- Canada

- /

- Renewable Energy

- /

- TSX:BEPC

There's No Escaping Brookfield Renewable Corporation's (TSE:BEPC) Muted Earnings

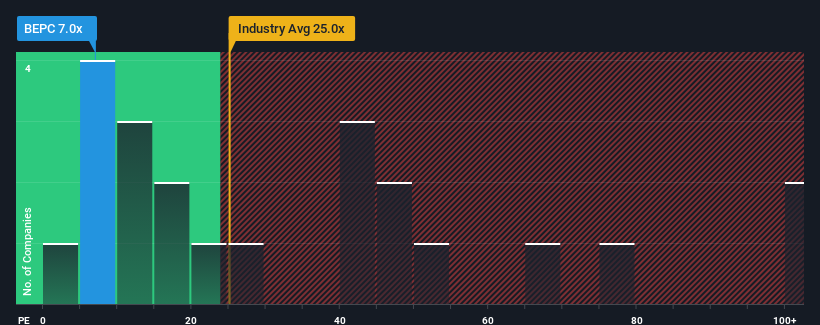

With a price-to-earnings (or "P/E") ratio of 7x Brookfield Renewable Corporation (TSE:BEPC) may be sending bullish signals at the moment, given that almost half of all companies in Canada have P/E ratios greater than 13x and even P/E's higher than 27x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Brookfield Renewable as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Brookfield Renewable

How Is Brookfield Renewable's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Brookfield Renewable's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 119%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 109% as estimated by the four analysts watching the company. That's not great when the rest of the market is expected to grow by 12%.

With this information, we are not surprised that Brookfield Renewable is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Brookfield Renewable's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Brookfield Renewable (at least 2 which are potentially serious), and understanding these should be part of your investment process.

If you're unsure about the strength of Brookfield Renewable's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Renewable might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BEPC

Brookfield Renewable

Owns and operates a portfolio of renewable power and sustainable solution assets.

Very low risk and overvalued.

Market Insights

Community Narratives