- Canada

- /

- Renewable Energy

- /

- TSX:BLX

The Boralex Inc. (TSE:BLX) Third-Quarter Results Are Out And Analysts Have Published New Forecasts

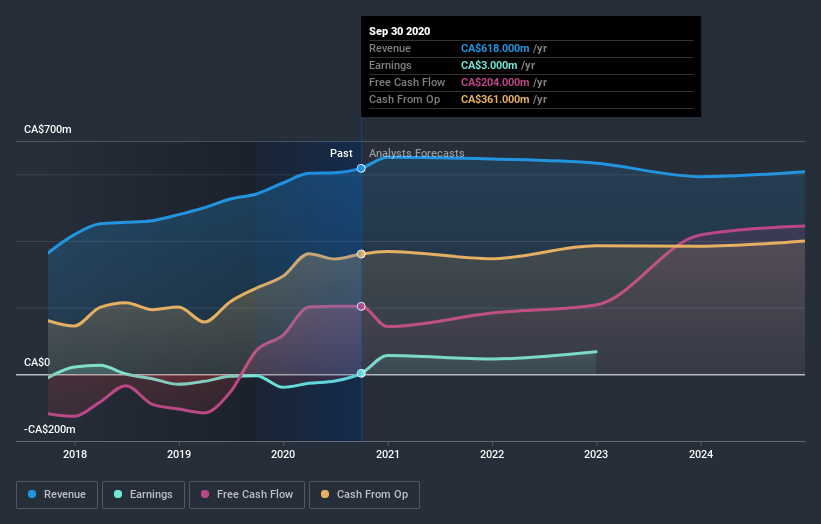

Last week, you might have seen that Boralex Inc. (TSE:BLX) released its quarterly result to the market. The early response was not positive, with shares down 2.4% to CA$39.30 in the past week. It looks like the results were pretty good overall. While revenues of CA$105m were in line with analyst predictions, statutory losses were much smaller than expected, with Boralex losing CA$0.06 per share. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Boralex after the latest results.

See our latest analysis for Boralex

After the latest results, the six analysts covering Boralex are now predicting revenues of CA$645.8m in 2021. If met, this would reflect a reasonable 4.5% improvement in sales compared to the last 12 months. Statutory earnings per share are predicted to surge 1,349% to CA$0.45. Before this earnings report, the analysts had been forecasting revenues of CA$623.6m and earnings per share (EPS) of CA$0.46 in 2021. Overall it looks as though the analysts were a bit mixed on the latest results. Although there was a a reasonable to revenue, the consensus also made a small dip in to its earnings per share forecasts.

There's been no major changes to the price target of CA$43.17, suggesting that the impact of higher forecast sales and lower earnings won't result in a meaningful change to the business' valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. Currently, the most bullish analyst values Boralex at CA$46.00 per share, while the most bearish prices it at CA$39.00. This is a very narrow spread of estimates, implying either that Boralex is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's pretty clear that there is an expectation that Boralex's revenue growth will slow down substantially, with revenues next year expected to grow 4.5%, compared to a historical growth rate of 18% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 7.3% next year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Boralex.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. They also upgraded their revenue estimates for next year, even though sales are expected to grow slower than the wider industry. The consensus price target held steady at CA$43.17, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Boralex. Long-term earnings power is much more important than next year's profits. At Simply Wall St, we have a full range of analyst estimates for Boralex going out to 2024, and you can see them free on our platform here..

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Boralex (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

If you’re looking to trade Boralex, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Boralex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:BLX

Boralex

Engages in the developing, building, and operating power generating and storage facilities in Canada, France, and the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026