- Canada

- /

- Renewable Energy

- /

- TSX:BEP.UN

A Fresh Look at Brookfield Renewable Partners (TSX:BEP.UN) Valuation as AI Pushes U.S. Power Demand Higher

Reviewed by Kshitija Bhandaru

The surge of artificial intelligence in the U.S. is fueling a spike in electricity demand, putting energy producers like Brookfield Renewable Partners (TSX:BEP.UN) in the spotlight. The company’s hydroelectric assets offer scalable solutions for AI-driven power needs.

See our latest analysis for Brookfield Renewable Partners.

Brookfield Renewable Partners has caught a wave of renewed interest as clean energy demand surges. Its share price has climbed 14.6% over the past 30 days, delivering a 1-year total shareholder return of 8.8%. Momentum appears to be building, reflecting optimism around its role in meeting AI-driven power needs as well as broader shifts toward renewables.

If the push for sustainable energy solutions has you curious about where market momentum is heading next, now’s the perfect chance to discover fast growing stocks with high insider ownership

After such impressive momentum and a wave of optimism in the renewables sector, the big question is whether Brookfield Renewable Partners is still undervalued or if future growth is already reflected in the price. This determines whether it is a true buying opportunity or not.

Most Popular Narrative: Fairly Valued

Brookfield Renewable Partners closed at CA$39.99, nearly matching the narrative’s fair value estimate of CA$39.61. The closeness of these figures spotlights an ongoing debate: has the recent rally captured all of the expected upside, or could shifting industry fundamentals drive the next surprise?

Ongoing decline in battery and renewable energy technology costs, combined with increasing grid modernization and the need for 24/7 clean power, positions Brookfield's diversified portfolio (including recent Neoen acquisition and major battery pipeline) to capture higher-margin growth and expand overall earnings and net margins.

Curious how aggressive expansion and falling tech costs unlock this near-perfect fair value? The valuation hinges on assumptions that most investors won’t expect. Are earnings and margin forecasts in this story more ambitious than meets the eye? Don’t miss the narrative’s most surprising financial leap.

Result: Fair Value of $39.61 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including potential regulatory shifts and unpredictable hydrology patterns. Either of these factors could quickly alter Brookfield’s future growth outlook.

Find out about the key risks to this Brookfield Renewable Partners narrative.

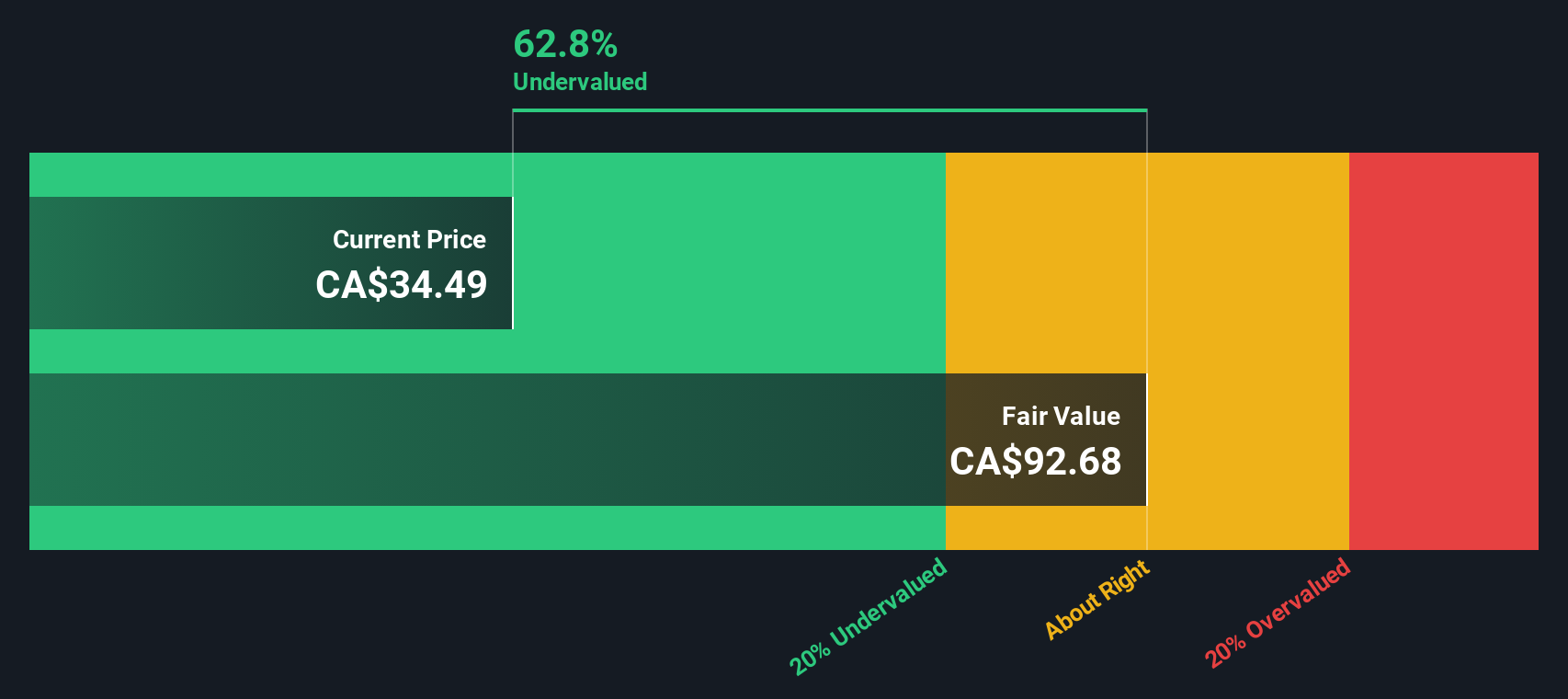

Another View: DCF Points to Deep Undervaluation

While the consensus view considers Brookfield Renewable Partners fairly valued, our DCF model sharply disagrees and suggests the shares are actually trading far below intrinsic value. This scenario challenges the market’s assumptions and raises the debate: is there a hidden opportunity in plain sight, or is the model missing key risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Renewable Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Renewable Partners Narrative

If you think there’s more to Brookfield’s story or want to dig into the numbers yourself, you can easily build your own perspective in just minutes. Do it your way

A great starting point for your Brookfield Renewable Partners research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Supercharge your watchlist and stay ahead of the market by checking out unique stocks in sectors with high potential, emerging trends, and attractive returns. Smart investors never settle for yesterday’s winners when new opportunities await.

- Unlock steady payouts and strong financials when you browse these 18 dividend stocks with yields > 3%. This screener offers yields above market averages from established businesses.

- Seize early opportunities in the evolving field of healthcare innovation by reviewing these 33 healthcare AI stocks. This resource showcases companies fusing medicine and artificial intelligence.

- Capitalize on trailblazers shaping tomorrow’s financial systems through these 79 cryptocurrency and blockchain stocks. This screener spotlights businesses advancing blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Renewable Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BEP.UN

Brookfield Renewable Partners

Owns a portfolio of renewable power generating facilities in North America, Colombia, and Brazil.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives