- Canada

- /

- Gas Utilities

- /

- TSX:ALA

Is Low ROE Despite High Leverage Altering the Investment Case for AltaGas (TSX:ALA)?

Reviewed by Simply Wall St

- AltaGas Ltd. recently reported a return on equity of 6.2%, closely matching the gas utilities industry norm, but this result comes despite a significant reliance on debt, with a debt to equity ratio of 1.03.

- Although the company’s debt usage is high, it has not translated into elevated returns, raising questions about the effectiveness of its capital structure and use of leverage.

- We’ll explore how persistent concerns around AltaGas’s low return on equity despite high leverage may influence its investment outlook.

AltaGas Investment Narrative Recap

To be a shareholder in AltaGas, you have to believe that its significant investment in energy infrastructure projects and its growing utilities business will drive long-term earnings and dividend growth. The recent report of a 6.2% return on equity, despite high leverage, does not appear to materially shift the short-term catalyst, which remains the on-schedule completion and ramp-up of major projects like REEF. For now, the biggest risk continues to be execution on these project commitments and associated capital demands.

Among the recent announcements, construction progress at the Ridley Island Energy Export Facility (REEF), with over 60% of project costs now incurred or committed, is particularly relevant. Timely completion of REEF is crucial to unlocking new export capacity, which underpins AltaGas's anticipated earnings and dividend growth, even as reliability of returns draws close scrutiny amid high leverage.

In contrast, while project progress is positive, investors should be mindful that AltaGas’s reliance on debt means that any...

Read the full narrative on AltaGas (it's free!)

AltaGas is projected to reach CA$14.7 billion in revenue and CA$820.5 million in earnings by 2028. This outlook assumes a 5.6% annual revenue growth rate and implies a CA$242.5 million increase in earnings from the current CA$578.0 million.

Uncover how AltaGas' forecasts yield a CA$40.75 fair value, in line with its current price.

Exploring Other Perspectives

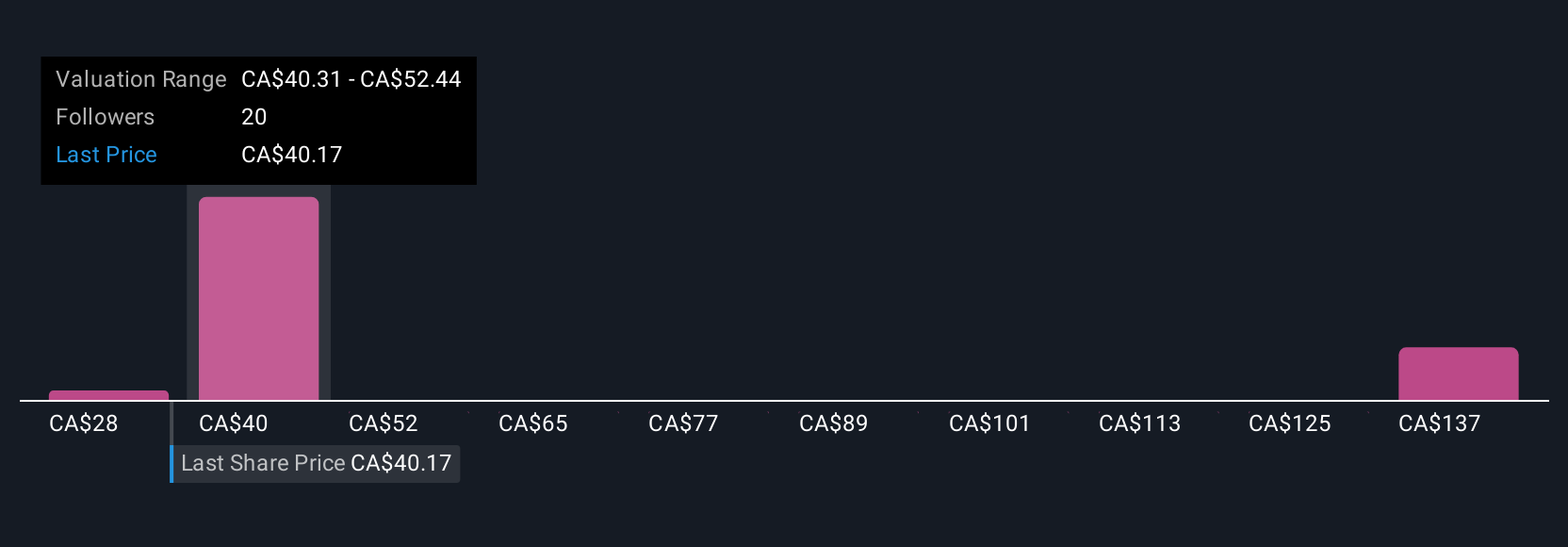

Four Simply Wall St Community fair value estimates for AltaGas range from CA$28.17 to CA$150.19 per share, reflecting dramatically different outlooks. While some see upside from REEF’s progress, others are cautious about capital structure risks, be sure to review all viewpoints before making up your mind.

Build Your Own AltaGas Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AltaGas research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free AltaGas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AltaGas' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ALA

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives