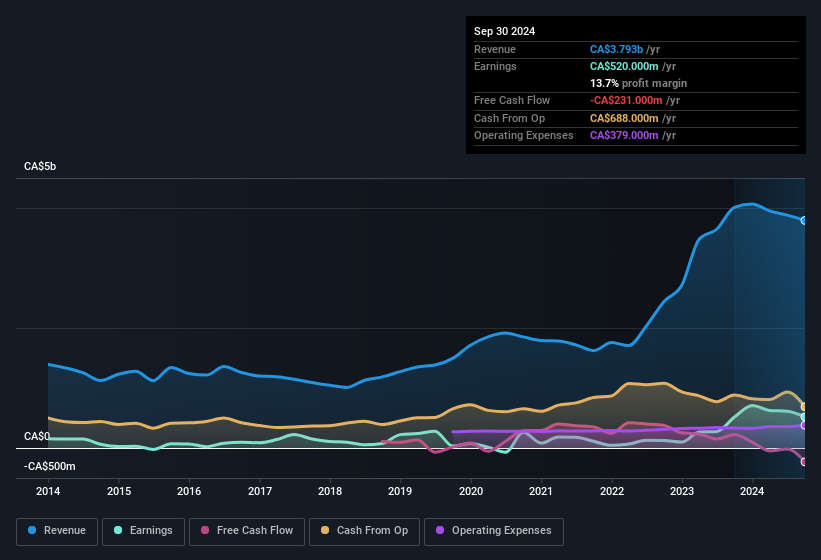

Despite Capital Power Corporation's (TSE:CPX) recent earnings report having lackluster headline numbers, the market responded positively. Sometimes, shareholders are willing to ignore soft numbers with the hope that they will improve, but our analysis suggests this is unlikely for Capital Power.

See our latest analysis for Capital Power

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. In fact, Capital Power increased the number of shares on issue by 11% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Capital Power's historical EPS growth by clicking on this link.

A Look At The Impact Of Capital Power's Dilution On Its Earnings Per Share (EPS)

Capital Power has improved its profit over the last three years, with an annualized gain of 364% in that time. But EPS was only up 306% per year, in the exact same period. However, net income was pretty flat over the last year with a miniscule increase. In contrast, earnings per share are actually down a full 6.1%, over the last twelve months. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if Capital Power's earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Capital Power's Profit Performance

Capital Power shareholders should keep in mind how many new shares it is issuing, because, dilution clearly has the power to severely impact shareholder returns. Because of this, we think that it may be that Capital Power's statutory profits are better than its underlying earnings power. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Our analysis shows 5 warning signs for Capital Power (2 make us uncomfortable!) and we strongly recommend you look at them before investing.

This note has only looked at a single factor that sheds light on the nature of Capital Power's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CPX

Capital Power

Develops, acquires, owns, and operates renewable and thermal power generation facilities in Canada and the United States.

Good value second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion