- Canada

- /

- Renewable Energy

- /

- TSX:BEPC

Avoid Brookfield Renewable On TSX And Consider One Better Dividend Stock Option

Reviewed by Sasha Jovanovic

Dividend stocks can be a key component of an income-focused investment portfolio, offering the allure of regular payouts. However, it's crucial to assess the sustainability of these dividends. Companies with high payout ratios may not sustain their dividend payments over time, potentially leading to financial strain or reduced dividend yields in the future. In this article, we will explore two Canadian stocks: one that presents a robust dividend opportunity and another—Brookfield Renewable—that might pose risks due to its high payout ratio.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.83% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.13% | ★★★★★★ |

| Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.43% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.37% | ★★★★★☆ |

| Secure Energy Services (TSX:SES) | 3.29% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.80% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.89% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.57% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 3.16% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.22% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Here we highlight one of our preferred stocks from the screener and one that could be better to shun.

Top Pick

Enghouse Systems (TSX:ENGH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Enghouse Systems Limited, a global enterprise software solutions provider, has a market capitalization of approximately CA$1.69 billion.

Operations: The company generates revenue through two main segments: the Asset Management Group, which brought in CA$180.88 million, and the Interactive Management Group, with revenues of CA$299.55 million.

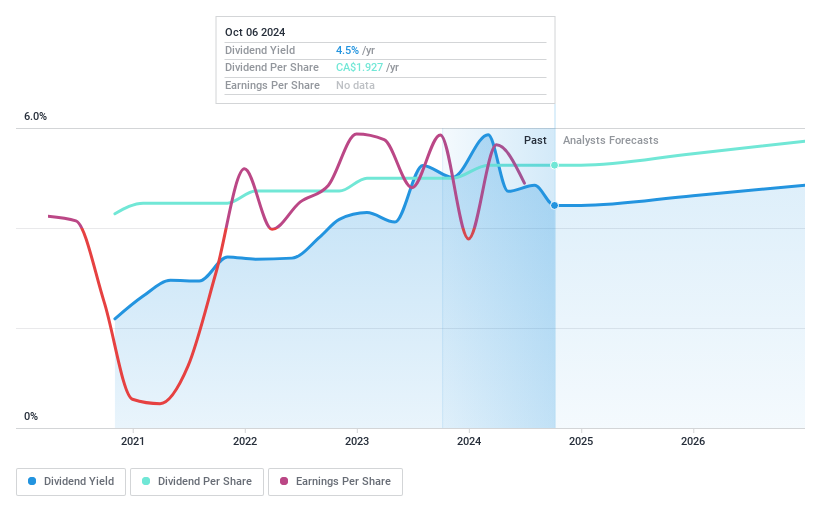

Dividend Yield: 3.4%

Enghouse Systems Limited has demonstrated solid financial performance with a significant increase in revenue and net income as reported in its recent earnings for Q2 2024. The company maintains a healthy dividend policy, evidenced by the recent affirmation of a CA$0.26 quarterly dividend per share, underpinned by a sustainable payout ratio of 65.7% and cash payout ratio of 45.8%, ensuring dividends are well-covered by both earnings and cash flows. This contrasts sharply with companies facing challenges due to high payout ratios, highlighting Enghouse's prudent financial management and reliability as a dividend stock despite its lower yield compared to the market's top payers.

- Click to explore a detailed breakdown of our findings in Enghouse Systems' dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Enghouse Systems shares in the market.

One To Reconsider

Brookfield Renewable (TSX:BEPC)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Brookfield Renewable Corporation operates a diverse portfolio of renewable power and sustainable solution assets mainly in the United States, Europe, Colombia, and Brazil, with a market capitalization of CA$14.66 billion.

Operations: The company generates revenue primarily through hydroelectric power (CA$1.26 billion), wind energy (CA$216 million), utility-scale solar (CA$216 million), and distributed energy & sustainable solutions (CA$137 million).

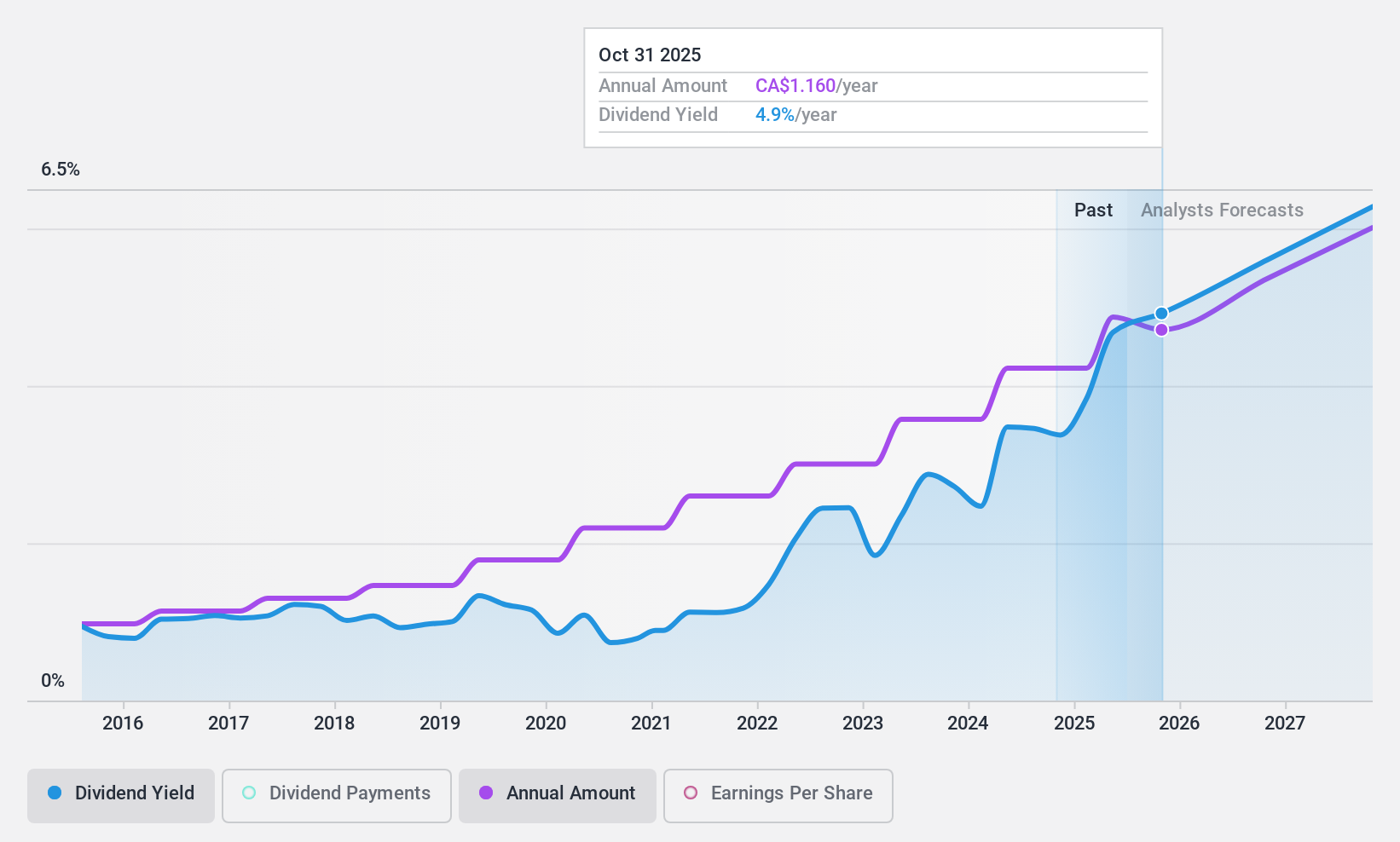

Dividend Yield: 4.9%

Brookfield Renewable's dividend sustainability is questionable with a cash payout ratio of 4426.9%, indicating dividends are not well supported by cash flows. Despite a recent recovery in net income to US$491 million from a previous loss, and an increase in sales to US$1,125 million, the company's forecasted average earnings decline of 38.2% annually over the next three years could pressure future payouts. Additionally, its dividend yield at 5.01% remains below the top quartile of Canadian dividend payers at 6.62%.

Turning Ideas Into Actions

- Gain an insight into the universe of 33 Top TSX Dividend Stocks by clicking here.

- Already own some of these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Renewable might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BEPC

Brookfield Renewable

Owns and operates a portfolio of renewable power and sustainable solution assets.

Good value low.

Market Insights

Community Narratives