- Canada

- /

- Renewable Energy

- /

- TSX:CPX

Capital Power (TSX:CPX) Valuation Spotlight After Strategic Debt Refinance and California Decarbonization Partnership

Reviewed by Simply Wall St

Capital Power (TSX:CPX) just revealed plans to redeem its outstanding 4.986% medium term notes and launch a new CAD 600 million debt offering, signaling a meaningful shift in its capital structure.

See our latest analysis for Capital Power.

Against the backdrop of these refinancing efforts and a new decarbonization partnership in California, Capital Power’s recent share price has moved sideways in the short term but built notable long-term value. While the 1-day and 1-month share price returns have edged down, the 1-year total shareholder return stands at an impressive 24.6%, with five-year holders seeing a robust 183.2% total return. This performance highlights momentum continuing over time despite short-term volatility.

If you’re curious what other companies are reshaping their future with bold capital moves, it’s a great moment to broaden your search and see fast growing stocks with high insider ownership

With strong long-term returns and a strategic push toward decarbonization, the question now is whether Capital Power’s recent share price lags its underlying value or if markets have already priced in the company’s long-term growth potential.

Most Popular Narrative: 10.6% Undervalued

Capital Power’s most-followed narrative sees fair value notably above the recent closing price, setting expectations for potential upside if the company's internal projections hold firm. With this outlook, the market's skepticism contrasts sharply with forecasts underpinning the consensus target.

The analysts have a consensus price target of CA$66.727 for Capital Power based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$76.0, and the most bearish reporting a price target of just CA$60.0.

Want to grasp the bold financial moves analysts are banking on? This narrative leans on elevated profit multiples and ambitious revenue progressions, figures that differ from utility sector norms. Curious what really drives these targets? The answer is buried in the full narrative, where the real assumptions powering this value are revealed.

Result: Fair Value of $75.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if electrification trends slow or if higher financing costs persist, Capital Power’s projected growth and earnings could ultimately fall short of analyst expectations.

Find out about the key risks to this Capital Power narrative.

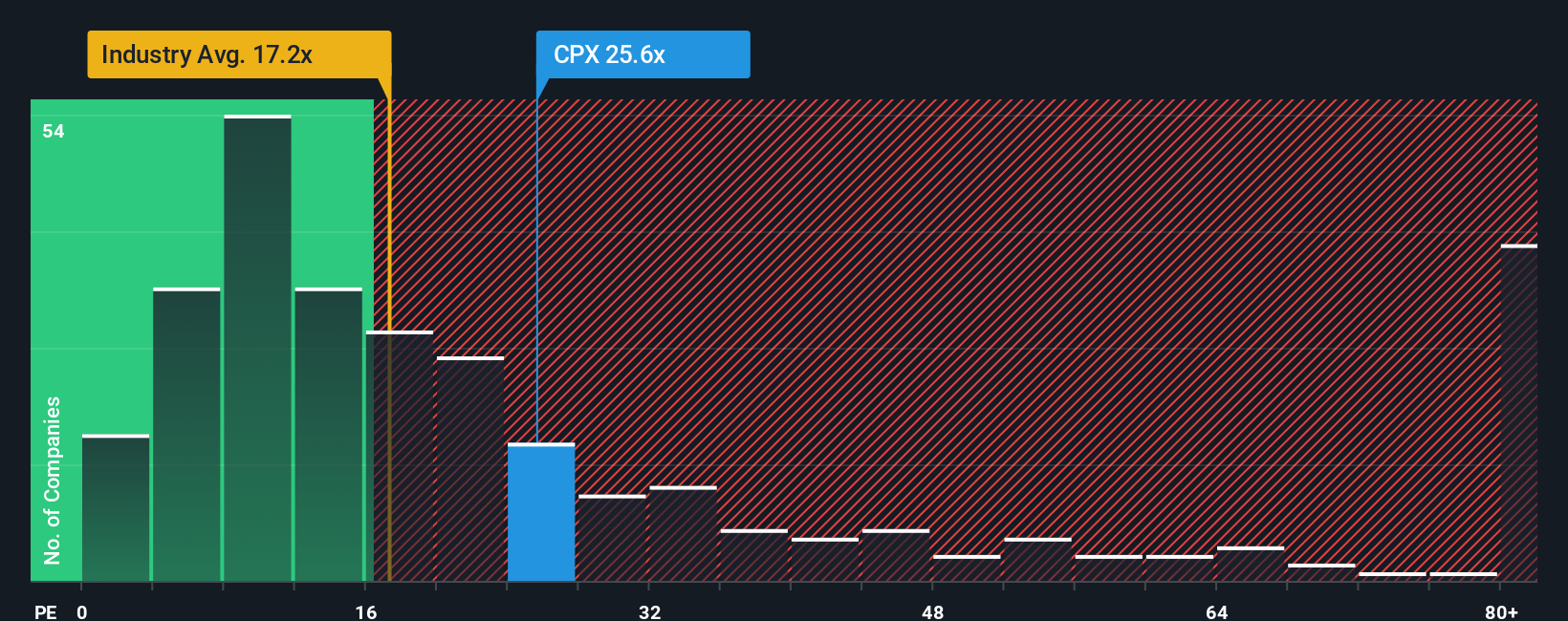

Another View: Risk Through Price-to-Earnings Lens

Taking a broader look at valuation, Capital Power's price-to-earnings ratio stands at 27.6x, which is notably higher than both the global renewable energy average of 17.9x and the peer group average of 17.8x. However, the company trades close to its fair ratio of 28.8x. This suggests its current premium may reflect justified growth expectations. This higher multiple hints at risk if growth does not materialize, but also at potential opportunity if market confidence is warranted. Does this indicate that optimism is warranted, or are investors overpaying for projected growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capital Power Narrative

Not convinced by the consensus view, or want to dive deeper into the numbers on your own terms? Taking the time to analyze the figures yourself is quick and rewarding. Uncover your own insights in just a few minutes and Do it your way.

A great starting point for your Capital Power research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself the edge by seeking out high-potential companies that most investors overlook. Markets can move fast, so don't let promising opportunities pass you by.

- Capitalize on explosive growth trends when you analyze these 25 AI penny stocks forging ahead in artificial intelligence and next-gen automation.

- Lock in streams of passive income as you review these 16 dividend stocks with yields > 3% offering reliable yields in a world of volatile returns.

- Stay ahead of the curve with these 82 cryptocurrency and blockchain stocks at the forefront of the digital finance revolution and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CPX

Capital Power

Develops, acquires, owns, and operates renewable and thermal power generation facilities in Canada and the United States.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives